LEADING ASIAN distributor of welding equipment, Leeden, yesterday announced that its 1H09 revenues grew 34% year-on-year to reach S$93.9 million.

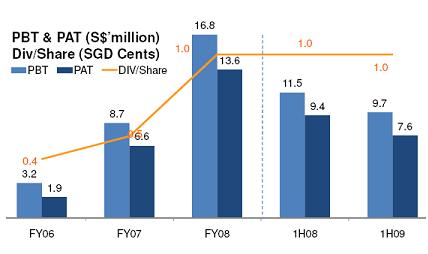

The company is paying an interim tax-exempt dividend of one Singapore cent per share on 2 Sept.

The provider of industrial welding solutions is known for its complete range of welding, gas and safety equipment, and specializes in top-tier brands such as Miller welding equipment and Red Wing Shoes.

”We are now ready to launch our own brands of welding and safety equipment and will cater to rising demand in the mid-end market,” said executive director, Mr Kelvin Lee, at its results briefing yesterday afternoon.

The management explained that now is the time for introducing proprietary brands as Leeden has attained sufficient market share and has built up a regional presence in Malaysia, Thailand, Indonesia and China.

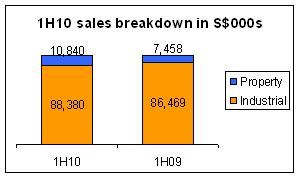

Industrial solutions contributed 92% to group revenues while the remaining 8% came mainly from property development.

Revenues from industrial solutions were boosted 48% yoy to S$86.5 million as shipyards around the world cope with an all-time high order book.

Gross profit margins for the industrial segment improved from 26.8% in 1H08 to 28.1% in 1H09.

Leeden’s performance was exceptional considering that a sampling of the distributor’s principals showed that 1H09 revenues were down roughly 40%, commented fund manager Toh Yiu Way.

The oil & gas industry currently accounts for about half of the group’s industrial orders, while another half comes from real estate construction and the aerospace sector.

Revenues from the property segment fell by 37% to S$7.5 million due to higher recognition of progress revenue in 1H08.

This segment comprises wholly of the Paterson Linc condominium development, which has been fully sold and will be hived off after Paterson Linc obtains its temporary occupation permit in 1H10, according to the management.

Overall gross profit margin fell slightly by 0.5 percentage points to 28.6% due to lower contribution from the property division.

Further, pretax profits fell 16% due to an increase in distribution, administrative and finance costs arising from the acquisition of NIG Industrial Gases Sdn Bhd on 1 Sep last year.

Net profits fell 37% to S$5 million. Gearing increased to 50%, compared to 46% as at 31 Dec 2008. Net cash flow from operations was S$1.4 million. The company had cash reserves of S$15.4 million as at 30 Jun 2009.

Related story: LEEDEN: A galloping profit workhorse