Excerpts from latest analyst reports….

Kim Eng Research says Super has ‘upside from higher dividend payout and TDR listing’

Analyst: Pauline Lee

What’s New

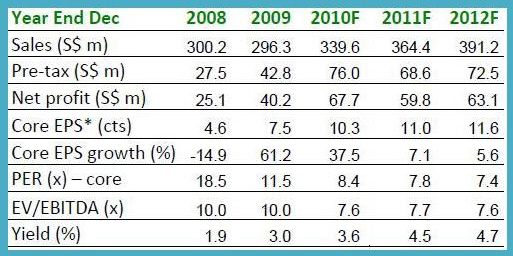

Super’s core business is seeing continued improvement with demand for its ingredient products remaining buoyant and market leadership of its branded consumer products in Southeast Asia still intact.

Our recent checks also suggest that the profitable divestments of its non‐core assets may pave the way for higher dividend payout this year. Approval for its Taiwan Depository Receipt or TDR issue could trigger an upward re‐rating of its share price. Maintain BUY.

Our View

Super has received the nod to list up to 40m TDRs (20m new ordinary shares) on the Taiwan Stock Exchange. It intends to use the proceeds to relocate to new premises. At a dilution of only 3.7%, the TDR listing gives Super a brand new fund‐raising platform while lifting its profile in Taiwan, one of its fastest‐growing markets. More importantly, investors stand to benefit from a re‐rating in Super’s share price as its TDR‐listed F&B peers trades at a sharp price premium of >30%.

Gross margin recovery is in sight as raw material prices stay low. Prices of coffee bean, sugar and palm oil have trended downwards from April to June 2010. Though coffee bean prices rose some 12% yoy in July, management believes the impact will be mitigated by the falling prices of other raw materials and its pricing strategy.

The sale of non‐core assets in Jiangsu Hengshun and Care Property Holdings could yield total divestment proceeds of $37m and gains of about $11m. Add Super’s net cash of $77m and the TDR listing proceeds, we believe there is upside to the group’s dividend payout this year, possibly double last year’s payout of 2.6 cts/share.

Action & Recommendation

We believe stock fundamentals are well supported by strong cash position and promising growth prospects. Trading at only 8.4x FY10F PER, the cheapest in the branded F&B sector, Super is clearly undervalued. Reiterate BUY and target price of $1.33.

Samsung Securities says Man Wah stock should be partying like it’s 1999!

Analyst: Matthew Marsden

WHAT’S THE STORY?

Event: Outstanding FY10 results show 171% YoY net income expansion, and the current international investor roadshow will improve the market’s understanding of this growth story. This stock should be partying!

Impact: Armed with improved visibility from our NDR with management, we update our assumptions; our EPS estimates increase by 7% in FY11 and 14% in FY12. We increase our price target to HK$10.60, representing 43% upside.

Action: Our valuation is cautious. At our price target, Man Wah would still only trade at 9.2x next fiscal year’s PE. This stock is clearly fundamentally undervalued and recent weakness offers an excellent opportunity. BUY.

THE QUICK VIEW

Man Wah has been a solid outperformer, gaining 18% in absolute terms in the month running up to FY10 results. However, since the numbers were published on June 22nd the stock has been losing ground. This is perplexing, as the results release was exceptionally strong with net profit growth of 171% YoY.

Is there genuine cause for concern, or does recent weakness represent opportunity?

In this report, we identify the eight bear arguments against this stock and comprehensively address them.

We find that most of the negativity is nonsense, although margin deterioration is likely this year. We price in the risk and assume that net margin falls to 19.5% in FY11 (from 20.7% in FY10).

Nevertheless, we still see handsome net profit CAGR of 36% FY10-13E.

The group employs a two pronged growth strategy:

• In the PRC, the recliner-sofa product category is relatively new and so should still demonstrate strong growth, even if the housing market slows. Man Wah is executing on an aggressive store rollout plan for its No. 1 CHEERS brand.

• In the US, the company’s good value for money proposition has enabled Man Wah to take market share during the economic downturn, occupying valuable real estate in US furniture showrooms.

The firm is now well positioned for the gradual stabilization in the housing market. A sum-of-the-parts methodology is most appropriate to value the stock, in order to reflect the market’s distinct valuations for exporters and China brand businesses.

Our new 12-month price target of HK$10.60 represents 43% upside NB we believe that our valuation is cautious; at our target price Man Wah would be trading at an undemanding 9.2x P/E next fiscal year. We reiterate our BUY.