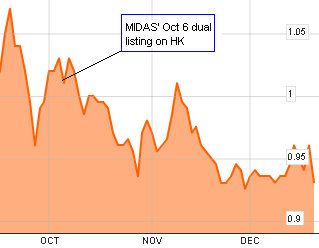

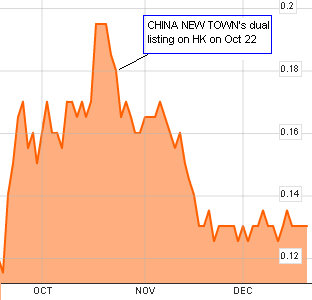

Midas has been trading lower since its dual-listing in HK, as has China New Town (below)

In Hong Kong, the stock closed at HK$2.36, or about 40 Singapore cents.

About two weeks earlier, Kevin Scully, the executive chairman of NRA Capital, in yet another accurate call, had raised the possibility of a dismal showing.

On Dec 9, on his blog, he had noted:

i) Midas Holding had traded down since its dual listing in HK on Oct 6.

ii) Stretched valuations - China Animal

iii) At 40 cents, the stock is just 5% from his price target of 42 cents.

“Investors should take some profit on the way up at S$0.40 and above,” he had advised.

“I am therefore removing China Animal from my Stock Picks more because its share have risen 48% since we included it in the portfolio but because the upside is probably about 20% in an optimistic scenario and 5% based on my conservative scenario.”

However, brokers have higher targets for the stock, ranging from S$0.48 to S$0.52.

Recent story: C&O PHARMACEUTICAL, CHINA ANIMAL HEALTHCARE, LC DEVELOPMENT: What analysts now say....