Photos: OSGH

GOLDEN HARVEST: Eye On PRC Moviegoers With IMAX Deal

Orange Sky Golden Harvest Entertainment (Holdings) Ltd (HK: 1132; OSGH), a major film exhibitor, distributor and producer, inked a deal with IMAX Corp (NYSE: IMAX) to install four new digital IMAX theater systems in Mainland China.

Pursuant to the contract, the first theater system is se to be installed in the Tianjin Milky Way International Shopping Centre in northern China this December.

The second IMAX theater will be installed in the Guangzhou Feishi Plaza in Sout China’s Guangdong Province and is slated to open in September 2013.

The remaining two systems are scheduled for installation by the end of 2014.

"IMAX is a powerful differentiator from the in-home entertainment experience, which is prompting more and more Chinese consumers to seek this out-of-home entertainment. We believe in the value that IMAX will bring to our business and are excited to add four new IMAX theatres as the flagship attractions to our top locations," said Golden Harvest CEO Andrew Mao.

"We're in the early stages of our expansion in China, as is the cinema industry overall. While our network has increased to over 200 theatres open or in backlog today, there are still 35 cities in China with a population of at least one million people that have no movie theaters," said Richard L. Gelfond, CEO, IMAX.

Chen Jiande, CEO, IMAX China, said: "OSGH is a pioneer in the Asian film industry and was one of the first companies to bring the multiplex concept to Singapore. They share our legacy of innovation and together we are excited to bring The IMAX Experience to more audiences in China."

Don Savant , IMAX's Senior Vice President and Managing Director, Asia Pacific, added: "The fact that one of the biggest media companies in Asia is looking to IMAX to grow their business, is a tremendous endorsement of the value that we deliver to our exhibitors. This agreement with OSGH highlights the value of the IMAX brand and builds on the continued momentum of our aggressive network expansion in China."

IMAX's digital projection system delivers The IMAX Experience and helps drive profitability for studios, exhibitors and IMAX theatres by eliminating the need for film prints, increasing program flexibility and ultimately increasing the number of movies shown on IMAX screens. The system can run both IMAX and IMAX 3D presentations.

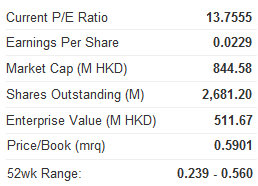

Orange Sky Golden Harvest (China) Cinemas Co Ltd is a wholly-owned subsidiary of OSGH, a leading integrated film entertainment company in the markets where it operates and primarily engages in exhibition, distribution, production and financing in Asia.

It has a focus on growing its business in the Mainland China. As of end-2011, the Group operates 48 multiplexes with collectively371 screens across Mainland China, Hong Kong , Taiwan and Singapore and is one of the leading distributors in its operating territories.

See also:

GOLDEN HARVEST: Seeing Gold In Silver Screens

TWO THUMBS DOWN: What’s Holding Back Cinema Stocks?

Photo: CSS

CPY: CHOW SANG SANG Target Set At 26.9 Hkd

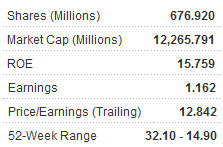

Core Pacific-Yamaichi said it is setting Chow Sang Sang’s (HK: 116) short-term target price of 26.9 hkd (current price 20.1 hkd) on a steady store expansion drive.

The brokerage has a stop-dollar price of 18.7 hkd on the Hong Kong-listed jewelry chain.

The rapidly expanding Chow Sang Sang, whose main business is jewelry manufacturing and retail, wholesale of precious metals, securities and futures brokerage operations, has seen Hong Kong, Macau and Mainland China same-store sales growth (SSSG) in January expand at around 30% year-on-year.

Management also announced that the RMB-denominated sales saw very strong growth over the Chinese New Year holiday, up some 27% from last year.

Per-customer spending also doubled from 2011 levels, the brokerage added.

CPY said Chow Sang Sang plans to maintain a steady sales network expansion strategy, targeting the opening of three new stores in Hong Kong.

See also:

OSK Stays ‘Buy’ On BAOFENG; BOCI Cuts CHOW SANG SANG Target

HK Jewelry Retailers: 'Buy CHOW SANG SANG, LUK FOOK On Weakness'

KIM ENG: CHINA LIFESTYLE Solidifying Major Client Order

Kim Eng says that after a recent visit to jellied snack maker China Lifestyle F&B (HK: 1262) to “gel” more around its key clients to boost orders and maximize sales revenue inflows.

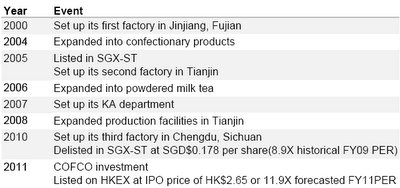

China Lifestyle, which delisted from the Singapore exchange in 2010 and relisted in Hong Kong the following year, is shifting its focus to key accounts (KAs).

“Following the setting up of its Key Accounts(KA) team in 2007, Lifestyle began to execute KA sales in 2011. Management expects 15-20% of its sales will come from direct KA sales in 2012. The price charged to KA customers is 30-50% higher as compared to other wholesale distributors; however, receivables days are much higher at 90 days compared with 30-60 days for other distributors.

“Management reasons the restructuring is necessary as modern channel account for 55% of industry jelly sales,” Kim Eng said.

Established in 2000 and listed on HKEX on 9 Dec 2011, Lifestyle F&B is currently the PRC’s no. 2 jelly products manufacturer with more than 1,000 offerings. It mainly sells under its core “Labixiaoxin” brand. It also offers confectionery products and powdered milk tea manufactured by OEM suppliers. It has over 190 independent wholesale distributors covering 31 provinces in China.

As of May 2011, China Lifestyle had a production capacity of 195,000 ton. All jelly products are produced in-house and utilization has been running high.

The company is targeting addition of 30,000 ton of capacity in southwestern China’s Chengdu in 2012 and a further 90,000 tons at its new Anhui plant in 2013.

Hence, management expects it is well positioned to capture volume growth of 25-30% over the next several years.

“We expect the new plants to strengthen its presence in Central China as well as save on transportation costs,” Kim Eng added.

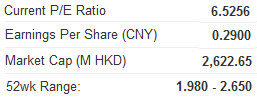

The brokerage confirmed that China Lifestyle management expects to deliver a net profit of 205 mln yuan in FY11E, which implies 9.5x FY11 PER.

Key drivers are capacity expansion, market share gains and margin expansion.

“We believe a valuation discount is justified owing to single product risk and execution risks of its new sales strategy; however, the discount of 60-70% or more to its peers appears to be a little too large to us,” Kim Eng said.

See also:

Just As In Gambling, Self-Control Equals To Research For Investors

GCL POLY Stuck At ‘Hold’; TSINGTAO Gets 46 Hkd Target