Excerpts from this morning's reports....

DBS Vickers initiates coverage of UNITED ENVIROTECH with 69-c target

Analyst: Tan Ai Teng

Stable flow of recurring income

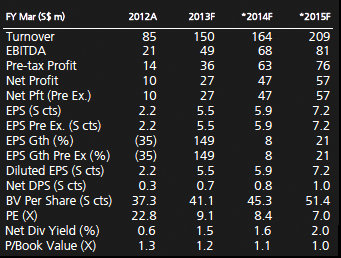

• Initiate coverage with BUY, +41% to fully diluted TP of S$0.69

• Expect earnings breakthrough as recurring income streams gather momentum

• Attractive at 8x/7xPE for 75%/21% PATMI growth in FY14F/15F, industry averages 13x

• Potential upside from acquisitions & expansion; CB dilution can be potential overhang

BUY, TP S$0.69. Our sum-of-parts TP is based on 10x PE for EPC and DCF valuation (8.6% WACC) for treatment. We have also assumed full dilution of the S$136.2m convertible bond to Kholberg Kravis Roberts & Co (KKR).

Recent story: MEMSTAR & UNITED ENVIROTECH: Trade shows good for branding

DBS Vickers says 'buy' CHINA MERCHANT HLDGS

Analyst: Paul Yong, CFA

NextInsight file photo

• Buying 48.1km Jiurui E’way for Rmb675m

• Consideration includes disposal of NZ property business and issue of 72.7m new shares at S$0.84 to the sellers of Jiurui E’way

• Transaction will a) lengthen CMHP’s average concession period b) streamline its focus to expressways only and c) improve liquidity

• Maintain BUY, TP raised to S$1.20. Factoring in this acquisition, we raise our DCF-based TP to S$1.20, adjusted to S$1.13 if all the convertible bonds were converted to new shares in the company.

Recent story: On acquisition trail: CHINA MERCHANTS, SAPPHIRE CORP