HEETON HOLDINGS announced on June 26, after the market closed, a bonus issue on the basis of one bonus share with one bonus warrant for every five existing ordinary shares of Heeton.

The announcement had a small surprise in the form of the bonus warrants.

To me, the bonus warrant is a rights issue that is cleverly repackaged as free warrants - because the warrants have a life of only 2 years and an exercise price (70 cents) which is "doable".

The jump in Heeton's share price subsequent to the announcement is proof once again (despite many companies claiming that "bonus issues have no material effect" on the worth of a stock) that bonus issues do benefit share prices, and hence shareholders.

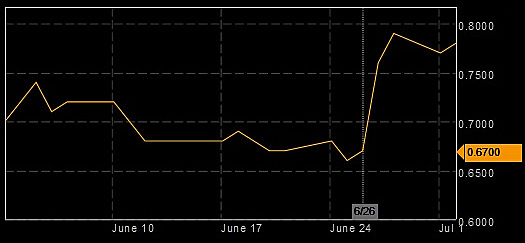

Following the announcement of a bonus isue, Heeton stock jumped from 67 cents on June 26 to close at 77 cents yesterday. Chart: Bloomberg

Following the announcement of a bonus isue, Heeton stock jumped from 67 cents on June 26 to close at 77 cents yesterday. Chart: BloombergWe know, of course, that bonus issues (or rights and stock splits) do not affect the company's Earnings Per Share or Net Tangible Assets per share on paper.

But the reality is that market players react to such announcements, and subsequently share prices are affected, sometimes substantially.

Hence, "on paper" logic is one thing, but what happens to the actual share price is another - and in Heeton's case, it clearly shows that "what is" (ie, the price reaction) has to be acknowledged, rather than simply dismissed by those who argue on "what it should be (ie, no effect)".

I hope that small shareholders can cite Heeton's bonus issue this time in support of their calls for other companies to make similar corporate moves - especially those that have a justification for it (eg, low liquidity, good ratios, high reserves).

Heeton's bonus issue this time could well be due to one shareholder's plea to the management during this year's AGM, and we thank him as well as the management for heeding this call.

Next year, during AGM season, perhaps we can all share some "reality wisdom" with other corporate bosses (like those of Hiap Hoe/SuperBowl perhaps).

In the case of Heeton, its fundamentals are quite clear to those who look at the stock closely.

A quick recap of Heeton: Its RNAV is above $2 per share, its earnings per share should be consistently high over the next 3 years (due to contributions mainly from Boutiq, Sky Green, Newest and KAP), possible surprises in the clearing of Lumos stock, sale of shopping centre and positive news on El Centro.

Apart from these, Heeton will be the only developer stock that has a warrant issue for speculative players to "fry" - another "reality wisdom" that escapes those who are locked into "on paper" logic.

Having said that, the Singapore government's latest housing loan move could dampen demand for properties, and have a negative effect on the physical market, and property stocks. That is market risk, which is another topic altogether, but do take it into consideration in your own analysis.

Recent articles by Sumer:

ROWSLEY: My take on its possible profit from Johor projects