Excerpts from analysts' reports

OSK-DMG: Straco is conservatively worth SGD0.70 on ex-cash basis

Analyst: Goh Han Peng

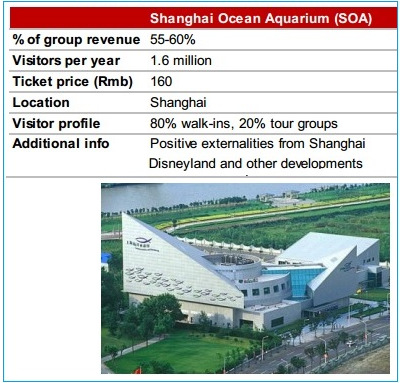

Straco Corporation is a developer and operator of aquatic attractions and tourism-related assets in China. Its key assets include:

Straco Corporation is a developer and operator of aquatic attractions and tourism-related assets in China. Its key assets include: 1) the Shanghai Ocean Aquarium, situated in Pudong Shanghai right besides the Oriental Pearl Tower;

2) Underwater World Xiamen, on the scenic Gulangyu Island, a key tourist attraction in Xiamen City;

3) Lixing cable car service at Mount Lishan.

The company reported net profit growth of 73% to SGD34m for FY13 on the back of increased visitation across all its three attractions.

Visitor numbers to each of its three attractions saw double-digit growth ranging from 10-33%, driving a 32% increase in top-line to SGD73m.

Straco has a cash-generative business model coupled with strong pricing power, resulting in pretax margin of 68% and a cash pile of SGD130m.

Net profit compounded at 40% from 2009-2013 on the back of price hikes and rising visitor numbers.

Straco expects to benefit from rising domestic travel as the Chinese government looks to balance its export-driven economy with higher domestic consumption, driving steady growth across its tourism assets.

The company has raised its full year dividend from 1.25cts/share for FY12 to 2cts/share for FY13.

Meanwhile, it is in the process of evaluating a bid for a new tourism asset that could further fuel its earnings growth.

Backing out its cash, the stock is attractively priced at 8.5x FY13 P/E. We think the stock is conservatively worth SGD0.70 on a 12x forward multiple, ex-cash basis.

Recent story: Initiation reports: Buy STRACO CORP, Buy TAI SIN ELECTRIC

OSK-DMG expects Yangzijiang to stage recovery in FY15 Analysts: Lee Yue Jer & Jason Saw  Yangzijiang's yard in Jiangsu: Shipbuilding industry is seeing a cyclical recovery. File photoYZJ’s FY13 PATMI of CNY3.1bn was in line. FY14 will be its toughest year, but a recovery in FY15 is expected due to orders of USD4.64bn in hand. Yangzijiang's yard in Jiangsu: Shipbuilding industry is seeing a cyclical recovery. File photoYZJ’s FY13 PATMI of CNY3.1bn was in line. FY14 will be its toughest year, but a recovery in FY15 is expected due to orders of USD4.64bn in hand. Margins will fall, but mitigated by revenue rising on higher work volume. Note that the street is far too downbeat on its HTM business. Maintain BUY, with our SOP-based TP raised to SGD1.55 (11.3x/10x FY14/15 P/Es), which is reasonable for China’s most profitable yard operating in a recovering industry. We now value its HTM assets at 1.1x of its expected end-FY14F balance of CNY11bn, to factor in one year of HTM earnings, less net debt, plus 9x FY14F shipbuilding earnings in FY14F to derive a TP of SGD1.55.

This implies 11.3x/10x FY14/15F P/Es, which is reasonable for China’s most profitable yard. The shipbuilding industry is seeing a cyclical recovery - asset prices rose c.10% in FY13 and are up 5% YTD. YZJ’s yard is also full to FY15. Meanwhile, investors are being paid to wait with a 4.4% yield. BUY. Recent story: YANGZIJIANG: FY2013 Gross Margins Widened In Shipbuilding Slump |