Excerpts from analysts' reports

Maybank Kim Eng reiterates 'buy' call on Cordlife

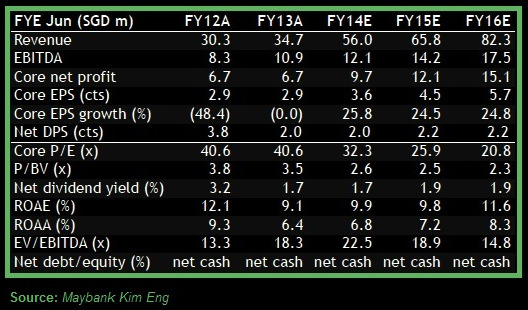

Analysts: John Cheong & Gregory Yap

New opportunities beckon: From just two markets previously, Cordlife expanded into the Philippines, India, Indonesia, Malaysia and Thailand last year with plans to extend its product range by launching new and existing products.

A cryovial containing processed umbilical cord lining segments. Photo: CompanyThe move is part of its strategy to transform itself from just a cord blood bank into a multi-product healthcare products distributor targeting the mother and child segment.

A cryovial containing processed umbilical cord lining segments. Photo: CompanyThe move is part of its strategy to transform itself from just a cord blood bank into a multi-product healthcare products distributor targeting the mother and child segment. Deepening its reach into China: Cordlife will deepen its reach into China via an alliance with China Cord Blood Corporation to provide cord tissue storage services that will give it a steady stream of royalty income.

Based on our conservative estimates, this tie-up alone could lift its FY6/15E EPS by 14%.

But this is just the tip of the iceberg as we expect more mutually beneficial ventures to kick in for the China market in future.

Reiterate BUY: We remain positive on Cordlife’s development from a single-product, twin-market cord blood bank into a multi-product, multi-market healthcare company. Reiterate BUY with our SOTP-based TP raised slightly from SGD1.42 to SGD1.43 for now.

We will incorporate the China royalty income into our forecasts when there are more material developments. When this happens, our TP could rise to SGD1.60.

Recent story: CORDLIFE makes a push into China with cord-tissue banking service

DBS Vickers forecasts stocks entering seasonal 'sweet spot'

Analysts: Yeo Kee Yan, Janice Chua & Ling Lee Keng

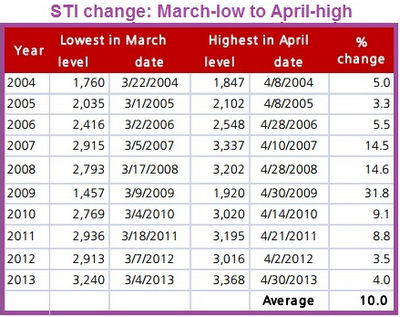

As the full year reporting season winds down, the period starting mid-end February through a good part of March is typically choppy and exhibits a downward bias. At the same time, we observed that historically, this pullback usually ends around mid-March. STI’s behaviour from mid-March till end-April in the 10 years from 2004 to 2013:

1. STI posted good gains ranging from 2.5% to as much as 21% in 7 out of 10 years.

A marginal 0.4% gain was recorded in the year 2004 2. STI lost ground in only 2 years. The average loss over these 2 years (2005 and 2012) was a moderate 1.55%.

3. Over the course of the 10 years, STI gained 5.7% Based on historical data, the odds look good with a 7 out of 10 chance for a positive return, 1 square and with only 2 out of 10 chance for a loss.

3. Over the course of the 10 years, STI gained 5.7% Based on historical data, the odds look good with a 7 out of 10 chance for a positive return, 1 square and with only 2 out of 10 chance for a loss.Table (right) shows the low points in March and the positive returns to April highs over the 10-year period from 2004 to 2013.

The returns ranged from 3.3% to 31.8% and averaged 10% over the 10-yr period.

Where we do not expect a March-low to April-high span of 10% this year, the observation underscores the likelihood that equities are about to enter a seasonally “sweet spot” in coming weeks, before the next seasonal trend to “sell in May and go away”.

Besides the hope for US economic activities to pick up again as the cold winter ends, STI could also be underpinned by bargain hunting ahead of blue chips’ going “ex-dividend” mostly during the April-May period.

Notable upcoming blue chip stocks with dividend payouts are Keppel Corp, ST Engineering, and UOB. Non-index stocks with attractive upcoming dividend payouts are M1, China Merchants and Venture Corp.