Excerpts from analysts' reports

Analyst: Benjamin Ong

Analyst: Benjamin Ong

|

|

Investment Merits

Asset light business with high returns and strong operating and free cash flow generation

Thomas Tan, executive chairman and CEO of Kim Heng Offshore & Marine. Photo: CompanyKim Heng’s business model is asset light due its nature of being in the services industry. Gross profit margins and net profit margins are also high, resulting in superior returns on equity and invested capital. In our opinion, this can be attributed to cost management discipline and being an established “all-in-one” service provider to the top rig owners.

Thomas Tan, executive chairman and CEO of Kim Heng Offshore & Marine. Photo: CompanyKim Heng’s business model is asset light due its nature of being in the services industry. Gross profit margins and net profit margins are also high, resulting in superior returns on equity and invested capital. In our opinion, this can be attributed to cost management discipline and being an established “all-in-one” service provider to the top rig owners. Operating and free cash flows has been robust and positive since FY10, once the capex cycle is over, we expect it to expand rapidly, signaling a good potential for increasing shareholder returns.

High utilization rates and aging rig fleet a positive for Kim Heng

Rig utilization across the global fleet of semi-subs, drillships and jackups remain at a high level, especially so for drillships and jackups. High oil prices (>US$100/barrel) are also keeping offshore activity levels buoyant.

Above 40% of global jackups and close to 30% of global floaters are above 30 years old. The culmination of these factors would be demand drivers for Kim Heng’s repair and maintenance services and solutions.

Above 40% of global jackups and close to 30% of global floaters are above 30 years old. The culmination of these factors would be demand drivers for Kim Heng’s repair and maintenance services and solutions.

Re-rating catalyst with expansionary plans and potential turnkey projects

Kim Heng will be enhancing their yard facilities and expanding their fleet as they ramp up their capex with the IPO proceeds. Kim Heng has also indicated plans to expand their subsea capabilities and could potentially acquire a subsea service contractor. We are excited on the rollout of its expansion plans and 1 key re-rating catalyst would be how accretive these plans and acquisitions are.

Kim Heng will be enhancing their yard facilities and expanding their fleet as they ramp up their capex with the IPO proceeds. Kim Heng has also indicated plans to expand their subsea capabilities and could potentially acquire a subsea service contractor. We are excited on the rollout of its expansion plans and 1 key re-rating catalyst would be how accretive these plans and acquisitions are. Investment Action

Kim Heng has a proven track record and enjoys an established relationship with top names like Transocean, Seadrill, Noble, Saipem and McDermott. Current high utilization rates, increasing rig counts and aging global fleet bodes well for Kim Heng.

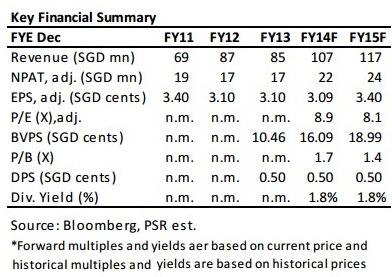

We initiate coverage on Kim Heng with a "Buy" rating based on our P/E valuation of 11X FY14 Earnings, in line with small/mid cap offshore and marine players, with a TP of S0.33.

Full report here.

Recent story: Buy KIM HENG OFFSHORE, target 34 cents, says OCBC initiation report

We initiate coverage on Kim Heng with a "Buy" rating based on our P/E valuation of 11X FY14 Earnings, in line with small/mid cap offshore and marine players, with a TP of S0.33.

Full report here.

Recent story: Buy KIM HENG OFFSHORE, target 34 cents, says OCBC initiation report