- Posts: 691

- Thank you received: 17

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

REX INTERNATIONAL . Worth a buy now ?

11 years 10 months ago #19557

by ZEN

POST IPO IT RALLIED TO A HIGH OF 97 CENTS . AND HAD CORRECTED TO CURRENT PRICE .

Target price of S$1.27 is derived from the risked NAV of Rex’s oil concessions, using the expected monetary value methodology based on average rates of exploration success from conventional methods of analysis.

We have not imputed improved success rates with the use of RT, which may provide further upside to our target valuation if RT proves to be successful.

REX INTERNATIONAL . Worth a buy now ? was created by ZEN

POST IPO IT RALLIED TO A HIGH OF 97 CENTS . AND HAD CORRECTED TO CURRENT PRICE .

Target price of S$1.27 is derived from the risked NAV of Rex’s oil concessions, using the expected monetary value methodology based on average rates of exploration success from conventional methods of analysis.

We have not imputed improved success rates with the use of RT, which may provide further upside to our target valuation if RT proves to be successful.

Please Log in to join the conversation.

11 years 10 months ago #19573

by pine

Replied by pine on topic REX INTERNATIONAL . Worth a buy now ?

Please Log in to join the conversation.

11 years 10 months ago #19578

by ZEN

Replied by ZEN on topic REX INTERNATIONAL . Worth a buy now ?

LOOKING AT THE TECHNICALS , THE STOCK LOOKS CONSOLIDATED AND BULLISH AND POISED FOR A RALLY

Please Log in to join the conversation.

11 years 10 months ago #19613

by yeng

Replied by yeng on topic REX INTERNATIONAL . Worth a buy now ?

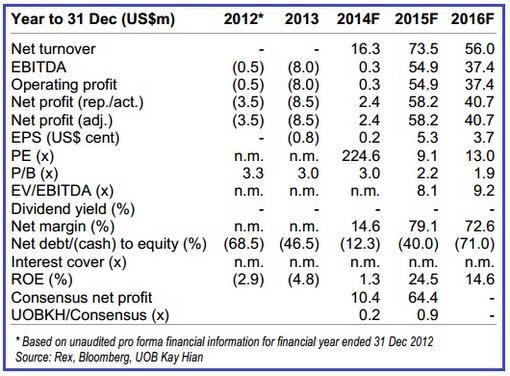

Show me the money (revenue/profit) first.

Please Log in to join the conversation.

11 years 9 months ago #19793

by lsiewfatt

Replied by lsiewfatt on topic REX INTERNATIONAL . Worth a buy now ?

My research shown this company technology is in the right direction. Its a matter of time for them to hit a big gold pot. Will move in when it start to move.

Please Log in to join the conversation.

11 years 9 months ago #19799

by yeng

Replied by yeng on topic REX INTERNATIONAL . Worth a buy now ?

REX (60.5 cents) currently commands a market value of S$662 million ---> which means it has to deliver strong pipeline of earnings to justify it. Until the first hint of oil strike happens, it's hard to see the market cap running very much higher.

Please Log in to join the conversation.

Time to create page: 0.230 seconds