From a low of RM1,389 a tonne, CPO recently hit RM1,833

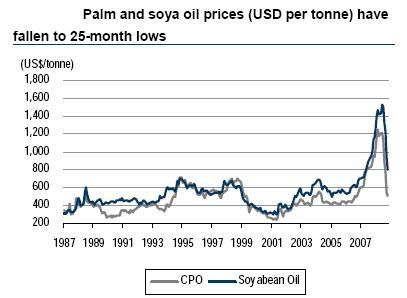

Don’t imagine that palm oil prices, which have fallen from a high of RM4,400 per tonne (March 2008) to a low of about RM1,380 (October 2008), to stay low for very long.

Credit Suisse, in fact, expects palm oil prices to rebound this year, ‘particularly in 2H09’, it said in a report on Jan 14.

In fact, prices have rebounded to about RM1,900 a tonne now.

Prices could average RM2,000 in 1H09 and RM2,500 in 2H09, according to Credit Suisse analyst Tan Ting Min, who is based in Kuala Lumpur and has a degree in bio-technology from Cambridge University. She began her career as an analyst in 1993 covering the plantations sector.

Source: Oil World

Palm oil’s discount to soya oil is now over US$200.

Palm oil’s huge discount should encourage a demand shift to palm oil from more expensive vegetable oils, wrote Ting Min.

Palm oil often tracks soybean oil as it’s a substitute in food and fuel applications.

Credit Suisse has ‘outperform’ ratings on Wilmar, Olam and Indofood Agri. These stocks have declined sharply with the broader market and with the plunge in palm oil prices.

This is what Ting Min wrote:

Palm oil fruit. Photo: Internet

Indofood Agri:

“We like Indofood Agri for the following reasons:

1) as an upstream player, it benefits when palm oil prices rebound,

2) as majority owner of London Sumatra, Indofood Agri stands to benefit from London Sumatra’s cost cutting programme and maturing plantation profile, and

3) it has the most undemanding valuations of all plantation counters under our coverage.

Wilmar:

“Wilmar is an integrated plantation company with superior market intelligence, given its dominant presence in China and India, the two largest edible oils markets in the world. As more than 80% of its profits are from downstream plantation manufacturing and merchandising,earnings volatility should be far less than upstream players.”

Olam:

“We like Olam given its integrated supply chain and strong presence in the producing geographies, and with a product portfolio that is focused on the agricultural commodities space.

”Volatile commodity prices have limited the impact to Olam’s profitability, given a business model that aims to drive volume growth, and capture an incremental contribution margin, without taking views on directional commodity price movements.”

Recent story: INDOAGRI: Top pick among Indon palm oil plays