Jurong Districentre is part of the Cambridge portfolio.

CAMBRIDGE INDUSTRIAL Trust rose 1 cent (3.5%) yesterday (Feb 2) to close at 29.5 cents while the Straits Times Index went down 2.35%.

Other REITs tumbled. Ascendas was down 5.5%. CapitaMall Trust fell 5.6% and Ascott Residence Trust was down 8.9%.

Cambridge, which is a REIT, had announced its full-year results over the weekend.

Conceivably, the market might have the following 5 reasons for loving the stock:

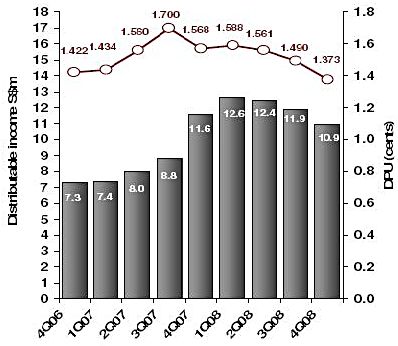

Negative trend of declining DPU because of higher financing charges. Source: Cambridge.

1. Distribution per unit (DPU): Cambridge announced a DPU of 1.373 cents for the quarter 1 Oct 2008 to 31 Dec 2008.

Last day of trading on "cum" basis is very soon – Wednesday, 4 Feb.

The dividend will be paid on 27 Feb.

2. Annual yield: Cambridge’s annualized DPU (ie, 1.373 cents X 4 quarters) works out to 5.462 cents, which is a 18.5% yield based on yesterday’s close of 29.5 cents a unit.

However, note that because its recent refinancing was achieved at a higher interest cost, the impact on DPU was estimated by Cambridge to be 0.9 cents per unit.

4. Quality of income: Cambridge said that as regards the quality of its rental income, 73% of income is from SGX-listed companies or whole/majority owned subsidiaries.

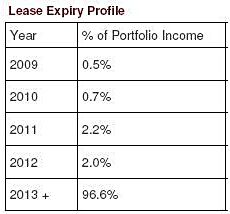

Low, low rate of expiry this year and next. Source: Cambridge

And what’s amazing is that it has collected security deposits equivalent to an average of 16 months rental! Now that certainly provides a great deal of certainty regarding it cashflow.

5. Low rate of expiry: This year and next will only see 0.5% and 0.7%, respectively, of Cambridge’s portfolio income expire.

The bulk of it - a whopping 97% - will happen in 2013 and beyond!

Dec 16 story: CAMBRIDGE REIT: Ratings by JP Morgan, Nomura, UOB Kayhian

NextInsight forum discussion on Cambridge REIT here