AUSGROUP, an infrastructure services provider to the mineral sources industry, announced a recovery in 2Q10 earnings compared to 1Q10, even as global mining companies are pushing steelmakers to accept a record price for iron ore for the 2010-11 annual contracts.

Ausgroup’s 2Q10 revenue was A$85.8 million, down 34.1% YoY but up 16.1% QoQ.

Second quarter net earnings were A$3.4 million, down 32.5% YoY but near double QoQ (up 96%).

However, year-on-year revenues and net earnings were down still down. 1H2010 revenues were A$159.7 million (down 39%), while semi-annual net earnings were A$5.1 million (down 52.8%).

The good news: a recovery in iron ore prices could well spark a long-awaited boost to infrastructure demand at iron ore mines.

Construction, fabrication, manufacturing and integrated services used in infrastructure for mineral resources contributed 47% to Ausgroup’s 1H2010 revenues while oil & gas contributed the remaining 53%.

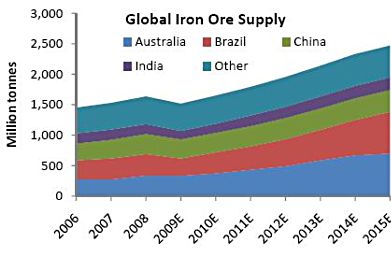

Vale SA, the world’s biggest iron-ore producer, was quoted by Business Week as saying last week that it expects to win contract prices this year that reflect a soaring spot market as Chinese demand for the steelmaking raw material surges.

Iron ore is currently trading for about US$130 a metric ton on the Chinese spot market, according to the Vale spokesman.

This is more than double of what Vale sold the commodity for (an average price of US$55.99 a ton) last year.

On the demand side, even as China haggles for a lower iron ore price, its China Iron and Steel Association (CISA) is also predicting this year’s iron ore prices will likely increase in sharp contrast to 2009, when China’s cost of purchasing imported iron ore decreased 34.2% YoY.

Purchases by China, the world’s largest buyer of the commodity, are rising after economic growth of 10.7% in 4Q09 boosted demand for steel used by builders and manufacturers.

Analysts, including from Nomura and Bank of America, have forecast that Rio de Janeiro-based Vale and other iron-ore producers may win price increases in annual talks of as much as 50% this year.

"We continue to be bullish about the outlook for 2010,” Credit Suisse analysts led by Ivan Fadel wrote in a report issued last week.

"We estimate a 40% iron-ore price increase for 2010, with upside risk, due to a very tight seaborne market,” according to the analyst.

Does this spell a bottoming out in Australia’s mining infrastructure sector?

AusGroup, which is SGX-listed, saw its order book balloon by two-thirds to A$467 million as at end Jan 2010 (from A$280 million as at end Jun 2009).

And Ausgroup’s clients are bulwarks financially, such as BHP Billiton and Rio Tinto (both Australian), who together with Vale (Brazilian) control 66% of the iron ore market.

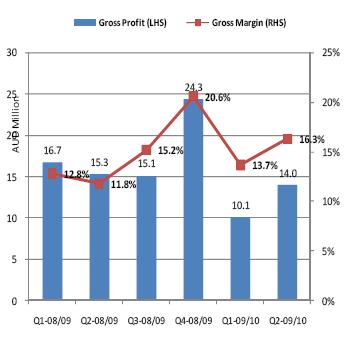

Ausgroup’s 1H2010 gross margins expanded 2.8 percentage points to 15.1% due to improved project execution and better timing in recognition of variation orders.

However, its CEO John Sheridan cautioned at its analyst briefing last Thu that while the company expects revenues to increase in the short term, margin pressures are expected.

Unfazed by Ausgroup’s year-on-year earnings contraction, CIMB-GK analyst Lim Siew Khee upgraded its FY2010 earnings estimate by 1%, and maintained price target at 96 cents.

CIMB-GK reckons that the catalysts for Ausgroup's share price could be an announcement of sustainable margins, and an acceleration in order wins from LNG and mineral projects.

OCBC Investment Research analyst Meenal Kumar, on the other hand, was disappointed by the subdued tendering activity sector-wise of late.

She noted that while AusGroup's order book remains very strong at A$467 million as of end Jan, tenders submitted fell 80.5% from A$621 million in 1Q2010 to A$121 million as of 10 Feb 2010.

The strength of the Aussie dollar against the USD (to which world no.1 iron ore consumer China’s Rmb is pegged), also puts it at a competitive disadvantage.

Ms Kumar has a fair value estimate of 60 cents for Ausgroup.

Ausgroup is one of Western Australia’s leading fabrication and construction service providers for the mining industry.

In Nov 2009 alone, it won 3 contracts as follows:

1) A$34 million for the onshore painting and insulation for Woodside’s Pluto LNG Project.

2) A$100 million contract by BHP Billiton Iron Ore.

3) A$30 million contract by Woodside Energy Ltd (Woodside).

Recent stories:

AUSGROUP: Bumpy earnings recovery in 2009

AUSGROUP, CHINA HONGXING: What analysts now say