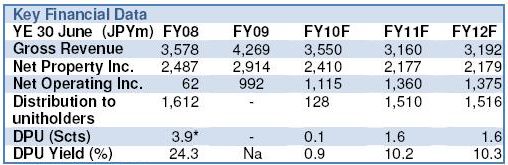

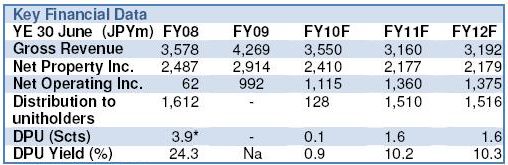

The following are excerpts from a NRA Capital report published on Friday Feb 19, and is reproduced here with permission. Note the report's forecast of 10% dividend yield for FY 11 and FY 12, and a reference to a possible catalyst for Saizen REIT's re-rating. For the full report, go to www.nracapital.com

All CMBS loans (excluding YK Shintoku) will be fully repaid by end April 2010

Relatively stable property income and no dividend distribution in1HFY2010, as expected.

Group revenue and net property income fell by 3.1% and 4.8% to JPY1.0bil and JPY715.4m respectively in 2QFY2010 mainly due to the divestment of five properties and a slight fall (less than 5%) in the rental rates of new leasing contracts entered in 2QFY2010.

Saizen REIT's property portfolio had an occupancy rate of 91% as at end-2009.

Occupancy of the portfolio remained healthy at about 91% as at 31 Dec 2009. Group NAV per unit declined from JPY26.16 as at 30 Sep 09 toJPY26.06 as the cash conserved over the past few quarters were disbursed for loan repayment in 2QFY2010.

As expected, there was no dividend distribution in 1HFY2010.

Full repayment of all CMBS loan (excluding YK Shintoku CMBS loan) by 25 April 2010.

Through various funding sources, Saizen has fully repaid CMBS loans of JPY5.4 bil due in 2QFY2010. Through a new loan repayment arrangement, all CMBS loan (ex-YK Shintoku loan) will be fully repaid by 25 April 2010.

By then, LTV is expected to improve to about 38% (including YK Shintoku loan) and this will facilitate securing of new financing.

Cashflow from operating assets remained stable.

In view of the local (Japanese) mass market tenant base, tenancy structure and low homeownership in the cities in which it operates, Saizen’s property portfolio remained relatively stable, generating steady cashflow, notwithstanding the prevailing economic weakness in Japan.

Downward pressure on rental reversion of new contracts (about 22% of total portfolio renewed annually) have also abated, declining by less than 5% in each of 2QFY2010 and 1QFY2010, compared to about 6.5% during the leasing season in 3QFY09.

Source: NRA Capital, Feb 19 (*Adjusted for rights issue)

Valuation and Recommendations.

In light of rapid improvements and stability in the credit market and Saizen’s strengthened balance sheet position, management efforts to successfully refinance the YK Shintoku loan cannot be ruled out.

Assuming a conservative stance and based on the assumption that the JPY7.25b CMBS loan encumbered with JPY9.10b worth of assets will be foreclosed eventually, using DDM, we value Saizen at 24.5 Scts (previously 24.3 Scts) and arrive at a target price of 17.0 S cts as previously, maintaining our discount to valuation of 30%.

News flow of new credit access is expected to lift valuations to 32.3Scts and a target price of 22.5Scts (based on the same 30% discount rate), providing catalyst for further upward re-rating of Saizen.

Further, Saizen is expected to start accumulating cash in 4QFY2010 and will resume dividend distribution in 2HFY2010 onwards, albeit nominal initially. Maintain Long-term BUY.

Recent NextInsight story: SAIZEN REIT: Insights from Q&A with CEO

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors