Excerpts from latest analyst reports….

CIMB sets 86-c target price for TECHCOMP, expects dual listing catalyst

Source: CIMB, Apr 28 report

Analyst: Gary Ng

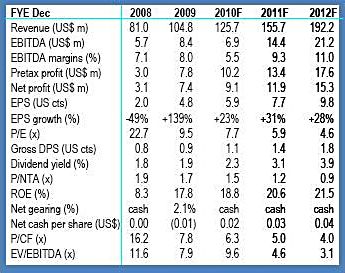

Reinstate coverage of Techomp Holdings (TCH) with a BUY rating, with target price setat S$0.86, based on 8x CY11 P/E to reflect TCH’s strong industry traction and market expansion strategy (though still at 1/3 the multiples global peers are trading at).

• TCH is severely undervalued despite recent share price outperformance. TCH offers excellent value at 5.9x CY11 P/E against 3-year core earnings CAGR forecast of 27.5%.

Stock catalysts could come from:

1) fast-tracked expansion through M&As of key scientific instruments space;

2) dual listing could catalyse its share price further, notwithstanding compelling valuations.

• We believe the upside in earnings include

1) cost savings in R&D from synergies of research platform-sharing; and

2) on top of the sales growth of existing products, fresh contribution of newly-acquired European businesses from FY10-12. We believe the group is on track for another record profit year.

Techcomp President Richard Lo (left) speaking with analysts. NextInsight file photo

• Stock is also trading cum bonus issue and dividend. TCH has also recommended a final dividend of 1.2 Scts/share and a 1-for-2 bonus share issue to reward shareholders recently.

Our EPS has not accounted for the bonus share issue that will go ex on 3rd May10. Investors buying TCH today will be rewarded with the “cum-all” bonus shares and dividend of 1.2 Scts/share.

Dual listing theme could further catalyse share price even without stating that valuation is compelling. Following the recent theme of various S-Chips pursuing dual-listing in Hong Kong, we noted that the market has been willing to assign higher trading multiples to these companies.

We will not be surprised if the group would pursue such a similar route. Such an exercise could potentially result in a surge in trading multiples for TCH.

OCBC Investment Research upgrades MICRO-MECHANICS to 'buy' on semi-con boom

Source: OCBC Investment Research, Apr 27

Analyst: Kevin Tan

Riding on market recovery. In view of the stronger-than expected activity within the semiconductor industry, we now see possibility for Micro-Mechanics (MMH) to exceed our projections for its 3QFY10 results, which is due to release on1 May 2010.

Worldwide semiconductor sales as reported bythe Semiconductor Industry Association (SIA) showed thatthe chip market had improved marginally by 0.3% MoM(+47.2% YoY) in January, before easing by a slight 1.3% MoM (+56.2% YoY) in February.

This leads us to believe that global semiconductor revenue may post a sequential growth for 1Q10(despite a seasonally softer quarter), should March sales maintain or improve from the February level. Moreover, recent quarterly results by chip makers and foundries have by far been encouraging, with most of them coming ahead of market expectations. As such, we believe MMH may similarly see strong demand for its consumable parts, translating into better results from its semiconductor tooling segment.

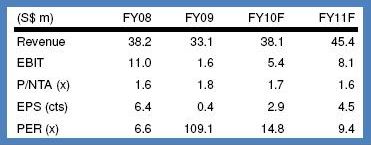

Upgrade to BUY. We are raising our FY10 forecasts by 3.3-7.3% in anticipation of the stronger-than-expected performance in its tooling segment and recovery within its CMA segment. With earnings visibility improving considerably, we are also reverting our valuation back to earnings multiple.

Pegging our FY11F earnings at 12x PER (slight discount to its five-year median PER of 12.6x), our fair value is now raised to S$0.55,up from S$0.40 previously. Looking at an attractive total return of 37.6% (including 8.2% dividend yield), we upgrade MMH from HOLD to BUY.