Nomura Singapore says BIOSENSORS’ 1Q results was good, reiterates ‘buy’

Analysts: Lim Jit Soon, CFA, and Tsai Yuan Yiu

Biosensors (BIG) posted a good set of results: 1Q11 net profit (excluding one-off) exceeded our quarterly forecast by 15%.

Core DES (drug-eluting stent) revenue was mildly impacted by the weak Euro, but Nobori sales and JWMS outperformed our expectations.

Perhaps a reflection of its confidence, management has maintained its revenue guidance of US$135-145mn set earlier this year despite the weak Euro (vs. our Euro-adjusted forecast of US$133mn).

Reiterate BUY: our PT of S$1.20 suggests 46% potential upside.

US restructuring: one-off charge of US$6mn. The group has closed its US operations (mainly R&D) and made a one-time provision of US$6mn, which mainly includes severance and personnel costs. Going forward, BIG will be consolidating its R&D efforts in Singapore, which involves the relocation of its key R&D personnel in California. The group expects to save US$4~6mn/year starting in FY12.

Revenue guidance unchanged despite weak Euro. Management maintains its product revenue (ex-royalty) guidance of US$135-145mn in FY11 despite the weak Euro. We remain conservative and maintain our forecast of US$133mn, leaving room for potential upside.

Reiterate BUY. This set of results reaffirms our investment thesis for Biosensors which is established on its three pillars of growth:

i) BioMatrix's growing market acceptance,

ii) BIG's valuable JV in China and

iii) accelerating royalty income from Terumo.

(Refer to: Three Pillars of growth, 19 July 2010 http://www.nomura.com/research/GetPub.aspx?pid=381575 )

Source: Yuanta Research, July 29

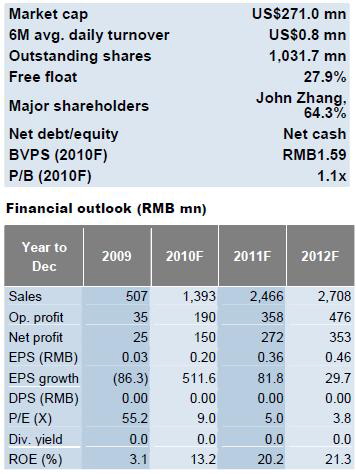

Yuanta Research initiates coverage of Comtec Solar, target price has 72% upside potential

Analyst: Min Li

(Comtec Solar provides its global customers with the highest quality monocrystalline solar ingot and wafer products with cell conversion efficiency of 17-18% on average.)

We initiate coverage of Comtec Solar shares with a BUY rating: Our positive view is based on the company’s (1) capacity expansion and shipment growth; (2) technology leadership; and (3) cost efficiency.

Exponential profit increase ahead on capacity expansion: We expect Comtec to see an immediate boost in profit starting from 1H10, owing to its ongoing capacity expansion, from 200 MW in 2009 to 600 MW by 3Q10F and to 1,000 MW by end-2011F.

Capacity expansion a response to increasing demand: Due to increasing wafer demand from downstream cell and module manufacturers, we expect Comtec’s total shipments to reach 257.6 MW in 2010F (up 215.7% YoY) and 596.4 MW in 2011F (up 131.5% YoY), with capacity utilization maintaining at above 80% from 2010 to 2012.

Technology leadership: We believe Comtec will capture the increasing wafer demand from downstream cell and module manufacturers owing to its mass production of “Perfect Wafers.” For example, using Comtec’s wafers, Neo Solar Power’s (3576 TT, BUY) “Perfect Cell” achieves a power density increase of over 3% and an average conversion efficiency of 17.8%.

Margin expansion: We expect Comtec’s gross margin to improve from 17.6% in 2010 to 21.6% in 2012, a result of poly ASP sliding from RMB2.3/Watt to RMB1.1/Watt and manufacturing costs falling from RMB2.3/Watt to RMB1.3/Watt over 2010F-12F, implying 511.6%/81.8%/29.7% EPS growth over the same period.

Valuation: Our 12-month TP of HK$3.50, derived from the average of 8.3x 2011F P/E, and 5.3x 2011F EV/EBITDA, implies 71.6% upside.