* Osim International, after a massive share buyback involving 35.4 million shares over recent months and weeks, didn’t buy a single share last week.

It, however, reported a transaction that was executed on July 29.

In the absence of buyback support, the stock eased by 4 cents to close at $1.02 for the week.

* Informatics Education, on the other hand, continued to enjoy the strong buying support of Kestrel Capital, in which former remiser king Peter Lim, has a stake in.

Mr Lim was ranked Singapore’s seventh-richest man last year by Forbes, with a net worth of US$1.5 billion ($2.1 billion).

Informatics stock rose 5 cents for the week to close at 18.5 cents.

It has come a long way from around 5 cents as recently as July 20. On July 26, Informatics announced that Kestrel has become a substantial shareholder with a stake of 6.48%. As of last week, Kestrel had accumulated 19.05% of the company’s shares.

Kim Eng Research, however, cautioned that whatever profit growth that Informatics may enjoy in the near term may already be priced into the stock.

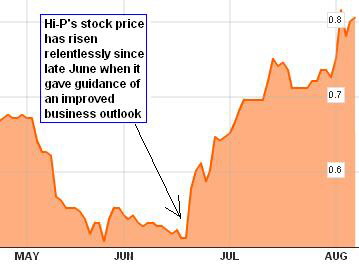

* Hi-P International is another stock that has enjoyed a good run in recent weeks – and strong buyback by the company.

Last week, it bought back 791,000 shares, inspiring the market to push the stock price to a 52-week high of 82 cents.

The company last week announced that it has swung from a $2.1 million net loss in 1Q to a $12.4 million profit in 2Q.

It added that it expects its full year profitability to be comparable to last year’s $53.7 million.

Working backwards, that means Hi-P is expecting the 2H to bring in about $55.8 million, suggesting strong growth momentum going forward.

DMG & Partners expects FY10 revenue to come in at S$998.6m (+24.0%) while net earnings are forecasted at S$54.6m (+19.5%).

FY11 sales estimate is increased to S$1,201.5m (+34.2%) while bottomline is forecasted at S$74.4m (+25.0%).

The research house’s target price for the stock is 97 cents.

Recent story: HI-P: After sharp 2Q turnaround, expect even stronger 3Q, 4Q