AFTER FIVE CONSECUTIVE QUARTERS of profitability, Samko Timber has further firmed up its turnaround story.

Not only that, the latest quarter -- 1Q12 -- was the most profitable among the five quarters at Rp27.5 billion (about S$3.9 million), it announced this morning.

Using simple annualising, the result is a profit of about S$16 million for the full year, which translates into a PE of 10.5 using the current stock price of 12.8 cents.

We don't have analyst forecasts as there is no regular analyst coverage of this stock as yet. That could start before long, though.

Samko Timber, which listed on the Singapore Exchange in 2008, is one of the top five tropical-hardwood plywood producers in the world.

It has over 800,000 cubic metres of processing capacity and accounts for about 32% of tropical-hardwood plywood produced in Indonesia.

In a press release, Mr Aris Sunarko, Samko’s CEO, said: “With 1Q12 attributable profit at 54% that of FY2011, we are on track to deliver better results in FY2012 than FY2011.”

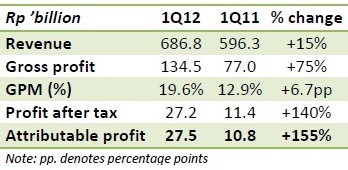

Revenue grew 15% year-on-year in the following manner:

* Domestic market – the increase was 7% to Rp537.1 billion on an 8% rise in average selling price (ASP) per cubic metre.

* Export sales – Largely driven by higher exports to Japan, sales surged 58% on a 29% increase in volume and a 22% increase in ASP per cubic meter.

The export sales, with their higher margins, boosted the gross profit margin of the Group by 6.7 percentage points to 19.6% for 1Q12.

Gross profit shot up 75% to Rp134.5 billion (about S$96.2 million).

For Samko's press release posted on SGX, click here.

Recent stories:

Insider buying at SAMKO TIMBER, OXLEY HOLDINGS

SAMKO TIMBER: R&D engineering, logistics and financing strategy for growth