Translated by Andrew Vanburen from a Chinese-language piece in Information Times

WHEN THE MERE whiff of the possibility of more money destined to enter the market occurs, the wheels are quickly set in motion and those investors who’ve been kicking tires on the sidelines are motivated to jump back into the market en masse.

Well, it looks like it might be safe to go back into the water once again, as billions of yuan in funds may soon flood into China’s capital markets in the second half as they chase major new proposed IPOs.

And that means higher share prices for the fortunate firms.

Or does it?

Investors should take note that there is a caveat to this “transfusion” of funds into the market.

On the surface, the injection of “new funds” into any bourse is reason for optimism among investors because more money circulating among shares almost always translates into higher average share prices.

However, this particular batch of funds will primarily be categorized under “proceeds raised” by at least three heavy duty initial public offers.

Therefore, the question about the claims of a significant injection is: will it come from new funds chasing the potential of the upcoming IPOs, or will it be drained from the market and merely shifted to the newcomers?

The rumor mill – and credit floodgates – began churning into activity this week with the announcement by Mainland China’s Ministry of Environmental Protection (MEP).

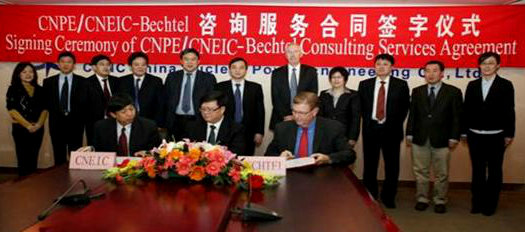

The cabinet-level body revealed it had granted preliminary approval to China Nuclear Power Engineering Co Ltd’s (CNPE) planned IPO from an environmental impact standpoint.

Although final approval of CNPE’s domestic listing rests with the country’s market regulator – the China Securities Regulatory Commission (CSRC) – a more important tidbit about the nuclear play’s investment strategy was laid bare.

“The MEP said that five of CNPE’s project proposals would require a total of up to 173.5 billion yuan. Therefore, it is quite likely that CNPE’s eventual IPO will surprise on the upside in terms of funds sought, and possibly funds raised.

“This has naturally caused some liquidity concerns in the market,” a market watcher said.

Therefore, for this and other marquis IPOs, investors should not only pay attention to the quality and potential of the main board aspirants, but also to where the IPO proceeds are originating from.

According to local media reports, CNPE is not the only major enterprise seeking to go public with ambitious fundraising campaigns.

Shaanxi Coal Industry Co Ltd, Citic Heavy Industries Co Ltd, China Post Group and three other major firms are seeking to list this half.

Their total pre-IPO funds raised to date are reportedly in excess of 31.4 billion yuan

Compare this to the much publicized and highly anticipated 13.5 billion yuan raised by Sinohydro Group Ltd (SHA: 601669) in the third quarter last year and we can see the current crop of IPOs is playing for keeps.

Regardless of where the IPO funds are sourced from, or how much they total, investors should take cheer from the fact that so many firms are confident enough in the market to launch such mega-listings at a time when many are too timid to follow suit.

The China Stock Digest describes Chinese A shares as thus: A shares refer to companies that have been incorporated in the mainland of China. These shares are then traded on the Chinese stock markets. A shares have seen a tremendous amount of growth as international interest has skyrocketed in the past few years. Part of the reason for this was due to the slow removal of some of the restrictions placed on the A shares for foreign investment, while another reason is the steady increase of the Chinese economy. A shares are currently quoted to investors as Renminbi, with a limited current investor pool. Mainlanders and a few select institutional investors are permitted to trade China’s A shares. In some cases under a regulated structure known as the Qualified Foreign Institutional Investor System (QFII), foreign investors are permitted to purchase A shares in China.

See also:

CHINA SHARES: Market Watchers All Over Map

FOREIGN TASTES: What QFIIs Are Buying In China

HALF HEARTED: 50% Of PRC Firms Expect Weaker 1H

ALL BLACKS: China’s Listed Brokerages All Profitable