Pek Lian Guan, CEO of Tiong Seng Holdings, with some analysts and fund managers after the results briefing yesterday.

Pek Lian Guan, CEO of Tiong Seng Holdings, with some analysts and fund managers after the results briefing yesterday.

Photos by Leong Chan Teik

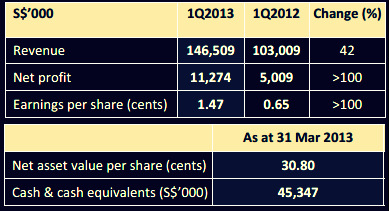

AFTER CHALKING up a scorching 42% growth in revenue for the full year of 2012, the construction division of Tiong Seng Holdings has kept up the pace in 1Q2013 with another 42% year-on-year growth.

Adding sparkle to the performance was a one-off gain of $8.1 million from the disposal of investment properties it had bought many years ago in Papua New Guinea. All told, Tiong Seng Holdings' net profit profit in 1Q2013 surged to $11.3 million from $5.0 million a year earlier (see table on the right).

All told, Tiong Seng Holdings' net profit profit in 1Q2013 surged to $11.3 million from $5.0 million a year earlier (see table on the right).

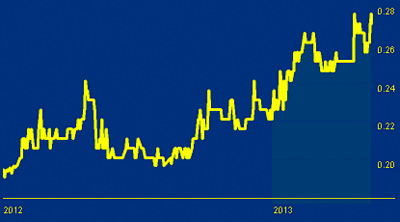

In the near term, a key event to look out for is the company's recognition of revenue in 2H of this year of its property development sales in China amounting to S$35-38 million based on sales to date. Tiong Seng stock, at 27 cents recently, translates into a market cap of S$210 million for the company. The stock's PE is about 8X with a dividend yield of 3.6%. Beyond that, the company targets to complete, and recognise revenue from, property development projects in China over the next two to four years.

Tiong Seng stock, at 27 cents recently, translates into a market cap of S$210 million for the company. The stock's PE is about 8X with a dividend yield of 3.6%. Beyond that, the company targets to complete, and recognise revenue from, property development projects in China over the next two to four years.

At home, Tiong Seng has amassed $1.4 billion worth of construction contracts, most of which will be fulfilled this year and next year. And it is waiting for planning approval from the Malaysian authorities for a pre-cast plant in the Iskandar region.

There is more on this -- and other important aspects -- in the Q&A highlights from a results briefing session yesterday, as follows:

Q: Your net gearing is pretty high. Do you have a target to lower it to or you are OK with it? Ken Choo, CFO.Ken Choo, CFO: In the market, there is a range of gearing, from 0.2 to 2. For property developers, the gearing tends to be higher because of the capital-intensive nature of the business.

Ken Choo, CFO.Ken Choo, CFO: In the market, there is a range of gearing, from 0.2 to 2. For property developers, the gearing tends to be higher because of the capital-intensive nature of the business.

The gearing is a reflection of the business opportunities and what is needed to realise those opportunities.

Pek Lian Guan, CEO: At the same time, the construction industry is going through a transformation. We have to adopt technologies and that is an investment. Over the next few years, the more progressive contractors will invest more as that is the only way to stay competitive.

We have invested S$36 million in a pre-cast facility. If I compare our automated facility with a very labour-intensive approach, you have to invest $8-9 million.

But the effective gain is not just the lower labour requirements. In our plant, we use pallets which can last for 30 years, unlike moulds that have to scrapped off after every project in the conventional method. The initial investment is high but after depreciation, it will continue to bring you benefits.

Another major investment we have done is in formworks, amounting to about $60 million since 2006.

Q: What is your guidance on construction margins going forward?

Pek Lian Guan: In the next one year or so, margins will face high pressure and decline. The reason is simply the new regulations.

Construction contracts span 2-3 years and the revenue is fixed but your costs can go up or down.

Contracts secured earlier will face margin erosion because costs are going up.

For new projects, contractors will factor in the additional costs but the revenue will start to come in only a year later.

The additional costs -- material costs are generally stable but labour and staffing costs are the major ones.

Worker levies have gone up as much as 3X - from $350 to $1,000. As for wages, we have been enjoying an influx of workers from China since the late 1990s. Their wages started to go up sharply. Four years ago, their take-home pay was around $30 a day. Today, it's $90.

The other cost increase is in staffing cost. The government has increased the minimum salary for applying S-pass.

For Tiong Seng, using various technologies, we have labour savings of about 30%. If we need 70 workers for a project, our competitors may need 100-110 workers, so the cost impact from higher levies and wages is greater on them.

Q: For the revenue from property development in 2H, what is your guidance on the profit margin?

Ken Choo: In 2011, we recognised revenue from phase 1 of the project in Cangzhou city which is a good reflection of the margin of the whole project. Subsequently, the selling prices were better.

Q: On the sale of the industrial properties in Papua New Guinea, do you have any more such properties? Pek Lian Guan, CEO of Tiong Seng Holdings, speaking with Standard Chartered Equity Research analyst Pauline Lee.Pek Lian Guan: We sold 3 out of 5 units. In the last 10 years, we have leased them out. The buyer was one of our tenants, who offered us a good price. We are in no hurry to sell the remaining two units.

Pek Lian Guan, CEO of Tiong Seng Holdings, speaking with Standard Chartered Equity Research analyst Pauline Lee.Pek Lian Guan: We sold 3 out of 5 units. In the last 10 years, we have leased them out. The buyer was one of our tenants, who offered us a good price. We are in no hurry to sell the remaining two units.

Q: Can you give us more information on your upcoming pre-cast plant in Johor and also your plan for a plant in Myanmar?

Pek Lian Guan: The Johor plant will be sited on 5.6 hectares of land and we will invest in 2 phases, each with 120 cubic metres a day in capacity. Total: 240 cubic metres a day, which is equivalent to our Singapore pre-cast operations.

We hope to start production by end of next year. The plant will complement our Singapore plant. In Singapore, the components are delivered out 1 or 2 days after production. There are components that are bulky and need more storage space -- these will be produced in Johor where the land is cheaper and we have a big piece of land.

Material costs in Malaysia are higher and there is additional transportation cost. Overall, it would a bit cheaper to produce in Johor.

In Myanmar, there are plans to build 20,000 units of public housing a year. The people have come to Singapore a few times to learn about HDB housing and decided to use pre-cast.

We formed a joint venture with Shwe Taung in April 2013, and have a MOU and are discussing the capacity for a pre-cast plant. It can be a springboard for us to get into Myanmar and look at other opportunities.

The Myanmar pre-cast plant won't contribute much to the bottomline in the next 1-2 years because our stake is just 30%.

For more on the 1Q results, read the official announcements on the SGX website.

Recent stories:

TIONG SENG HOLDINGS: Revenue boost to come from China properties

TIONG SENG HOLDINGS, MTQ CORP: Latest good news

TIONG SENG HOLDINGS: Riding construction boom with advanced technologies