Photo: Chow Sang Sang

Credit Suisse: CHINA CONSUMER SECTOR ‘Overweight’; CHOW SANG SANG ‘Top Pick’

Credit Suisse said it is maintaining its “Overweight” recommendation on Mainland China’s consumer sector while giving jewelry retailer Chow Sang Sang (HK: 116) “Top Pick” status.

Credit Suisse recently conducted its Emerging Consumer Survey 2013, interviewing 2,600 Chinese consumers who provided “tremendous insight” into consumption growth trends and how to invest in them, the Swiss research house said.

“Young and optimistic consumers are the key catalysts to growth. Survey results are encouraging and the foundation for long-term consumption growth outpacing GDP growth is set.”

The research note added that young consumers are not only planning on spending more on discretionary items (technology, fashion, travel) than the older consumer, but they are being prescient in their savings habits.

“We have assembled a portfolio that is comprised of stocks that directly benefit off the key findings from the Emerging Consumer Survey. Our Top seven picks are Belle, Intime, Tingyi, China Unicom, Hengan, Chow Sang Sang and Skyworth.”

Credit Suisse added that domestic brand owners must address the aspirations of young Chinese consumers to compete against foreign brands.

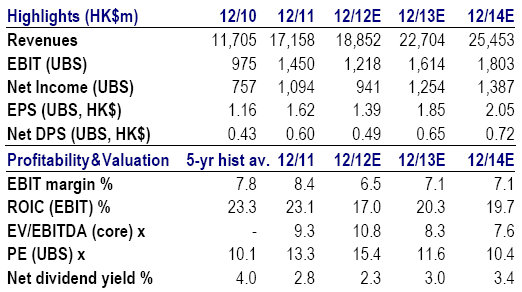

UBS: CHOW SANG SANG Upped to ‘Buy’, TP Hiked

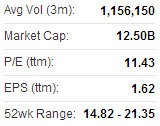

UBS said it is upgrading its recommendation on jewelry retailer Chow Sang Sang (HK: 116) to “Buy” from “Neutral” while hiking the target price to 25.00 hkd from 17.50 (recent share price 21.05).

“We expect an earnings recovery driven PE re-rating in 2013. As a cyclical consumer company, Chow Sang Sang’s valuation is closely correlated with its earnings prospects.

“We expect its PE to re-rate to the mid-cycle valuation, driven by 33% EPS growth in 2013E after a 14% decline in 2012E, due to a same-store sales growth (SSSG) recovery from the low base effect and a GPM recovery in gold jewelry with gold price stabilization,” UBS said.

Hong Kong: Beneficiary of less affluent visitors

The Swiss research house said it believes a multi-year trend has emerged in Hong Kong with visits from the less affluent provinces accelerating.

“We think CSS is a key beneficiary given its strong brand name and mass-market price points. The company notes that its low- to mid-end products have experienced strong volume growth, more than offsetting weak ultra high-end product sales.”

UBS added it expects sustainable sales growth in Hong Kong driven by high volume growth of mid-to-low-end products.

China: More room to grow, greater selectivity to excel

“We expect CSS to outperform its peers in China in the medium term. With a plan to add ~40 stores pa in the next few years and a low store count base (~270 versus +1,000), CSS could achieve higher growth than its peers,” UBS said.

Photo: Chow Sang Sang

The note to investors added that it also expects higher store efficiency for CSS due to its 100% self-operated model.

“We believe selectivity is even more important now given the oversupply of department stores.”

UBS’s price target implies 13.5x 2013E PE.

Credit Suisse: CHOW SANG SANG ‘Outperform’

Credit Suisse said it is assigning an “Outperform” recommendation on Chow Sang Sang Jewelry (HK: 116) with a target price of 24.10 hkd (recent share price 21.05).

The research note said it is most bullish on Chow Sang Sang given the jewelry retailers relatively lower reliance on gold prices vis-à-vis the competition.

The “Outperform” recommendation outshines Credit Suisse’s calls on Chow Sang Sang’s top domestic rivals: Chow Tai Fook (“Neutral”) and Luk Fook (“Neutral”).

“Compared to other retail segments, we believe jewelers deserve lower valuations due to the lack of pricing power,” Credit Suisse said.

The Swiss research house said Luk Fook would be “the most adversely affected” due to its lowest hedging on gold prices, which are expected to trend lower.

See also:

ALL THAT GLITTERS: Morgan Stanley Weighs In On HK-Listed Jewelers

Goldman Sees CHOW SANG SANG Growth

GOLDEN OPPORTUNITIES? CHOW SANG SANG Jewelry ‘Outperform’; RETAIL Upbeat

CHOW SANG SANG Target Hiked