Main reference: Story in Sinafinance

CHINESE SHARES are down over 10% from year-earlier levels and some 18% since February.

However, panicking is not an option.

In fact, quoting former US President Franklin D. Roosevelt might be appropriate here.

“The only thing we have to fear is fear itself.”

This is especially true for retail-level investors, who may more easily overwhelmed with anxiety given the topsy-turvy market swings and prolonged bearishness for most of trading year 2013 so far.

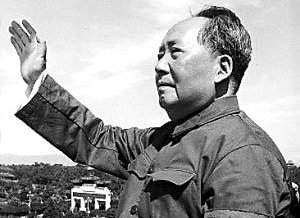

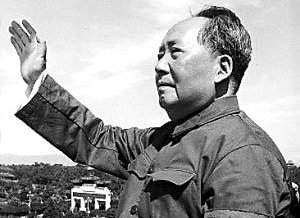

Much was made of the benchmark Shanghai Composite Index plummeting to a low point of 1,949 points in December, a number significant for its symbolism as it represents the year of the PRC’s founding by Chairman Mao (above). Photo: jpwMuch was made of the benchmark Shanghai Composite Index plummeting to a low point of 1,949 points in December, a number significant for its symbolism as it represents the year of the PRC’s founding.

Much was made of the benchmark Shanghai Composite Index plummeting to a low point of 1,949 points in December, a number significant for its symbolism as it represents the year of the PRC’s founding by Chairman Mao (above). Photo: jpwMuch was made of the benchmark Shanghai Composite Index plummeting to a low point of 1,949 points in December, a number significant for its symbolism as it represents the year of the PRC’s founding.

Analysts quickly pounced on the coincidence, calling it the “second founding” of a new bull run.

And so far they have been right, to an extent, as the Index has not dipped below 1,949 these past seven months.

Even when it came alarmingly close to happening last week, the market rebounded at just the right point and managed to close the day’s trading at 1,950 points.

It turns out that there wasn’t much stomach in the market to hover so close the historically-significant near-term low, and bargain hunters have swooped in over the five days since, pushing the Shanghai Composite up over 3% by Friday trading.

There has been a full frontal assault on the market of late which led to major corrections for most of the month of June.

One was the major flirtation the Index made with the sacred 1,949-point level last week, and then the market chaperone (i.e. bargain hunters) stepping in to put a stop to the whole affair.

There were also the recent pronouncements from Beijing which in aggregate suggested that the era of cheap credit was over, and non-performing loans alongside the important shadow-banking system were both falling under increasingly intense scrutiny by financial authorities.

This put a major dent in any hopes for a bullish second half in China’s equity markets, and also sent shockwaves across bourses elsewhere as the world increasingly looks to the PRC economy as an engine of global growth.

And for football fans like myself, the recent heartbreaking but not totally unexpected defeats by China’s long-suffering men’s soccer team also weighed on sentiment – at least it felt that way – but the market still tenaciously refused to fall below 1,949.

Investors are hoping China shares will get a boost from interim earnings season.

Investors are hoping China shares will get a boost from interim earnings season.

Source: Yahoo Finance

The fact that market sentiment can endure slings and arrows such as these and still manage to lick its wounds and slowly crawl higher is testament to the resiliency of buying activity in Shanghai and Shenzhen.

With so much dispiriting news hitting the A-share markets these days, investors are starving for something auspicious to lift sentiment back into a sustainable buying frame of mind.

Soon the financial pages will be dominated by news of surprises on the upside -- and downside -- regarding first half earnings.

Investors are certainly hoping the former outnumber the latter, and if so it could be another “second founding” as was seen in December of last year during which a solid launching pad for a new recovery could get underway.

In three recent trading days, the number of stocks rising by their daily 10% limits has consistently surpassed 30, suggesting that there is still a lot of pent up bursts of buying behavior out there.

Therefore, while panicking might seem like what the heart is telling us to do, investors should listen to their heads and patiently take a wait-and-see attitude as interim reporting season enters full bloom.

See also:

China Urbanization And The Bull Market

Much was made of the benchmark Shanghai Composite Index plummeting to a low point of 1,949 points in December, a number significant for its symbolism as it represents the year of the PRC’s founding by Chairman Mao (above). Photo: jpwMuch was made of the benchmark Shanghai Composite Index plummeting to a low point of 1,949 points in December, a number significant for its symbolism as it represents the year of the PRC’s founding.

Much was made of the benchmark Shanghai Composite Index plummeting to a low point of 1,949 points in December, a number significant for its symbolism as it represents the year of the PRC’s founding by Chairman Mao (above). Photo: jpwMuch was made of the benchmark Shanghai Composite Index plummeting to a low point of 1,949 points in December, a number significant for its symbolism as it represents the year of the PRC’s founding. Investors are hoping China shares will get a boost from interim earnings season.

Investors are hoping China shares will get a boost from interim earnings season. NextInsight

a hub for serious investors

NextInsight

a hub for serious investors