Alphonsus Chia, deputy CEO of XMH Holdings. NextInsight file photoXMH HOLDINGS has endured its second quarter of business slowdown in its key market, Indonesia, but is looking forward to a release of pent-up demand for its marine diesel engines after the country's presidential elections in July.

Alphonsus Chia, deputy CEO of XMH Holdings. NextInsight file photoXMH HOLDINGS has endured its second quarter of business slowdown in its key market, Indonesia, but is looking forward to a release of pent-up demand for its marine diesel engines after the country's presidential elections in July.

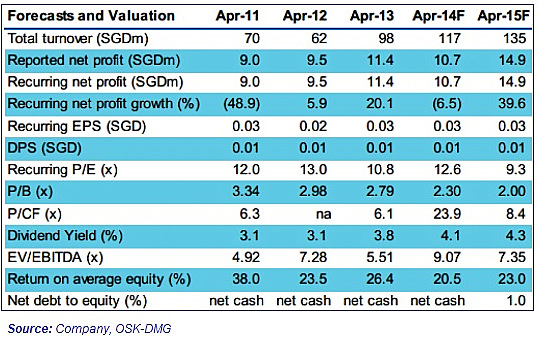

Then, uncertainties perceived by its potential customers would be removed and business should rebound, according to XMH management in a FY13 results briefing this week.

In the meantime, XMH has reported that its recent 100% acquisition in Singapore, Mech Power Generator (MPG), has contributed strongly in 3Q ended 31 Jan 2014.

MPG pulled in S$15.1 million of revenue in 3Q to enable the group to report a 71.4% jump in 3Q revenue to S$33.1 million.

Mech-Power's product offering is targeted at buildings and, especially, data centres. Photos: CompanyWithout MPG, XMH's revenue would have declined 7% instead.

Mech-Power's product offering is targeted at buildings and, especially, data centres. Photos: CompanyWithout MPG, XMH's revenue would have declined 7% instead.

Net profit attributable to shareholders in 3Q rose 47.9% to S$3.2 million.

For 9MFY14, net profit stood at S$7.9 million, virtually unchanged from the previous corresponding period.

Aside from bolstering the group's financials, MPG has reduced XMH's reliance on Indonesia, where it distributes mainly diesel engines chiefly for tugs and barges that transport coal from inland mines to ships.

Thus, instead of 70% in the last financial year, Indonesia accounted for about 40% in 3QFY14 of XMH's revenue.

And Singapore has emerged as a major contributor (around 46%) because virtually all of MPG's sales are in Singapore.

MPG assembles (in its Johor plant) and installs power generator sets in a wide range of buildings such as hospitals and data

centres.

(See its past projects here)

Cliff Loke (left), MD and co-owner of Mech-Power, with Elvin Tan, chairman of XMH, signing a sale and purchase agreement for Mech-Power last year. On the right is Alphonsus Chia, deputy CEO of XMH. NextInsight file photo Data centres are sprouting up in Singapore and the region, providing significant business potential for MPG, according to XMH deputy CEO Alphonsus Chia.

Cliff Loke (left), MD and co-owner of Mech-Power, with Elvin Tan, chairman of XMH, signing a sale and purchase agreement for Mech-Power last year. On the right is Alphonsus Chia, deputy CEO of XMH. NextInsight file photo Data centres are sprouting up in Singapore and the region, providing significant business potential for MPG, according to XMH deputy CEO Alphonsus Chia.

MPG's product range also enables XMH to reduce its exposure to marine diesel engines, its mainstay all these years.

The Group would be further diversified if and when more acquisitions are concluded, said Mr Chia.

XMH is exploring acquisitions, given the encouraging results from MPG.

"Look at the profits coming in from MPG, other numbers coming in, and the synergies from doing things together," he said.

Johnson Yap, financial controller of XMH. NextInsight photo Johnson Yap, financial controller of XMH. NextInsight photo

XMH shares Subsequently, in August, Credence exercised options to buy a further 47.6 million shares at 31.5 cents apiece from the substantial shareholding Tan family, thus raising its stake to 19.87%. |

For more information, download XMH's 9M2014 financial statement at the SGX website.

Recent stories:

XMH HOLDINGS: Bought Back 3,559K Shares, Stock Price Recovers

XMH - A Stock to Power Up Your Stock Portfolio?