Analyst: Liu Jinshu

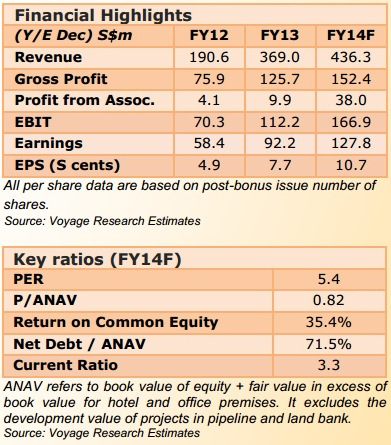

Expect Bumper Harvest of TOPs in 2014: Based on their pace of revenue recognition, seven out of 16 uncompleted projects may TOP this year, including the Russell Street project; and will free up financial resources for the company to reinvest in opportunities abroad.

Roxy-Pacific chairman and CEO Teo Hong Lim (left) with Voyage Research analyst Liu Jinshu after the recent results briefing.

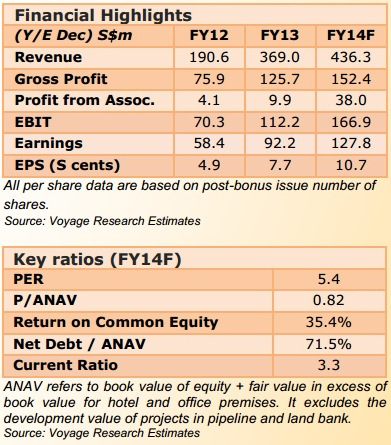

Roxy-Pacific chairman and CEO Teo Hong Lim (left) with Voyage Research analyst Liu Jinshu after the recent results briefing. NextInsight file photo Roxy currently trades at 86.3% of its adjusted net asset value, suggesting that forward growth expectations are not high. Therefore, we foresee limited downside risk for its share price in spite of industry headwinds.

More importantly, upside surprise may stem from the company increasing its pace of new projects overseas, as well as gradually growing its hotel business.

Profits to Be Back-Loaded: Roxy’s 1H FY14 profit attributable to shareholders amounted to S$37.7m. In contrast, our updated forecasts of S$127.8m may seem aggressive.

However, the 1H FY14 results do not reflect that Centropod and Russell Street, Hong Kong, as revenue recognition from these full sold projects will only take place on completion. Works at both projects are underway and are likely to be completed within 2014.

However, the 1H FY14 results do not reflect that Centropod and Russell Street, Hong Kong, as revenue recognition from these full sold projects will only take place on completion. Works at both projects are underway and are likely to be completed within 2014.

Centropod will add about S$141.4m to revenue and about S$55m to gross profit in 2H FY14. We further expect Russell Street, Hong Kong (30% owned by Roxy) to add another S$40m to share of profits from associates.

In view of these gains on top of the other projects on hand, we maintain that our FY14 forecasts are reasonable.

In view of these gains on top of the other projects on hand, we maintain that our FY14 forecasts are reasonable.

In view of these gains on top of the other projects on hand, we maintain that our FY14 forecasts are reasonable.

In view of these gains on top of the other projects on hand, we maintain that our FY14 forecasts are reasonable. Potential Year End Revaluation Gains from Goulburn Street? Goulburn is currently held for its pre-tax investment income of about S$7.3m per year whilst the company finalizes plans to unlock its redevelopment potential.

Accordingly, many buildings in Sydney have locked in tenancies of 10 years or more, while the lease of Goulburn’s major tenant (occupying half of the building) will expire in three years, thus paving the way for redevelopment.

Buildings in the vicinity have recently been sold for about A$8,000 to A$9,000 per sq. m., while Roxy bought Goulburn for about A$4,610 per sq. m.

Bearing in mind that the pricier buildings in the vicinity may have different characteristics or features from Goulburn, the higher transacted prices suggests that there may be significant value to be unlocked upon further action such as redevelopment works or a renewal of the tenant base.

For more, see: ROXY-PACIFIC: On Track For 10th Consecutive Year Of Record Profit

Bearing in mind that the pricier buildings in the vicinity may have different characteristics or features from Goulburn, the higher transacted prices suggests that there may be significant value to be unlocked upon further action such as redevelopment works or a renewal of the tenant base.

For more, see: ROXY-PACIFIC: On Track For 10th Consecutive Year Of Record Profit