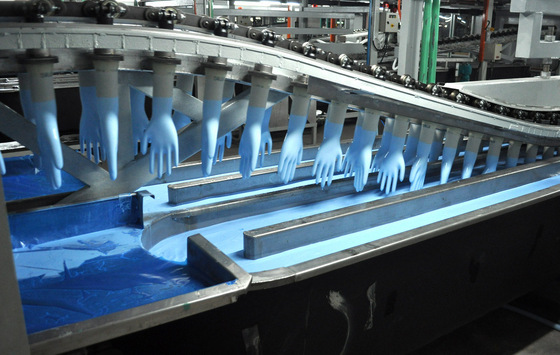

Production line 1 (out of six lines) at Riverstone's new factory in Taiping: The factory can produce about 1 billion gloves a year for use in the healthcare industry and cleanrooms of electronics manufacturing companies.  The production process involves many steps with the 'formers' (or hand moulds) moving along the production line and being dipped into various tanks of chemicals, including acids and alkalis.

The production process involves many steps with the 'formers' (or hand moulds) moving along the production line and being dipped into various tanks of chemicals, including acids and alkalis. Phase 1 of 5 phases has just been completed. Phase 2 is about 30% constructed and will be ready in late 2015.Photos by Leong Chan Teik

Phase 1 of 5 phases has just been completed. Phase 2 is about 30% constructed and will be ready in late 2015.Photos by Leong Chan Teik

NEXTINSIGHT and 10 analysts (one of whom is from Malaysia) visited Riverstone Holdings' new glove production factory in Taiping, Malaysia, last Friday.

It is just a 10-minute drive from an existing factory of Riverstone, which has production facilities also in Kuala Lumpur, Thailand and China.

The new plant in Kamunting Raya Industrial Estate has six lines -- which can deliver 1 billion gloves a year in total.

Some 80% will be nitrile gloves (made from synthetic rubber) for the healthcare industry and the rest for use in cleanrooms of electronics manufacturers. A production line starts on the ground level and snakes its way up 8 levels, producing 12,000-15,000 gloves an hour.Riverstone invests RM3-4 million a year in R&D, and more than 50% of its gloves are customised to customers' requirements.

A production line starts on the ground level and snakes its way up 8 levels, producing 12,000-15,000 gloves an hour.Riverstone invests RM3-4 million a year in R&D, and more than 50% of its gloves are customised to customers' requirements.

Singapore-listed Riverstone had news that is a positive surprise. Three new customers from Germany, the US and Japan have signed agreements with Riverstone to take up the production capacity of one line each for two years.

With a dedicated customer for each line, there is cost savings in not having to change, as frequently, the various parameters of production.

There will be cost savings in less production downtime, which will be shared with the customers. Riverstone CEO Wong Teek Son (in white shirt) fields questions from analysts. Mr Wong owns 50.8% of Riverstone (market cap: S$347 million).Said Riverstone CEO Wong Teek Son: "They are happy that they are assured of a constant supply of gloves, and there is better quality control as they have their own requirements -- this is like having their own plant.

Riverstone CEO Wong Teek Son (in white shirt) fields questions from analysts. Mr Wong owns 50.8% of Riverstone (market cap: S$347 million).Said Riverstone CEO Wong Teek Son: "They are happy that they are assured of a constant supply of gloves, and there is better quality control as they have their own requirements -- this is like having their own plant.

"For us, we have secured the business, and can do better planning, and lower the production downtime."

If a contract is to be terminated, a notice period of six months is required. Workers stripping off gloves from the formers (ie hand moulds) for packing into boxes.

Workers stripping off gloves from the formers (ie hand moulds) for packing into boxes.

Riverstone's new plant will boost its production capacity by 31% from 3.2 billion to 4.2 billion gloves a year in aggregate.

All six new lines -- 3 single, 3 double -- will be operational by the end of this year.

The plant sits on part of a 30-acre site (equivalent to 30 soccer fields) which Riverstone bought for RM12.4 million in April 2013 and is planned for development at the rate of 1-billion capacity a year for a total of 5 billion.

For perspective, the 30 acres far exceeds the 22 acres that all of Riverstone's existing plants occupy. Riverstone CFO Lim Sing Poew (left) with Maybank Kim Eng analyst John Cheong.The new plant cost RM80 million while the second factory will cost RM50 million only -- as the latter will share certain facilities with the first one.

Riverstone CFO Lim Sing Poew (left) with Maybank Kim Eng analyst John Cheong.The new plant cost RM80 million while the second factory will cost RM50 million only -- as the latter will share certain facilities with the first one.

The capex for the first plant was funded by internal resources. It will be the same case for the second plant.

Riverstone is set to achieve RM65.4 million in net profit this year, up from RM 39.7 million in 2012, according to analysts' consensus forecasts.

Riverstone CEO Wong Teek Son (left) with analysts near the site of construction of Phase 2.At 93.5 cents, its stock price is trading at 10X next year's estimated earnings of RM 86.4 million (up 32% year-on-year).

Riverstone CEO Wong Teek Son (left) with analysts near the site of construction of Phase 2.At 93.5 cents, its stock price is trading at 10X next year's estimated earnings of RM 86.4 million (up 32% year-on-year).

Its much larger Malaysian-listed peers are trading at 14.4X consensus FY15F P/E and their plants are experiencing lower utilisation rates.

For more on the new plant, see recent story: RIVERSTONE's 2Q: Another Excellent Quarterly Result Q&A session with Riverstone CEO Wong Teek Son.

Q&A session with Riverstone CEO Wong Teek Son. @ lunch in Taiping with Riverstone management before we took a 1.5-hour trip by road to Penang for our 1.5-hour flight back to Singapore.

@ lunch in Taiping with Riverstone management before we took a 1.5-hour trip by road to Penang for our 1.5-hour flight back to Singapore.

Recent stories:

Heading up to Taiping to visit RIVERSTONE HOLDINGS

Puzzling why compare 2014 NP forecast to 2012 & not 2013? Because 2014 NP forecast RM65.4mil compared to 2013 RM58mil NP is only 13%, as opposed to 65% when compared to 2012 RM39.7mil NP?

At 2014 NP forecast of RM65.4mil, 2014H2 over 2013H2 increase is only 5%. So it looks like NP surge is expected only in 2015.