Excerpts from analysts' report

Standard Chartered Research analysts: Michael Parry & Claire Teng, CFA

Standard Chartered Research analysts: Michael Parry & Claire Teng, CFA

|

· Investors wanting to capitalise on Singapore’s 2H16 public bus restructuring should take comfort in ComfortDelGro’s (CD) dominance of its home taxi market in the interim. · Clarity from the Land Transport Authority (LTA) regarding the ownership transfer of bus assets should serve as positive catalysts through 2015. · We strongly reiterate our Outperform rating and price target of SGD 3.35, implying 36% upside potential. · The current share price does not come close to capturing the value of the bus restructuring in our view, and we urge long-term, fundamentally driven investors to add weight. |

Bus labour tripartite agreement reached. The Public Transport Tripartite Committee, including members of the LTA, bus operators and labour union, recently agreed on guidelines for labour portability prior to the public bus restructuring. These were modelled on London’s existing legislation, and should pave the way for the LTA to issue invitations to tender for the three ‘open’ packages of bus services in 4Q14.

"We expect the government to acquire all of SBUS’ bus assets in 2H16 when the new operating model takes effect."

"We expect the government to acquire all of SBUS’ bus assets in 2H16 when the new operating model takes effect." NextInsight file photoTreatment of bus assets. CD has accumulated debt of SGD 406mn (58% of total group borrowings as of 30 June 2014), most of which was paid for bus capex as the bus business has been loss-making. If the LTA were to pay for CD’s bus assets gradually over time, it would put CD at a disadvantage to new entrants able to enter the market with a clean slate on an asset-light model, while CD would continue to incur financing costs on its accumulated borrowings. We continue to believe that CD will be compensated in cash for its bus assets at book value.

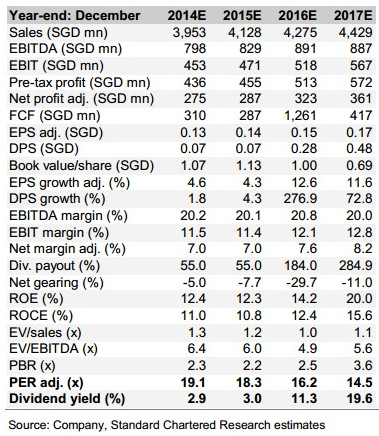

Valuation. Despite CD’s strong share price performance YTD and the premium forward multiples, we urge investors to look ahead to 2016/17. CD’s loss-making, capex-heavy Singapore bus business (19% of 2016E revenue) should turn materially profitable (8.0% OPM for core bus business, 10.6% OPM including advertising) and asset-light; the government should take ownership of its bus assets in exchange for cash, resulting in materially higher cash-flow yield, strong likelihood of significant cash distribution to shareholders and a sustainably higher payout ratio from 2016E onwards.

One-time cash windfall

We expect the government to acquire all of SBUS’ bus assets in 2H16 when the new operating model takes effect. We value those assets in 2016E at SGD 1.15bn. We estimate this by taking the carrying amount of SBUS’ bus assets at the end of 2013, adding two and a half years of capex (estimated SGD 200mn per year), and finally subtracting disposals and depreciation.

We expect the government to acquire all of SBUS’ bus assets in 2H16 when the new operating model takes effect. We value those assets in 2016E at SGD 1.15bn. We estimate this by taking the carrying amount of SBUS’ bus assets at the end of 2013, adding two and a half years of capex (estimated SGD 200mn per year), and finally subtracting disposals and depreciation. We also estimate SBS Transit’s total debt in 2016 by taking the company’s total short and long-term borrowings at the end of 2013 and adding debt equivalent to capex less disposals. CD has accumulated debt of SGD 406mn (58% of total group borrowings as of 30 June 2014), most of which paid for bus capex as the bus business has been loss-making. We expect SBUS to fund all future capex with new debt, as we do not expect the company’s bus and rail business to generate any surplus cash with which to fund capex.

Dividend upside

As SBUS operates exclusively in the public transport domain in Singapore, and with the public bus services transitioning to an asset-light business model, SBUS should no longer have any need for surplus cash or debt on its balance sheet. Thus, we expect SBUS to pay off all of its borrowings in 2016, and to distribute the remaining proceeds of the bus asset ownership transfer to shareholders. Thus, CD should receive its 75.21% share of these proceeds in the form of a special dividend in 2017.

Given CD’s excess cash as a result, we see a strong likelihood for significant cash-distribution to shareholders in 2016/17E, and forecast total dividends of SGD 595mn and SGD 1bn in 2016/17E. Even after such substantial payouts, CD’s net cash position would still be more than SGD 260mn.

Due to the less capital-intensive and more cash-generative nature of the business from 2016, CD should easily be able to afford such a special dividend as well as increasing its payout ratio without compromising its cash reserves for its reduced capex needs and potential M&As. We forecast a 90% payout ratio from 2017E onwards. This would not be unprecedented for the company, as CD paid out 93-102% of earnings from 2004 up until the global financial crisis in 2008.

Given CD’s excess cash as a result, we see a strong likelihood for significant cash-distribution to shareholders in 2016/17E, and forecast total dividends of SGD 595mn and SGD 1bn in 2016/17E. Even after such substantial payouts, CD’s net cash position would still be more than SGD 260mn.

Due to the less capital-intensive and more cash-generative nature of the business from 2016, CD should easily be able to afford such a special dividend as well as increasing its payout ratio without compromising its cash reserves for its reduced capex needs and potential M&As. We forecast a 90% payout ratio from 2017E onwards. This would not be unprecedented for the company, as CD paid out 93-102% of earnings from 2004 up until the global financial crisis in 2008.