Jeremy Yee, CEO of Cordlife, being interviewed by One TV.Photos by Mark Lee

Jeremy Yee, CEO of Cordlife, being interviewed by One TV.Photos by Mark LeeCORDLIFE GROUP took its investment story right to the doorstep of of China's investment community when its CEO, Jeremy Yee, presented to 28 funds on Thursday (8 Jan) in Shenzhen.

The event: "Scaling New Heights-Asia Investment Forum 2015".

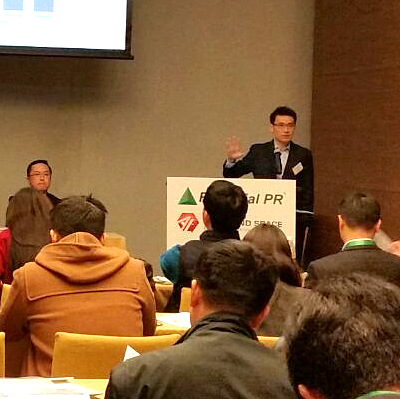

Jeremy Yee pitches to analysts and fund managers.It was the 5th annual event organised by Financial PR and Asia Fund Space with support from the China Enterprise Reputation & Credibility Association (Overseas) and the Hong Kong Investor Relations Association.

Jeremy Yee pitches to analysts and fund managers.It was the 5th annual event organised by Financial PR and Asia Fund Space with support from the China Enterprise Reputation & Credibility Association (Overseas) and the Hong Kong Investor Relations Association.Cordlife, a private cord blood bank operator listed on the Singapore Exchange, has a significant exposure to the cord-blood banking business in China through its 10% stake in China Cord Blood Corporation, which is listed on the New York Stock Exchange.

That stake is set to rise to 14.2% in 2017 when it converts its holding of the convertible bonds of China Cord Blood Corporation, China's leading cord blood bank operator.

Jeremy Yee (second from left) poses for a photo with, amongst others, Mark Lee (extreme right), MD of Asia Fund Space.An equity stake aside, Cordlife has a strategic business partnership with China Cord Blood Corporation.

Jeremy Yee (second from left) poses for a photo with, amongst others, Mark Lee (extreme right), MD of Asia Fund Space.An equity stake aside, Cordlife has a strategic business partnership with China Cord Blood Corporation.The two companies jointly launched a cord-lining storage service in China in July 2014.

Apart from China, Cordlife has a presence in mature markets Singapore and Hong Kong and high growth markets like India, Indonesia and the Philippines.

Maybank Kim Eng has a 'buy' call and a target price of $1.30 for Cordlife's shares (which traded recently at 91 cents).

The research house cited catalysts such as possible maiden dividends from China Cord Blood Corporation and better sales traction in China.

Kathy Zhang, Group MD of Financial PR, addresses the conference.

Kathy Zhang, Group MD of Financial PR, addresses the conference. Some 200 investment professionals took part in the conference at the Grand Hyatt Shenzhen.

Some 200 investment professionals took part in the conference at the Grand Hyatt Shenzhen.Recent story: @ CORDLIFE's EGM: Questions On Loan Repayment, China Dream, Etc