@ Ocean Financial Centre: Seven Trendlines portfolio companies presentation. Photo: CompanyHUNDREDS OF INVESTORS in Singapore yesterday got their first exposure to the entrepreneurial and innovative traits of start-ups of Israel, which has more high-tech start-ups and a larger venture capital industry than any other country in the world. @ Ocean Financial Centre: Seven Trendlines portfolio companies presentation. Photo: CompanyHUNDREDS OF INVESTORS in Singapore yesterday got their first exposure to the entrepreneurial and innovative traits of start-ups of Israel, which has more high-tech start-ups and a larger venture capital industry than any other country in the world. Trendlines Group brought seven of its Israel-based portfolio companies (out of 48) on a roadshow in Singapore, the first since Trendlines was listed on the Singapore Exchange last November.  @ SGX Centre. Photo: CompanyThe seven CEOs presented their innovative medical technologies in the morning to investors at Ocean Financial Centre and in the afternoon at SGX Centre. @ SGX Centre. Photo: CompanyThe seven CEOs presented their innovative medical technologies in the morning to investors at Ocean Financial Centre and in the afternoon at SGX Centre.Below are pictures of the CEOs and a brief description of the technologies which reflect Trendlines' stated objective of "helping to improve the human condition".

From Singapore, the Trendlines party will head to Hong Kong, Shenzhen, Shanghai and Beijing to meet investors there. In its roadshows, Trendlines seeks to attract financial investments into its portfolio companies to enable them to develop and commercialise their innovations.

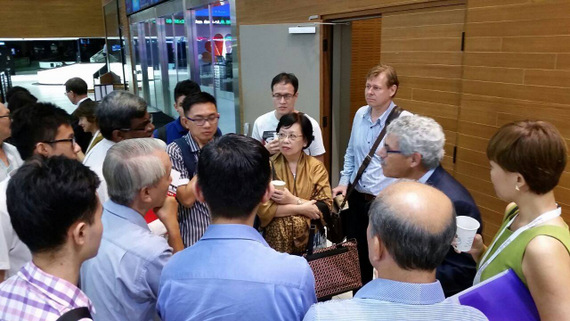

Trendlines' business model is still something new to many Singapore investors -- which is likely why its stock valuation has been trading below its peers'.  Trendlines Co-Chairman Steve Rhodes (left) with an investor. Photo by Colin LumIts stock closed yesterday at 20.5 cents with 3.9 million shares traded, substantially below its IPO price of 33 cents. Trendlines Co-Chairman Steve Rhodes (left) with an investor. Photo by Colin LumIts stock closed yesterday at 20.5 cents with 3.9 million shares traded, substantially below its IPO price of 33 cents. DBS Vickers, the only house covering the stock currently, has a 28-cent target price based on FY16F P/BV of 1.1x (versus selected peers trading at 1.3x). Trendlines' Co-Chairman Todd Dollinger says the book value is conservatively estimated, and the real value is substantially higher. "We think that when people understand the potential in these companies, they'll understand the hidden value in our portfolio."  @ SGX: Investors chat with Trendlines Co-Chairman Todd Dollinger. @ SGX: Investors chat with Trendlines Co-Chairman Todd Dollinger. Photo: Company |

NextInsight photos