|

Stock price |

88 c |

|

52-week range |

38.2 – 95 c |

|

PE (ttm) |

7.6 |

|

Market cap |

S$438 m |

|

Shares outstanding |

492 million |

|

Dividend |

1.7% |

|

Year-to-date return |

77% |

|

Source: Bloomberg |

|

Unlike many of its S-chip peers that have fallen by the wayside and destroyed shareholder value, China Sunsine has grown from strength to strength.

It reached the 10th anniversary of its listing on the SGX this year, its stock price recently touched a record high, and its profitability is at its best.

China Sunsine, the world's largest producer of rubber accelerators, has another great milestone this year: The 40th anniversary of its principal wholly-owned subsidiary, Shangdong Sunsine Chemical Co.

China Sunsine celebrated its 10th anniversary listing milestone at the SGX Centre last Friday.

More than 100 investors attended the event which included a briefing on its 2Q2017 results by CFO Tong Yiping (2Q17 net profit shot up 52% to RMB 74.5 m).

(An open invitation to the event was released on the SGX website on 17 July. Click here.)

Photos courtesy of China Sunsine @ SGX auditorium: Speeches and 2Q results briefing attended by investors and other guests.

@ SGX auditorium: Speeches and 2Q results briefing attended by investors and other guests.  Mr Chew Sutat, Head of Equities & Fixed Income, SGX, greets China Sunsine CEO, Mr Liu Jing Fu.

Mr Chew Sutat, Head of Equities & Fixed Income, SGX, greets China Sunsine CEO, Mr Liu Jing Fu. Mr Chew Sutat, Head of Equities & Fixed Income, SGX

Mr Chew Sutat, Head of Equities & Fixed Income, SGX L-R: China Sunsine CEO Liu Jing Fu | Independent director Koh Choon Kong | Lynn Gaspar, Senior VP, Head of Client Development & Relationships, Equities & Fixed Income, at SGX | China Sunsine CFO Tong Yiping.

L-R: China Sunsine CEO Liu Jing Fu | Independent director Koh Choon Kong | Lynn Gaspar, Senior VP, Head of Client Development & Relationships, Equities & Fixed Income, at SGX | China Sunsine CFO Tong Yiping.  China Sunsine CFO Tong Yiping presenting the 2Q17 results and answering questions of investors.

China Sunsine CFO Tong Yiping presenting the 2Q17 results and answering questions of investors. Investors asked many questions....

Investors asked many questions....

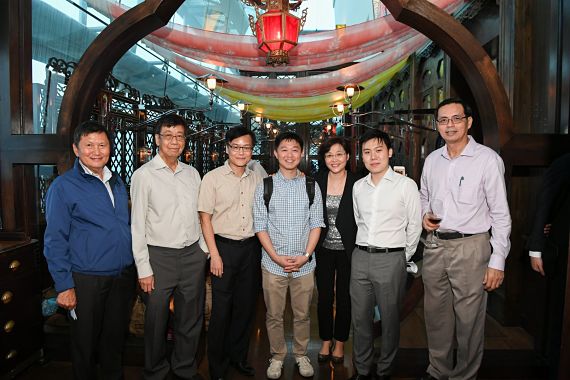

China Sunsine board of directors and management and SGX management. China Sunsine board of directors and management with Mr Chew Sutat of SGX.

China Sunsine board of directors and management with Mr Chew Sutat of SGX.

Investors and other guests at a private event interacting with China Sunsine CEO Liu Jing Fu.

Investors and other guests at a private event interacting with China Sunsine CEO Liu Jing Fu.