|

In a perfect investment world, Powermatic Data Systems' stock would be trading at much higher prices.

|

These three assets, respectively, add up as follows: S$26.3 million + S$10.2 million + S$33.5 million = S$70 million.

|

1HFY2018 |

|

|

Gross profit margin |

52% |

|

Net profit margin |

32% |

|

Historical dividend yield* |

5.0% |

|

Historical dividend payout ratio* |

58.5% |

|

Market cap |

$49 m |

|

* Based on $1.40 stock price and 5-c ordinary dividend and 2-c special dividend for FY2017. |

|

In contrast, its market cap at a share price of $1.40 is S$49 million.

So, the stock price doesn't give an iota of respect to the business per se.

It's no ordinary business: You can recognise that from the 52% gross margin (1HFY18) and 32% net margin.

Powermatic is in high-tech engineering. It designs wi-fi solutions for use in various aspects of everyday life, to be more precise.

You can read more in the couple of articles we have written on it, including quite recently: @ AGM of POWERMATIC DATA: Riding on growth of wi-fi connectivity in transport

So, it's an imperfect investment world which is not a fantastic environment for shareholders to realise the full potential of their investment.

Powermatic's share liquidity is thin, its management focuses on the business and spends not a big amount of time on investor outreach.

For incoming investors, though, the share price looks like a dream bargain.

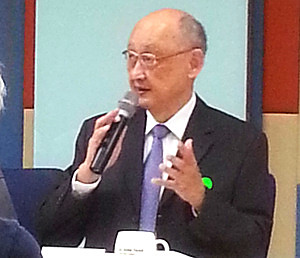

Dr Chen Mun, executive chairman and CEO of Powermatic Data Systems. NextInsight file photoThe need for more and faster connections over the internet from businesses, public places, households and consumers continues unabated. This has propelled growing demand for reliable and high performance wireless connectivity devices. The Group's expertise in design and manufacturing of wireless connectivity products has gained increasing recognition and acceptance in the market place. However, competition and cost pressure are expected to remain intense, this applies to our OEM and ODM customers as well. There will be up and downs in our business. Overall, we are confident in maintaining profitability and growth for the coming year." Dr Chen Mun, executive chairman and CEO of Powermatic Data Systems. NextInsight file photoThe need for more and faster connections over the internet from businesses, public places, households and consumers continues unabated. This has propelled growing demand for reliable and high performance wireless connectivity devices. The Group's expertise in design and manufacturing of wireless connectivity products has gained increasing recognition and acceptance in the market place. However, competition and cost pressure are expected to remain intense, this applies to our OEM and ODM customers as well. There will be up and downs in our business. Overall, we are confident in maintaining profitability and growth for the coming year."-- Powermatic Data Systems. See its 1HFY18 results statement here. |