| There are only two iron ore miners listed on the Singapore Exchange -- Southern Alliance Mining (SAM) and Fortress Minerals. Combine the fact they are relatively newly listed with iron ore being a little understood industry for Singapore investors, and what do you get? Illiquidity and undervaluation. In the meantime, a record-busting run in global iron ore prices has been taking place, largely driven by demand from China coupled with a fall in supply from Brazil. (See Bloomberg's: Iron Ore Is This Year’s Hottest Commodity on China-Fueled Surge) Here's a snapshot of the stock-related metrics of the 2 listcos:

|

||||||||||||||||||||||||

But all that illiquidity and undervaluation changed dramatically after SAM -- which listed in June 2020 -- announced its 1HFY2021 results last Sunday (14 March).

From Monday to today (Wed), its stock price surged as much as 49% (from 42 cents to as high as 62.5 cents) on heavy volume.

And Fortress Minerals? Its stock also awakened (rising 13% from 31.5 cents to 35.5 cents).

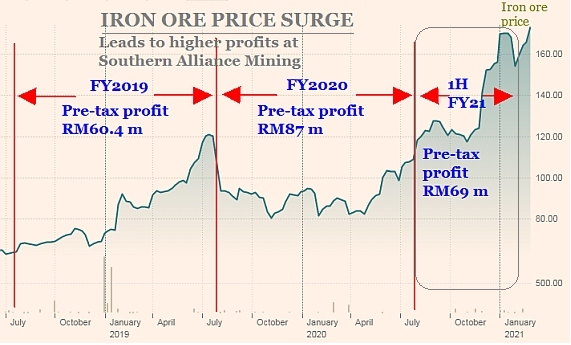

Here's an illustration of the rise in iron ore price boosting SAM's 1HFY21 profit.

SAM's 1HFY2021 revenue: RM152.1 million (+8% y-o-y).

SAM's 1HFY2021 revenue: RM152.1 million (+8% y-o-y).

Net profit: RM 51.4 million (+47% y-o-y).

The business of SAM -- whose sole producing mine and three exploration mines are located in Johor -- is sensitive to the market price of iron ore.

And when the market price surged from around US$90 in Feb 2019 through to around US$170 a tonne in Jan 2021, SAM enjoyed substantial profits on substantial margins.

SAM's breakeven point ranges from US$30 to US$50 per tonne, it was previously reported.

SAM reported a lower volume of iron ore concentrate sold because of a higher "strip ratio" at the mine -- ie, more waste or overburden had to be removed before the ore could be extracted.

But, thanks to elevated selling prices, revenue still increased 7.8% y-o-y to RM152.1 million in 1H FY2021 (Aug 2020 - Jan 2021 period).

The margins were abnormally high:

| • Gross margin: 47.6% (1HFY2020: 39.5%); • Net margin: 33.8% (1HFY2021: 24.8%). |

After two years of elevated profits, the balance sheet of SAM is looking very pretty. As at end-Jan 2021:

| • Cash and bank balance: RM190.1 million; • Bank borrowings: RM5.8 million. |

And the near term prospect? Market prices for iron ore are hovering around US$170 per tonne, which is a record in at least the past 5 years, and SAM is positioning itself to gain even more than before:

CFO Lim Wei Hung on an 1HFY2021 earnings call yesterday (Tues)."The removal of overburden is an ongoing process and we are going to intensify it over the next six months. There is an incentive for us to do much more as we have sufficient cash flow to finance that. You can say we are reinvesting so that the Group can benefit from more ore that may be extracted in the future." CFO Lim Wei Hung on an 1HFY2021 earnings call yesterday (Tues)."The removal of overburden is an ongoing process and we are going to intensify it over the next six months. There is an incentive for us to do much more as we have sufficient cash flow to finance that. You can say we are reinvesting so that the Group can benefit from more ore that may be extracted in the future." -- CFO Lim Wei Hung |

The 1HFY2021 presentation material is here.