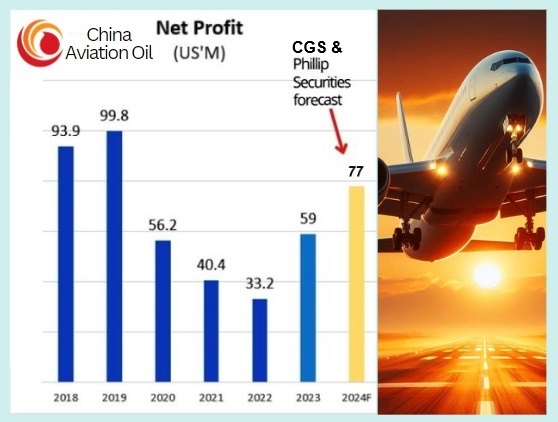

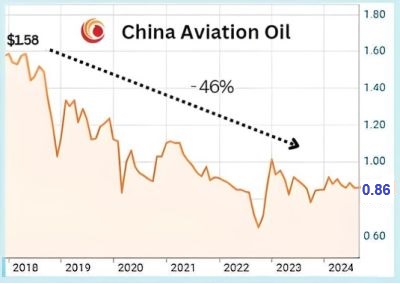

• China today (24 Sept) unveiled fresh stimulus to boost its economy, sending Shanghai and HK stocks on a rally. Interest rate cuts and measures to revive the local stock markets could lead to increased consumer spending, including on travel and tourism. • On the Singapore Exchange, China Aviation Oil (CAO) is one of the possible beneficiaries of a recovery in Chinese consumption and, specifically, aviation travel. • The Covid pandemic dealt a blow to its business. With domestic and international travel picking up pace, but still below pandemic levels, CAO’s supply of jet fuel should rise accordingly. • CAO staged a recovery in profit in 2023 and is set to extend the trend in 2024 (see chart).  CAO stock currently trades at 3.6X PE after excluding its large cash balance. CAO stock currently trades at 3.6X PE after excluding its large cash balance.• While CAO's profits have been recovering, its stock price has continued to languish.  Chart: ReutersPhillip Securities and Lim & Tan Securities have target prices of $1.05 and $1.24, respectively. Chart: ReutersPhillip Securities and Lim & Tan Securities have target prices of $1.05 and $1.24, respectively.CAO's business is low in capex and high in cash generation, leading to a US$354 million cashpile (zero debt) which is about 62% of its current market cap (S$735 m). • However, margins are thin as this is a volume game: Gross margins are merely 0.4%! CAO operates a cost-plus model whereby it earns a margin for every unit of fuel it supplies. Volatile oil prices, among other things, pose a risk. Read more what Phillip Securities says below.... |

|

• CAO also markets jet fuel to airports outside China, and engages in international trading of jet fuel and other oil products, as well as carbon credits. |

Excerpts from Phillip Securities' report

Analyst: Liu Miaomiao

• Revenue for 1H24 increased by 20% YoY to US$7.5bn, slightly below expectations and accounting for 44% of our FY24e forecast.

• Net income soared by 117.8% YoY to US$42.4mn for 1H24, in line with our forecast, forming 54% of our FY24e estimates. |

|||||

• 2024e earnings supported by the recovery in international air traffic in China, which we anticipate will reach c.90% of pre-pandemic levels (currently 25% below pre-COVID levels).

We are positive on CAO as the largest physical importer in China and associate SPIA, the sole jet fuel supplier for international flights at Shanghai airport.

We maintain our FY24e earnings forecast and BUY recommendation with an unchanged DCF-TP of S$1.05.

Outlook

CAO is diversifying its geographical presence outside of China, although revenue from the PRC still accounts for 75% of its total income.

| "According to a report from the Civil Aviation Administration of China, international air passenger demand in China grew rapidly in the first half of 2024, with a remarkable rebound exceeding 80% of pre-pandemic levels for 5 consecutive months since February 2024 and further growth in the international air passenger traffic is expected in the second half of the year." --China Aviation Oil, 14 Aug 2024 media release |

We expect higher contributions from other regions as several partnerships, particularly in Korea and the US (+30%YoY), are progressing well.

We believe there is an good opportunity for CAO to increase its payout ratio or announce a special dividend, given its current cash-rich position of US$353mn.

In addition State Owned Enterprises have been encouraged to raise dividends.

Liu Miaomiao, analystMaintain BUY with an unchanged TP of S$1.05 Liu Miaomiao, analystMaintain BUY with an unchanged TP of S$1.05 Earnings will be supported by a recovery in international air traffic in China, which we expect to reach c.90% of pre-pandemic levels (currently around 25% below pre-COVID levels). We maintain our BUY recommendation with an unchanged DCF-TP of S$1.05. |

Full report here.