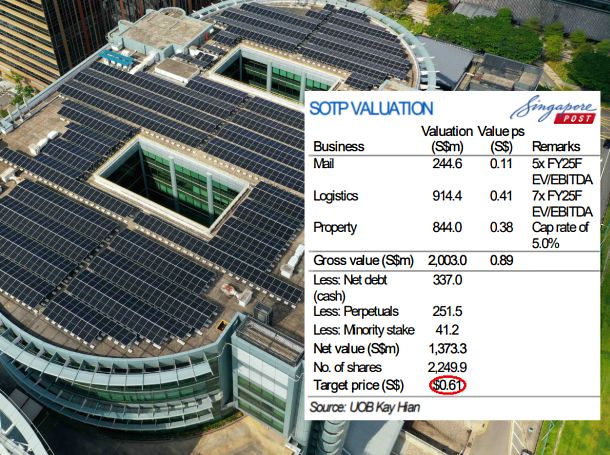

• Investor interest in SingPost spiked up in the past week after Aussie news media reported "heavyweight private equity firms vying" for SingPost's A$1 billion portfolio of Australian assets. • SingPost stock, up from 46 cents to as high as 55 cents in the past week, has seen also a strong recovery from its year-low of 38 cents in March. The stock is still "severely undervalued", according to UOB Kay Hian's latest report. It used a sum-of-the-parts valuation method to value it at 61 cents (see graphic below). Does a 20% upside translate into "severe" undervaluation currently?  Solar panels were recently installed on the rooftop of SingPost Centre in Eunos Road, a prominent mixed-use development valued at S$1.1 billion. Solar panels were recently installed on the rooftop of SingPost Centre in Eunos Road, a prominent mixed-use development valued at S$1.1 billion.• In transforming itself into a technology-driven logistics enterprise in recent years, SingPost has addressed an existential threat -- the structural decline in its legacy postal business.

|

Excerpts from UOB Kay Hian report

Analysts: Llelleythan Tan Yi Rong

Singapore Post (SPOST SP)

Due to an ongoing shift to digital alternatives and declining letter mail volumes, SPOST has closed 12 post offices in Singapore. |

WHAT’S NEW

• Rationalisation of post offices. With 44 remaining post offices, SPOST is now focusing on other customer service touchpoints such as its POPStation network.

|

SingPost |

|

|

Share price: |

Target: |

As mentioned in our earlier reports, the rationalisation of the post offices was within our expectations as we expected the group to consolidate its postal branches and multiple sorting centres, lowering overhead costs.

Moving forward, we expect the group to continue consolidating its post offices, albeit at a slower pace which would support segmental margins.

• Strategic review still ongoing. As a recap, SPOST initiated a strategic review of its Australian business to explore options to drive growth and maximise shareholder value.

Some options include near-term partnerships, providing equity to deleverage debt, M&A opportunities and seeking future liquidity options.

In our view, we expect the strategic review to be completed around end-4Q24/early-1Q25 and reckon that the most likely outcome would be a strategic partnership stake sale.

• Market talk of a potential sale. It was reported that several prominent private equity firms such as Brookfield Corporation, Blackstone Inc and Kohlberg Kravis Roberts (KKR) have shown interest in SPOST’s portfolio of Australian assets with potential bids incoming within the next few weeks.

These assets primarily include CouriersPlease and Freight Management Holdings (FMH) and is in line with the group’s strategy to seek strategic partnerships and M&A opportunities.

In our view, we expect that confirmation of any potential deal would be announced only after the group’s strategic review of the Australian business has been completed.

| Severe undervaluation |

| "Based on our estimates, the touted A$1b valuation of SPOST’s Australian portfolio is largely within our expectations, implying a roughly 6-7x EBITDA multiple. "We opine that the market is severely undervaluing SPOST’s businesses (see table overleaf), given that SPOST’s current market cap is around S$1.17b as compared to the S$844m and S$914m valuations for its property and logistics segments respectively." -- UOB KH |

STOCK IMPACT

• Singapore: To stay profitable in 1HFY25. For 2QFY25, we expect the Singapore business to grow yoy, largely driven by the postal delivery business benefitting from the postal price hike in 3QFY24.

As a recap, the Singapore delivery business recorded a profit in 1QFY25 as e-commerce volumes rose (+2.9% yoy), offset by the secular decline in letter mail and printed paper volumes (-8.1% yoy).

However, similar to 1QFY25, we reckon that the postal office network would remain unprofitable in 2QFY25, dragged by inflationary pressures.

Based on our estimates, we expect 1HFY25 operating profit for the Singapore business (including the postal office network) to be around S$7m.

Moving forward, we expect the rationalisation of the postal office network to continue in 2HFY25, reducing operating costs and improving profitability. Potential downside may come from lower-than-expected letter mail and domestic e-commerce volumes.

• International: Headwinds persist. We expect a weak macroeconomic environment and a strong Singapore dollar against the Chinese yuan to dampen cross-border postal volumes in 2QFY25.

As a recap, the international business was profitable in 1QFY25 and we do expect 2QFY25 to post a small profit as well, driven by implemented cost-efficiency initiatives and the group’s focus on managing profitability and ensuring a stable operating margin.

We reckon that air conveyance costs would likely continue trending downwards and the highermargin commercial cross-border operations would help support margins.

We opine that earnings from the international business would bottom out in 1HFY25 and grow moving into 3QFY25. Based on our estimates, 1HFY25 operating profit is at S$4m.

• Australia: Inorganic growth to come through. We expect revenue and operating profit to grow in 2QFY25/1HFY25, largely driven by the consolidation of Border Express (BEX).

Excluding BEX, we expect 2QFY25 operating profit from the Australian business to grow yoy, on the back of organic volume growth from its 4PL business but offset by the 3PL business and the strong Singapore dollar against the Australian dollar.

Also, we expect BEX to deliver a strong performance in 2QFY25. Based on our estimates, 1HFY25 operating profit is likely around S$35m with S$15m coming from BEX. Moving forward, we expect BEX to significantly boost segmental annual operating profit in FY25, coupled with organic growth from the Australian business.

• Famous Holdings: Correction underway. In line with falling sea freight rates, we expect 2QFY25 revenue and operating profit to decline but still post a small profit for the quarter.

Based on our estimates, 1HFY25 operating profit is roughly around S$4m. Earmarked as a non-core asset in our view, we reckon that the divestment of Famous Holdings is likely in the short to medium term.

• Property: Expect stable performance. We expect 2QFY25 overall occupancy rates at SingPost Centre to remain stable or improve from the 96.0% overall occupancy rate in 1QFY25. Based on our estimates, 1HFY25 operating profit would be around S$20m.

EARNINGS REVISION/RISK

• We maintain our earnings estimates. For 1HFY25, we expect overall group operating profit of around S$58m (including S$12m in corporate overhead costs) and underlying net profit of around S$30m, implying yoy growth rates of 84.7% and 123.9% respectively.

| VALUATION/RECOMMENDATION • Maintain BUY with the same SOTP-based target price of S$0.61. Based on our SOTP valuation, we value the property, logistics and postal segments at S$844m, S$914m and S$245m respectively.  Llelleythan Tan, analystGiven that SPOST’s current market cap is around S$1.17b, we think that the market is severely undervaluing SPOST’s businesses. At our target price, SPOST trades at 19x FY25F PE, at -0.5SD to its long-term mean. Llelleythan Tan, analystGiven that SPOST’s current market cap is around S$1.17b, we think that the market is severely undervaluing SPOST’s businesses. At our target price, SPOST trades at 19x FY25F PE, at -0.5SD to its long-term mean. SHARE PRICE CATALYST • Potential stake sale of its Australian business. • Divestment of non-core businesses. |

Full report here.