|

Excerpts from CGS International report

Analysts: Meghana KANDE & LIM Siew Khee

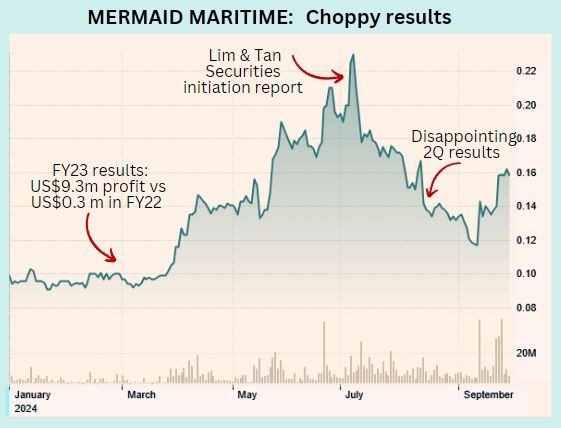

Mermaid Maritime (MMT SP)

| ■ We hosted MMT’s management for a call with investors on 7 Oct 24. Postcall, we remain positive on MMT’s fleet utilisation and order outlook. ■ Key investor questions were focused on the impact of oil prices on day rates, margin outlook and capex needs. ■ Management expects fleet utilisation to remain above 80% in 2025F, on the back of tight global vessel supply and higher oil price-driven demand. ■ We reiterate our Add call, with an unchanged TP of S$0.20, based on 11x 2025F P/E. |

Mermaid's subsea IRM (inspection, repair and maintenance business segment is a core contributor while decommissioning is a strongly emerging business.

Mermaid's subsea IRM (inspection, repair and maintenance business segment is a core contributor while decommissioning is a strongly emerging business.

Higher oil prices are likely to keep vessel demand intact

We see limited geopolitical risk to Mermaid Maritime (MMT) as major areas of conflict in the Middle East are primarily concentrated in the western region of Saudi Arabia, while MMT operates predominantly in the eastern region and Qatar.

The company may see some cost increases due to the need for alternative shipping routes when mobilising vessels from the UK or US to the Middle East.

| Mermaid Maritime | |

| Share price: 18 c | Target: 20 c |

AManagement noted that higher oil prices are supporting increased development in Mozambique, Guyana and Asia-Pacific. Given its favourable order outlook, MMT expects fleet utilisation to remain well above 80% for 2025F.

A continued high demand environment and limited vessel newbuilds should support day rates for its fleet, in our view.

Cost pass-through can support margins in the medium term

According to data provided by management, there were 104 diving support vessels (DSVs) in operation globally as of Jan 2018.

This number has since fallen to 56, of which seven are tied up and 27 are locked into long-term contracts. MMT typically secures contracts for 5-6 months, but some can extend much longer (for example, Mermaid Asiana has been working for Aramco for 13 years on an extension basis).

Around 75% of MMT’s contracts are long term, supporting more predictable cash flows, while the remaining 25% are kept on spot to be opportunistic of rising day rates.

While margins could soften in the near term as MMT charters in vessels at higher rates, the company expects to pass these costs to customers when signing new contracts.

| Targeting capex spend on ROVs to optimise costs In the near-term, MMT is planning to order around four new remotely operated vessels (ROVs). It currently owns 14 ROVs and has chartered another 13 units.  Meghana Kande, analystThe new ROVs, costing c.US$3m-3.5m each, will be partially funded through bank financing and internal cash. MMT does not plan to purchase additional DSVs, given the high cost (US$150m each) and the need for 20-year visibility. Meghana Kande, analystThe new ROVs, costing c.US$3m-3.5m each, will be partially funded through bank financing and internal cash. MMT does not plan to purchase additional DSVs, given the high cost (US$150m each) and the need for 20-year visibility. We maintain our Add call and unchanged TP of S$0.20, based on 11x 2025F P/E, a c.15% discount to global peers given MMT’s smaller scale. Key catalysts include order wins, higher-than-expected day rates and fleet expansion. We see downside risks from escalation of geopolitical tensions, poor weather and prolonged dry-dock impacting vessel utilisation, and order cancellations. |

Full report here.