• Globally, the Offshore Support Vessel market has captured investor attention this year with rising charter rates and fleet utilisation. On the Singapore Exchange, Marco Polo Marine has done well with good analyst coverage and stock performance (until a recent correction). • A peer, Nam Cheong, has also reaped strong profits this year after saling out of choppy waters post-pandemic. (NAM CHEONG: Demand is strong, supply is constrained. Things have not been this good for this company in a long while)  Now, CGS International has taken a deep dive into this thriving market.

In a 38-page report today, CGS also initiated coverage (long after several brokerages) on Marco Polo and Pacific Radiance. While Marco Polo's story has been well highlighted in the market, Pacific Radiance's has been under the radar. Pacific Radiance (PACRA) recently restructured its business, moving into a net cash position and expanding into East Asia's burgeoning offshore wind market.

Marco Polo Marine, on the other hand, is expected to reap the benefits from its recent capital expenditures on shipyard capacity expansion and new vessel construction. Their strategic investments are set to pay off from FY25F onwards, with a significant ramp-up in FY26F.

|

Excerpts from CGS International report

Analysts: Meghana KANDE & LIM Siew Khee

Offshore & Marine

| Sailing towards growth |

■ Our outlook for offshore support vessels remains positive given dual demand from traditional oil & gas and the growing nascent offshore wind industry.

|

||||

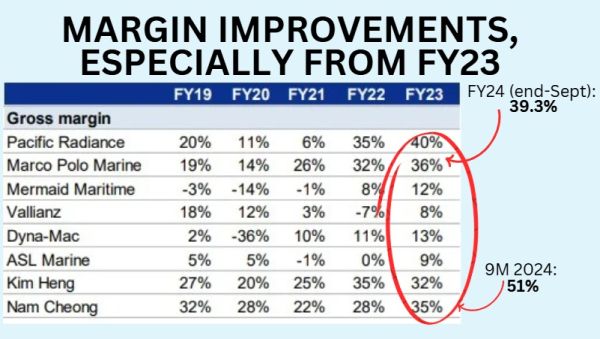

Data: CGS International

Data: CGS International

Robust demand from oil & gas and offshore wind

YTD average offshore rig utilisation, a proxy for oil & gas production activity, remains high at 80% and is forecast to reach 88% by 2028F (source: Riglogix).

Research and energy intelligence company Rystad Energy estimates 2027F offshore energy capex at c.US$375bn (+40% from 2023) as YTD Brent crude oil prices traded well above Rystad’s average breakeven estimate of US$26/bbl.

Meanwhile, offshore wind capacity is expanding in Taiwan, Japan and South Korea to meet their combined targets of 37.4GW by 2030F (2023: 2GW).

We estimate this requires c.3,400 wind turbines, nearly 10x more than 2023.

Strong demand from both sectors is driving the need for vessel chartering, subsea construction, ship management and other offshore support services.

Offshore support vessel charter rates are up 120-145% since 2021

Global fleets of anchor handing tug supply (AHTS) and platform supply vessels (PSV) are 2-7% below historical peak in 2015-17 due to demolitions, limited newbuilds and challenges in reactivating laid-up vessels.

| "Charter rates for OSVs are now more than double 2021 levels. "As of Nov 2024, large AHTS rates were at US$2.2/BHP (2021: US$1/BHP) and PSV rates at US$10.5/DWT (2021: US$4.3/DWT)." -- CGS |

Following the 2014 oil price collapse, O&G industry consolidation and restricted financing slowed fleet growth.

According to Clarksons, as at Nov 2024, newbuild offshore support vessels (OSV) in orderbook (OB) was equivalent to 2-3% of existing global fleet (vs. 21-27% during 2007-14).

Shipyards stand to benefit too

Due to the lack of newbuild OSV, the market share of older vessels (15-30 years) grew to 20% of working fleet in 2023 (2016: 7%) to meet demand, as per Spinergie.

Given the high utilisation rates since 2021, we expect demand for repairs and maintenance for ageing vessels to grow.

In addition, reactivation of some of the 444 laid-up AHTS and PSV could further catalyse demand for retrofit and upgrade works.

With the number of active yards at a 24-year low globally (source: Clarkson), shipyards are well-positioned to command higher rates for OSV repairs work and order prices for newbuild vessels, in our view.

|

Full report here