When Beng Kuang Marine reports its FY2024 results next month, the figures are likely to amplify the CEO's success in turning around the company that was previously struggling due to a crash in the oil price about a decade ago followed by the Covid pandemic. *Excludes discontinued operations. **Includes $7.7 m other gains, including gains from land saleYong Jiunn Run, 61, after a 30-year career in banking, was appointed CEO of Beng Kuang Marine in June 2021. *Excludes discontinued operations. **Includes $7.7 m other gains, including gains from land saleYong Jiunn Run, 61, after a 30-year career in banking, was appointed CEO of Beng Kuang Marine in June 2021. Since then, under a transformation plan dubbed BKM 2.0, the company's revenue and profit have turned up (see charts). His focus: go asset-light (minimal capex), financial discipline, operational efficiency, and growth. He spearheaded a shift away from traditional shipbuilding and repair activities towards specialised, high-margin services, primarily in the Floating Production Storage and Offloading (FPSO) market. He is as pragmatic and results-oriented as they come. His message to his men: "The first thing I look for is topline growth. Secondly, bottom line. If you don't deliver top line, you make sure you deliver the bottom line. If you cannot, you drop your costs. So the drop in cost comes from where? Your bonus!" he said in a recent meeting with investors. "In business, the rate of increase in sales must be faster than the rate of cost increase. If sales grow slower than costs, something has to give—that’s how I run it." |

Focus on FPSO Servicing: A Winning Strategy

Most FPSO owners rely on multiple contractors for repair and maintenance. From a tiny number just two years ago, Beng Kuang Marine now services over 20 FPSO vessels out of 180 or so globally.

The significant market share generates recurring revenue.

"Once they use you, they always want you because we know what works and what doesn’t. They mainly want to focuse on extracting oil uninterrupted."

Yong Juinn Run: Has more than 30 years of experience in corporate and commercial banking. Yong Juinn Run: Has more than 30 years of experience in corporate and commercial banking. • Ex-CEO of CIMB Group Commercial Banking • Ex-Business Head for Global Enterprise Banking at OCBC. |

Its workers are involved at various stages, ensuring continuity and expertise.

This approach creates a "sticky" relationship with clients, as Beng Kuang Marine's teams develop deep knowledge of the vessels they service, making them indispensable for ongoing operations.

Beng Kuang Marine's success can be attributed to several factors:

• Specialised Expertise: The company has a team of highly skilled personnel, including Singaporean, Malaysian, and international experts, who oversee workers hired from the regions where the FPSOs operate.

• Safety and Reputation: Beng Kuang Marine has built a reputation for safety and reliability, crucial factors for FPSO operators concerned with minimizing downtime and ensuring the smooth operation of their vessels.

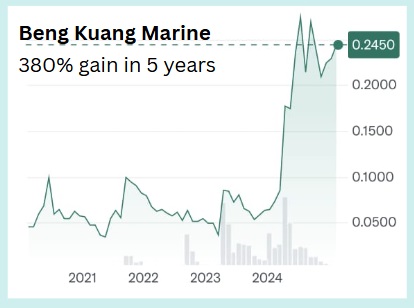

Market cap: S$48 million. Chart: Yahoo!

Market cap: S$48 million. Chart: Yahoo!Prior to Yong's arrival, Beng Kuang Marine struggled with a debt-laden balance sheet.

Yong's strategic decision to sell a significant piece of shipyard land in Batam owned by Beng Kuang Marine significantly bolstered the company's financial position.

The S$19 million in proceeds were used to pay off loans and build up cash reserves.

Aside from the FPSO core business, the company has a long-standing reputation as one of Singapore’s leading providers of corrosion prevention services.

This division specializes in protecting marine and offshore assets from corrosion, contributing $11.1 million revenue (18% of Group total) and $1.3 million pre-tax profit (7.5% of Group total) in 1H2024.

Growth Opportunities: Expanding Services

Beng Kuang Marine's future growth hinges on several promising opportunities:

The global FPSO market is projected to expand significantly in the coming years, driven by rising oil demand and the development of new offshore fields.

This growth translates into a larger pool of potential clients for Beng Kuang Marine's services.

"We must be a market leader. We don’t do things as just a small player. If the business is only a few hundred thousand or a million dollars a year, it’s a waste of time. We must aim to be a big business and a market leader," Yong says.

This growth translates into a larger pool of potential clients for Beng Kuang Marine's services.

"We must be a market leader. We don’t do things as just a small player. If the business is only a few hundred thousand or a million dollars a year, it’s a waste of time. We must aim to be a big business and a market leader," Yong says.

|

• New Business Lines: Yong is exploring opportunities in related sectors such as FPSO module fabrication, leveraging the company's existing expertise and relationships in the offshore industry.

• Labour Costs: Although the company's offshore workforce is not affected by rising dormitory costs in Singapore, it has about 300 workers housed in a dormitory leased from a third party at attractive rates. • Dividend: Beng Kuang has not paid a dividend since 2012.

Given its profitability and cash reserves, there is a chance of a resumption in dividends soon but the company can be expected to reinvest profits to support further growth. |