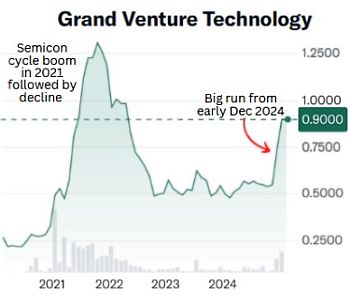

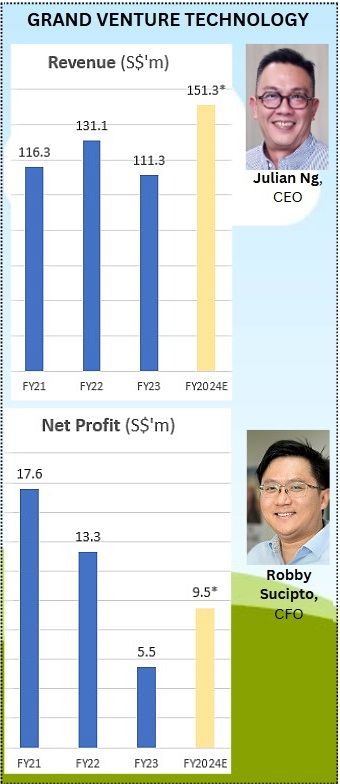

• Grand Venture Technology (GVT) is among only a handful of Singapore tech stocks that have done very well in the past year. It is up 77%, from 51 cents to 90 cents (see chart).  Chart: Yahoo!This has pushed its market cap to S$305 million, which translates to a PE that looks stretched at around 30X for FY24 and 23X for FY25 (using DBS Research's forecast). Chart: Yahoo!This has pushed its market cap to S$305 million, which translates to a PE that looks stretched at around 30X for FY24 and 23X for FY25 (using DBS Research's forecast). • The stock surged 64% from early December 2024, spurred by three announcements. The first said GVT has been selected as a preferred supplier of High Level Assembly, inclusive of precision parts and components for next generation Thermal Compression Bonding equipment by a leading global semiconductor assembly and packaging equipment manufacturer.  *Assumes 2H24 revenue is $83 m, which is midpoint of GVT guidance. *Assumes 2H24 revenue is $83 m, which is midpoint of GVT guidance. Assumes 2H24 net margin = 1H24 net margin• This may be getting too technical for most general investors. GVT is a Singapore-based company that provides manufacturing solutions and services, primarily catering to industries like semiconductors, life sciences, electronics, medical, and industrial automation. In simple terms, GVT helps its clients by producing specialized components and tools that are essential for their advanced technologies. • The exciting growth in GVT's business is coming from the front-end of the semiconductor industry -- ie, where the focus is on the fabrication of semiconductor wafers and the creation of integrated circuits on these wafers. The dollar value of a front-end equipment is multiples of a back-end piece. • Novo Tellus is a shareholder in GVT, with a significant stake of 26.7%, which was purchased about four years ago (See: GRAND VENTURE TECHNOLOGY: Novo Tellus to buy S$30 million controlling stake).As a private equity investor, Novo Tellus is well known for its role in transforming AEM Holdings several years ago. Read more about GVT's latest win in a DBS report below .... |

Excerpts from DBS Group Research report

Grand Venture Technology

New project win marks milestone in front end expansion

|

Grand Venture Technology was established in 2012 and it is a manufacturing solutions and services provider for the semiconductor, life sciences, electronics, medical, and industrial automation industries. Its manufacturing plants are located in Singapore, Malaysia, and China with a total of 540k sqft of factory floor area. |

TSV win showcases GVT’s capabilities in advanced chip manufacturing production.

GVTannounced in a press release that it won a TSV (through-silicon VIA) project from a leading wafer fabrication equipment company.

GVT termed the project win a “major milestone” and a “breakthrough”, demonstrating its capabilities in semiconductor front end manufacturing processes.

TSV (Through-Silicon Via) is a critical leap in semiconductor manufacturing and is pivotal in advanced packaging and high bandwidth memory, enabling high-density integration and enhanced performance.

Market demand for high end advanced packaging remains robust and is expected to grow at a CAGR of 37% to USD28bn by 2029 (Yole Intelligence), supporting the demand for TSVs which are foundational for next-generation chips.

Front end contributions gaining momentum and strength, in line with our expectations.

We believe that the TSV project is a significant initiative with a new front-end customer who holds over 50% of the market share in deposition and etch for advanced 3D HBM stacking, as well as a monopoly for certain systems across memory customers for TSV formation.

| GVT | |

| Share price: 90 c | Target: $1.04 |

Other than TSV, GVT is also developing front-end solutions in areas such as atomic layer deposition, metrology, and inspection which should augment front-end contributions once it enters mass production.

We believe that GVT’s front-end products will enter meaningful mass production in FY25, which is expected to boost semiconductor revenues to SGD100 /131mn in FY25/FY26, reflecting a 30% y/y growth in both years.

|

There is no change to our forecasts, as GVT had previously indicated that the TSV project was in the qualification phase and is expected to begin contributing in FY25. |