|

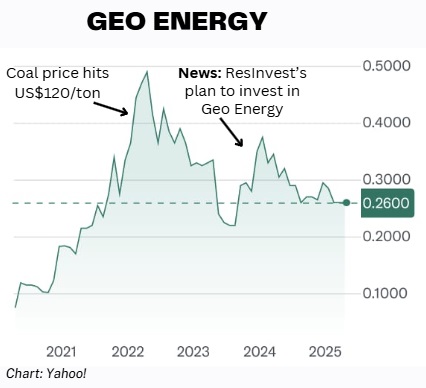

Geo Energy Resources has had a bumpy ride lately, with its stock price sliding over the past year.

As for coal prices, management said in a results briefing that prices are expected to remain stable between US$50–$53/ton, as supported by Wood Mackenzie reports and futures indices. |

|

Stock price |

26 c |

|

52-wk range |

24 – 38 c |

|

PE (ttm)* |

7.4 |

|

Market cap |

S$368 m |

|

Shares outstanding |

1.41 b |

|

Dividend |

3.8 % |

|

1-yr change |

-27% |

|

P/B |

0.5 |

|

* 3.53 SGD cents EPS |

|

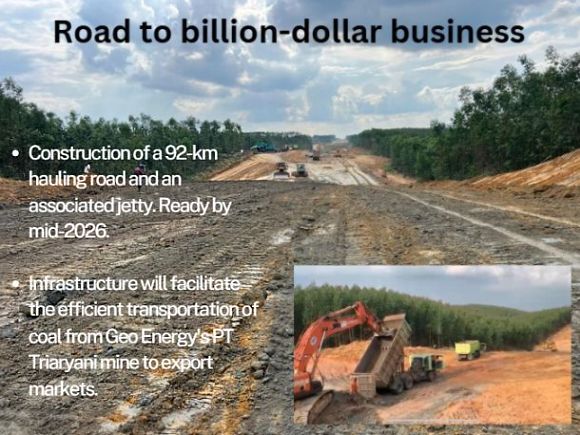

If 2025 looks strong, the following year is expected to be even better, assuming certain infrastructure work reaches completion then.

The company is constructing a 92-km hauling road and a jetty with a capacity to handle up to 50 million tonnes per year.

This project will:

- Enable Geo Energy's TRA mine in South Sumatra to scale up production to as much as 25 million tonnes annually over the next few years.

- Generate mega revenue by leasing unused road/jetty capacity to nearby mine owners.

There will be revenue to be earned from allowing third parties to use the infrastructure capacity -- possibly at a conservative US$8–10 per ton.

Geo Energy itself will have cost savings.

In all, a back-of-the-envelope estimate is that the infrastructure may generate US$300–400 million EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) annually.

Philip Hendry, the COO, said the road is akin to a monopoly, as it is indispensable for neighboring mines to transport their coal.

Philip Hendry, the COO, said the road is akin to a monopoly, as it is indispensable for neighboring mines to transport their coal.

He said these potential customers own a whopping two billion tons of coal reserves, ensuring that their mines will be in production for several decades.

They currently use a road that is in poor condition.

The new road is targeted for completion by June 2026, with commissioning starting in Q3 (July–September) of that year.

Assuming US$300-400 million EBITDA annually, the valuation of the infrastructure could be US$1 billion, conservatively.

Geo Energy holds a 63.7% stake in PT Marga Bara Jaya (MBJ), which owns the infrastructure.

Philip said: "We believe GEO shares are severely undervalued. Once the MBJ road is operational, GEO will deliver substantial returns to shareholders."

CFO Adam Tan: "While dividends remain a priority, the real value of GEO lies in its long-term growth potential as we ramp up production and unlock new revenue streams."

That potential is validated by the investment into Geo Energy in 2024 by ResInvest (part of EP Resources), one of Europe’s largest energy conglomerates led by billionaire Daniel Daniel Křetínský.

That potential is validated by the investment into Geo Energy in 2024 by ResInvest (part of EP Resources), one of Europe’s largest energy conglomerates led by billionaire Daniel Daniel Křetínský.

Their partnership opens doors for future investments and collaborations with Geo.

(See: GEO ENERGY: Swiss investor commits to buy US$35 m of stock, mostly in open market)

Geo Energy said coal demand remains robust, especially in key markets like China and India, where coal is essential for energy generation.

Geo Energy's low-calorific-value coal (GAR 4,200 kcal/kg), known for its low ash and sulfur content, continues to be a preferred choice for buyers across Asia.

|

Geo Energy's FY24 financial statement is here.