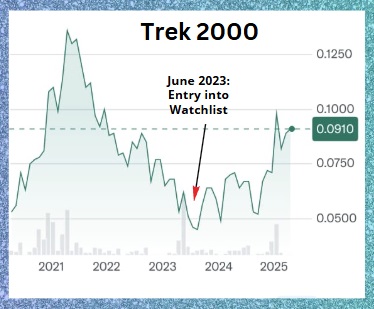

| Trek 2000 International, a Singapore-based tech company, has been busy buying back its shares—lots of them. The buybacks usually accounted for a large portion of the daily trading volume.  Since April 2024, it has bought back 3,661,400 shares, contributing to the stock's rise from 7 cents to 9.1 cents recently. As of now, it is sitting on 14,736,400 treasury shares, or nearly 5% of the outstanding issued shares, which were accumulated over several years. |

You might know this for inventing the ThumbDrive®—the USB flash drive that revolutionized portable storage.

Today, Trek 2000 operates in tech-heavy spaces like interactive consumer solutions (ICS) -- which spans its range of in-house memory solutions --customized solutions, and renewable energy.

Its market cap is S$28.5 million (stock price: 9.1 cents).

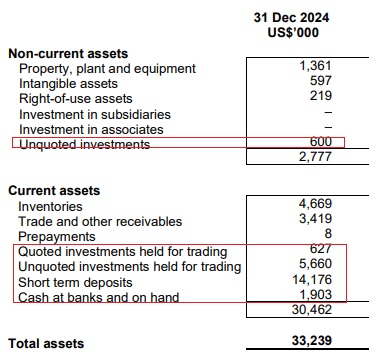

Interestingly, that is lower than the S$30.8 million, comprising cash and investments, that it held as at at end-2024, as follows:  Source: FY24 financial statement

Source: FY24 financial statement

The company has no debt. Its Net Asset Value is 9.3US cents (~12.5 SGD cents).

The Watchlist Problem

While its balance sheet is strong, its operations continue to face challenges.

It had pre-tax losses in FY20-FY22, and an average daily market capitalisation of less than S$40 million over the 6 months prior to June 2023.

|

Stock price |

9.1 c |

|

52-week range |

5 – 9.8 c |

|

PE (ttm) |

48 |

|

Market cap |

S$28.5 m |

|

Shares outstanding |

309.4 m |

|

Dividend |

- |

|

1-year change |

34% |

|

|

|

As a result, it was placed on the SGX Watchlist.

To exit the Watchlist, it has to record a pre-tax profit for the most recently completed financial year and have an average daily market capitalisation of S$40 million or more over the last 6 months.

The clock is ticking -- it has until June 2026 to meet these requirements or risk getting delisted.

In FY24, Trek eked out a pre-tax profit of US$187,000 and after-tax profit of US$443,000 (FY23: US$2.7 million).

Revenue Growth: A Bright Spot

Trek 2000’s revenue grew by an impressive 18.4% year-on-year (YoY), reaching US$19.9 million in FY2024.

Most of this growth came from their ICS division, which accounted for a whopping 92.5% of total sales.

The ICS business continues to be Trek’s bread and butter, driving the bulk of its revenue through consumer-centric tech products.

Profitability: A Steep Decline

The decline in profitability was largely driven by:

- Lower gross margins.

- A sharp drop in 'other income', which fell from US$4.3 million in FY2023 to US$1.2 million in FY2024 due to the absence of one-off gains from unquoted investment disposals.

Cost Management: Cut, cut

On the bright side, Trek managed to cut total expenses by 23.8% YoY, bringing them down to US$2.9 million:

- R&D expenses dropped significantly by 75.7%, thanks to capitalizing on new product development costs and lower staff expenses.

- General administrative costs fell by 25.3%, reflecting tighter cost controls.

| Trek is cautiously optimistic about its prospects, particularly in renewable energy—a segment with vast potential that the company plans to focus on moving forward. Investors might see potential here: a cash-rich company with no debt and a legacy of innovation trying to reinvent itself in today’s competitive tech landscape. But whether it can pull off a full turnaround remains to be seen. Its frequent share buyback is contributing to a rise in its market cap as it seeks to exit the Watchlist. A sustained average share price of 14 cents looks to be the minimum level at which it will fulfill one of the 2 conditions for an exit. |