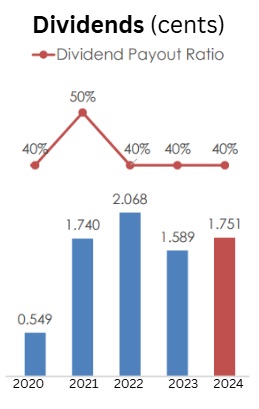

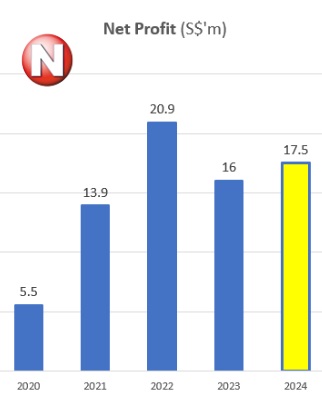

| At Nordic Group's FY2024 briefing, the company said it was looking into building its own dormitories to house 800 of its foreign workers. That would save quite a ton of cash that it currently hands over to dormitory operators.  You can work it out: 800 x $500 (assumed) x 12 months = a whopping $4.8 million a year. You can work it out: 800 x $500 (assumed) x 12 months = a whopping $4.8 million a year. Sure, there will be operating costs but they are relatively small (but we don't have exact figures). And to put the $4.8 million in perspective -- Nordic's 2024 earnings was $17.5 million. Because of a shortage in Singapore dormitory capacities and a rise in demand, dormitory charges have been rising fast in recent years. |

Nordic Group is a diversified group of companies providing solutions in areas of automation and systems integration; maintenance, repair, overhaul and trading; precision engineering; scaffolding; insulation services; petrochemical and environmental engineering services; cleanroom, air and water engineering services and structural engineering and construction services.

The Numbers Game: Steady Growth

So, 2024 started slow for Nordic compared to 2023 because some big projects in Malaysia were wrapping up.  Executive chairman Chang Yeh HongBut Nordic caught up big time in the second half, with numbers way stronger than 2023.

Executive chairman Chang Yeh HongBut Nordic caught up big time in the second half, with numbers way stronger than 2023.

Even with a slight revenue dip (from $160 million to $158 million in 2024), Nordic managed a sweet 10% profit increase, hitting $17.5 million.

This translates into a PE ratio of 7.6X (based on $134 million market, 33.5 cents stock price).

Its order book as at end-2024 was $201.6 million, which "can give us visibility for next two years," said executive chairman Chang Yeh Hong, at a results briefing.

What's on the Horizon?

Here's what's cooking:

- Marine Oil & Gas: Thanks to some major projects secured in 2024, Nordic "should see marine oil and gas contribution grow from 10% to a higher percentage this year."

- Avon: This subsidiary is set to shine with projects to build fuel tanks for a Singapore air base.

- Dorms: "The cost of dorms has really eaten into our profits and if we don't do anything we'll be handing over the profits on the platter to the dorm operators."

- Acquisitions: While Mr Chang gave no inkling of any acquisition on the horizon, he said Nordic's net debt as at end Feb 25 has fallen to only $5 million.

It continues to be open to buying companies that fit the company's strategy, as in the past – basically, businesses that complement its existing services and customer base.Stock price

33.5 c

52-wk range

28 – 37 c

PE (ttm)

7.6

Market cap

S$134 m

Shares outstanding

399 m

Dividend

yield5.2%

1-yr return

--

P/B

1.0

Source: Yahoo!

No random, out-of-the-blue purchases here.

Q&A Highlights: Some takeaways:

- Trump's Tariffs: The potential impact of huge US port call fees on Chinese-built vessels could slow down orders for Chinese shipyards, affecting Nordic's business of providing system integration, among other things.

However, Nordic is optimistic that FPSO and FSO -- specialized vessels used in the offshore oil and gas industry -- will much less impacted. - Dorm Plans: Nordic is looking at building 800 beds in 2 of its existing factories in Tuas, which should cover about two thirds of its workforce.

Capex is estimated at $4-5 million, a very manageable sum. The payback period is probably only 1.5 years. - Starburst's Potential: With the Singapore government moving the Paya Lebar air base to Changi, Avon (which Starburst acquired) has secured two big projects worth about $25 million in aggregate to build fuel tanks.

More opportunities could arise as another air base is planned for Tengah several years from now. - Semiconductor Outlook: Nordic is looking at opportunities overseas, like in Thailand (with its customer) and India (with another customer, Micron).

In this segment, Nordic's subsidiary, EnviPure, builds and maintains the clean air and water systems essential for chip manufacturing. - Capital Management: Nordic is aware that its stock is tightly held (more than 75%) by insiders and is exploring ways to increase liquidity in the market.

"The shares of Nordic group are very tightly held. For us to provide more liquidity in the marketplace, something has to be done, some corporate action."

|

The Bottom Line

|

Nordic's FY2024 Powerpoint deck is here.