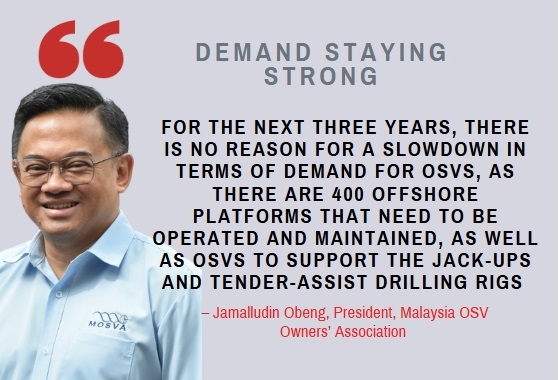

| As the economic turbulence created by Trump's tariffs swirled in recent weeks, no sector in the stock market was spared. Stocks of Offshore Support Vessels (OSV) in Singapore and Malaysia have taken a hit even though the key factor -- shortage of OSV supply -- determining their profitability remains resilient. “It will take about two to three years to introduce a new fleet, and longer if it includes the planning and financing," Malaysia OSV Owners’ Association (Mosva) president Jamalludin Obeng told The Edge recently. "It is worth noting that there had been no new build orders for new assets since 2019 until one was announced a few months ago. None of the major players has announced fleet expansion plans."  OSV demand is solid but long-term contracts? Not so much. “There are some long-term contracts, but their tenures are not encouraging. For banks to give out loans for new builds, they want to see at least seven- to 10-year contracts,” he said. “At the moment, some long-term contracts exist, such as three-year-plus-three-year agreements, totalling six years. However, since the contract is not fully firm for six years, banks may only recognise it as a three-year term. You know they want security, right?” The average age of MOSVA’s member fleets stands at 13.2 years versus the 20-year operational lifespan (which was increased from 15 years by Petronas recently). “Almost all the development and oil and gas activities are offshore [but] you need vessels to operate, do maintenance and support offshore development and drilling. The industry is at a crossroads — we recognise the need for new builds, but we lack the financial means to proceed,” said the MOSVA President. |

| Key takeaways: • Demand for OSVs in the oil and gas sector and the offshore wind sector will continue to outstrip supply, creating a favourable market for OSV providers. • Underlying OSV supply constraints are: ageing fleets, limited shipyard capacity, financing limitations, and a woeful lack of newbuilding. • If oil price falls and stays low, leading to a drastic drop in oil exploration and production, OSV demand will be affected too. |

Although local fleets are prioritised under the cabotage policy, 30% of more than 300 vessels operating in Malaysia are reportedly foreign-flagged vessels.

This indicates that the local OSV capacity crunch is covered by foreign vessels.

“Our checks with OSV players suggest that Malaysian-flagged OSVs remain in severe deficit. This in turn will support the elevated charter rates in 2025, although growth may be marginal or flattish,” said Hong Leong Investment Bank in a report.

What do Singapore-listed OSV owners say?

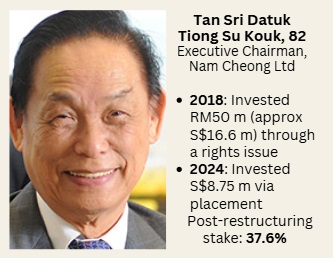

Let's start with Nam Cheong Ltd, which has the largest OSV fleet (37 vessels, average age 8 years) among its peers in Malaysia where it operates.

Below is an excerpt from its chairman's statement in the recently-released annual report:

According to Petronas’ activity outlook report for year 2025-2027, it aims to significantly boost Malaysia’s oil and gas output over the next three years. Its plan includes maintaining the country’s oil and gas production at 2 million barrels of oil equivalent per day (“mmboepd”) between 2025 and 2027, up from 1.7 mmboepd in 2024, along with expanding exploration and development projects.  Ref: NAM CHEONG: This man's large cash contribution was decisive in his company's survival. Now business is boomingThis optimistic outlook bodes well for the Group as one of the leading OSV players in Malaysian waters. Underlying OSV supply constraints, including an ageing fleet, a limited supply of shipyard capacity, limited financing and limited newbuilding, are expected to collectively keep OSV market capacity tight. Ref: NAM CHEONG: This man's large cash contribution was decisive in his company's survival. Now business is boomingThis optimistic outlook bodes well for the Group as one of the leading OSV players in Malaysian waters. Underlying OSV supply constraints, including an ageing fleet, a limited supply of shipyard capacity, limited financing and limited newbuilding, are expected to collectively keep OSV market capacity tight. With a fleet of 37 vessels averaging just eight years in age, Nam Cheong is strategically positioned to capitalise on the tightening supply-demand dynamics and capture growth opportunities in the evolving industry landscape. In addition, the current global OSV fleet is getting “long in the tooth”. The global platform supply vessel (“PSV”) fleet has an average of 16.4 years, while the anchor handling tug supply (“AHTS”) fleet averages 15.2 years. Our shipbuilding business, currently operating at a minimum maintenance level, is well-positioned to leverage the anticipated OSV shipbuilding upcycle when market opportunities arise in the near future. -- Tan Sri Datuk Tiong Su Kouk |

As we look to the year ahead, we are cautiously optimistic about the growth potential in both the oil and gas and offshore wind sectors.  Pang Yoke Min, Exec ChairmanThe demand for offshore support vessels in the oil and gas sector is anticipated to continue outstripping available supply, creating a favourable market for offshore service providers. Pang Yoke Min, Exec ChairmanThe demand for offshore support vessels in the oil and gas sector is anticipated to continue outstripping available supply, creating a favourable market for offshore service providers. At the same time, the offshore wind sector is becoming increasingly important to energy transition as the world shifts towards more sustainable energy solutions, presenting new opportunities for offshore service providers that are diversifying their services across both sectors. In this regard, the Group has initiated the construction of new crew transfer vessels in FY2024 to meet the rising demand in the offshore wind sector, a move expected to generate an additional revenue stream in the year ahead. -- Pang Yoke Min, Executive Chairman, Pacific Radiance, annual report 2024. |

In the oil and gas sector, demand growth is anticipated, driven by major industry players selectively increasing investments in exploration and production while maintaining strategic capital allocation, capital discipline, and shareholder returns.  Lee Gee Aik, Non-Executive ChairmanChina’s recent monetary stimulus measures may provide a boost to economic activity, though overall growth is expected to remain subdued. Lee Gee Aik, Non-Executive ChairmanChina’s recent monetary stimulus measures may provide a boost to economic activity, though overall growth is expected to remain subdued. On the supply side, vessel retirements and limited new builds are expected to keep availability constrained. The interplay of these factors should support stronger charter rates and utilisation in 2025. -- Lee Gee Aik, Non-Executive Chairman, CH Offshore, annual report 2024. |

CH Offshore currently is in the midst of conducting a rights issue.

Its rationale (as spelt out in a filing on the SGX, seee below) adds further insights into the OSV situation:

| The Group currently has six (6) vessels, one (1) of which is owned by the Group’s associated company in Indonesia. As the vessels are all 15 years or older, fleet renewal / enhancement becomes more relevant. This could come in the form of purchasing existing younger vessels or new vessels or placing an order for a new build vessel or upgrading the specifications on existing vessels. At present however, the price of new build vessels is high due to relatively high inflation and interest rates. In addition, the lack of guidance in relation to the optimum choice of alternative fuels which oil majors will supply to vessel owners when the vessels are on charter causes difficulties in selecting the appropriate vessel design. The proceeds from the Proposed Rights Issue would therefore allow the Company to be able to seize opportunities to partially fund the purchase or building of vessels, either directly or through subsidiary or associated companies at the appropriate time and with the right configuration as tenders for charters present themselves. The strengthened balance sheet will also provide greater comfort to sellers and shipyards as they generally require proof of financial stability and funds. The ability to acquire a vessel will also allow the Group to participate in tenders requiring younger vessels or alternative types of offshore vessels. The Group plans to deploy the acquired / enhanced vessels in stable markets to support the offshore marine sectors i.e. oil and gas or wind farms. |