Executive Chairman Xu Cheng Qiu has been a cornerstone of China Sunsine Chemical for over four decades -- which is remarkable longevity in his leadership role.  He joined the Group in 1977 and in 1998, together with other employees, executed a management buyout of the state-owned enterprise. He joined the Group in 1977 and in 1998, together with other employees, executed a management buyout of the state-owned enterprise. He has since steered it from a modest operation to a global leader in rubber chemical production. He’s guided the company through economic cycles, industry shifts, and its 2007 listing on the Singapore Exchange (when he was 63). Even after ongoing capex for expansion, it has generated lots of surplus cash but investors have yet to pay attention to that. Its cash currently amounts to 38 Singapore cents/share, and UOB Kay Hian estimates the stock (52 cents) is trading at just 1.4X PE ex-cash. Xu, now aged 81, has given no indication of stepping down. His statement in the recently-released 2024 annual report is a mix of pride, caution, and forward-thinking. Let’s break it down and see some clear takeaways. |

| Tough Year, Solid Fight |

2024 wasn’t a walk in the park for China Sunsine but its core business—making rubber chemicals like accelerators and anti-oxidants—kept humming along.

The company is the world’s largest producer of rubber accelerators, which are used in the making of tyres.

Xu said: “Although demand in the downstream tire industry has increased, expansion of production capacity in China’s rubber chemicals industry triggered intense competition in recent years, asserting huge pressure on our average selling price".

Still, China Sunsine achieved commendable results:

- Revenue flat: Sales grew 1% to RMB 3,515 million. Why? Lower average selling prices (2%) and intense competition.

- Profit power: Net profit clocked in at RMB 424 million, up 14% from FY23. Not bad for a rough year!

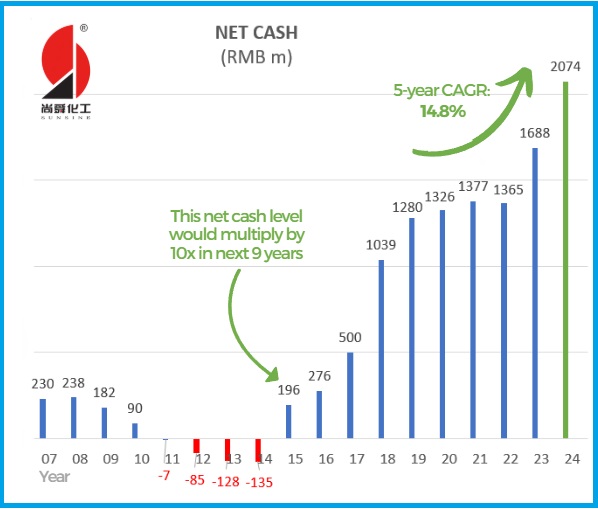

- Cash is king: The company’s sitting on RMB 2,074 million in cash, with zero bank borrowings.

| Dividends: Sharing the Love |

China Sunsine’s dishing out a final dividend of 3 Singapore cents per share after considering the “Group’s strong earning performance, robust cash position, and strategic expansion plan,” said Mr Xu.

|

CHINA SUNSINE |

FY20 |

FY21 |

FY22 |

FY23 |

FY24 |

|

Dividend/share |

1 |

2 |

3 |

2.5 |

3.0 |

| Looking Ahead: Cautious but Confident |

Xu’s not wearing rose-tinted glasses for 2025.

"The rubber chemicals industry in which we operate continues to face an oversupply of capacity, and market competition remains intense. These factors have placed significant pressure on our selling prices."

What’s the game plan? Xu lays it out:

- Vertical integration: The company continues to pursue "internal integration by expanding the production capacity of key raw materials, which not only lowers production costs but also strengthens supply chain security."

- Innovation push: R&D to stay ahead of the curve.

- Market expansion: Doubling down on both domestic and global markets, with a nod to growing demand in China’s auto sector.

The company’s debt-free status and fat cash pile give them wiggle room to handle whatever comes.

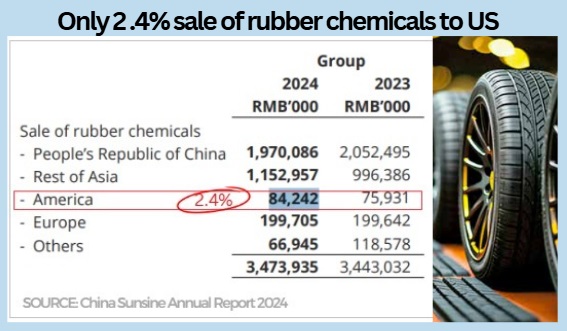

As for US tariffs on Chinese imports, China Sunsine exports very little to the US (chart below).

A large amount of tyre production is carried out in low-cost sites such as China and Thailand.

For the busy investor, China Sunsine’s 2024 story is about resilience and smart moves. If you’re holding China Sunsine stock, Xu’s statement suggests you’re in for a stable ride with decent dividends and growth potential. |

See also: CHINA SUNSINE: Analysts Grow More Bullish on This Cash-Rich Company Trading at 1.4x Ex-Cash PE