| Analysts from two houses —CGS International and DBS Bank—offer contrasting takes to news of Yangzijiang Shipbuilding's slowdown in order intake. CGS is trimming forecasts and cautioning on near-term risks, while DBS sees an attractive buying opportunity given the company’s strong backlog and balance sheet. |

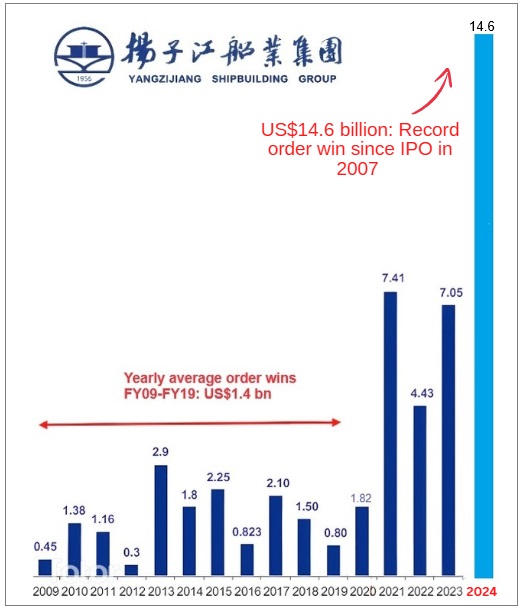

Yangzijiang Shipbuilding kicked off 1Q25 with only US$290 million of orders (consisting of six units of small-mid-size containerships and bulk carriers) secured against a US$6 billion annual target.

Its ship delivery execution stayed on track with no cancellations.

Q1 Performance Highlights

- New order wins plunged to US$290 million, down sharply from US$3.3 billion in 1Q24 as clients adopted a “wait-and-see” stance.

- The group delivered 21 vessels YTD, achieving 38 % of its full-year delivery target of 56 vessels, with no reported delays or cancellations.

- The order backlog stood at US$23.2 billion, securing yard capacity through 2028 and providing multi-year revenue visibility.

- Steel costs were flat quarter-on-quarter and down 14 % year-on-year, supporting gross margins of around 29–30 % for 1H25, in line with management’s guidance.

- Foreign-exchange exposure remains largely unhedged and managed at spot rates, leaving some earnings sensitivity to RMB/USD movements.

| CGS’s Cautious Stance |

|

YANGZIJIANG |

|

|

Share price: |

Target: |

CGS analysts Lim Siew Khee and Meghana Kande trimmed their FY25 earnings forecasts by 2% and cut the 12-month target price to S$2.72, citing:

- A subdued new-order outlook as shipowners prefer Korean yards amid factors such as limited early delivery slots at Yangzijiang for 2028–291.

- A lowered assumption for FY25 order wins to US$2.5 billion from US$6 billion, reflecting average pre-COVID run-rates.

- Stable margins underpinned by flat steel costs, but potential pressure from unhedged forex and competitive contract renegotiations in the market.

Despite the caution, CGS maintains an “Add” rating: "We keep our Add call as EPS is backed by order book and deposits received, with stock valuations of 7x FY26F P/E (c.50% discount to peers)."

| DBS Bank’s Contrarian Buy Call |

|

YANGZIJIANG |

|

|

Share price: |

Target: |

DBS Bank views the weak 1Q order intake as an overreaction.

"Vessel delivery lead time is at least 3 years as major shipyards are full through 2028. As a result, shipowners adopt a wait-and-see approach, postponing vessel ordering decisions."

It also highlights:

- The yard’s sturdy US$23 billion backlog keeps production full through 2028, cushioning near-term new-order softness.

- Trading at only 6 x FY25 P/E and 1.5 x P/BV versus peers at double-digit P/E and ~2.5 x P/BV, despite superior 24 % ROE and over 6 % dividend yield.

- A net-cash position of about S$1.10 per share, more than half of the current share price, underpinning the balance sheet.

DBS reiterates a “Buy” with a S$3.80 target, expecting the stock to re-rate on clearer US outcomes, revived containership ordering, and margin stability.

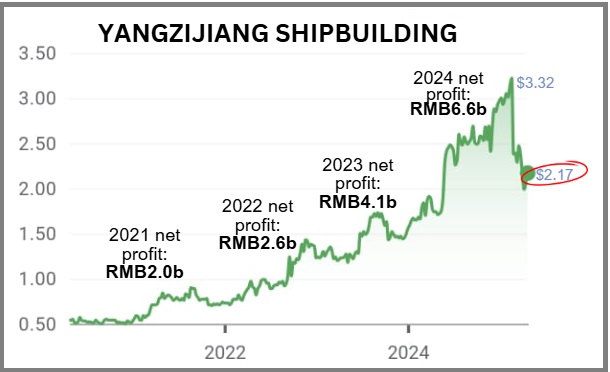

"Yangzijiang’s share price, which corrected c.35% from high of SGD3.30 in Feb-2025 prior to the USTR news has barely recovered despite the de-escalation of US tariff and watered-down USTR actions that is not expected to impact Chinese shipyard materially." Yangzijiang's stock price had been rising with rising profits in recent years, until the US threatened in Feb 2025 high port fees for Chinese-built ships.

Yangzijiang's stock price had been rising with rising profits in recent years, until the US threatened in Feb 2025 high port fees for Chinese-built ships.

Yangzijiang’s execution remains solid, but near-term growth hinges on tariff resolutions and shipowner sentiment. |