|

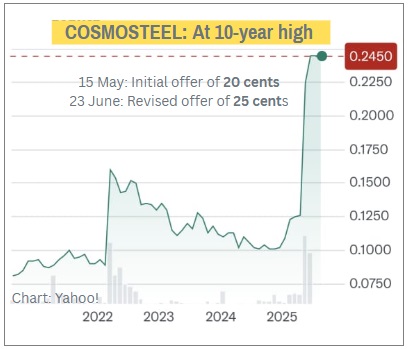

The takeover offer for CosmoSteel Holdings has reached a pivotal moment following the Ong family's stated intent to accept the revised 25 cent per share offer from 3HA Capital.

As of March 31, 2025, CosmoSteel’s NAV per share was 29.31 cents, and its revalued NAV was 37.6 cents.

|

The Offeror -- -- which is a consortium of non-CosmoSteel shareholders and Hanwa Co, the No.1 CosmoSteel shareholder -- emphasized that this was the final price and pitched it as a good exit option for shareholders given the stock’s low liquidity..

With the Ong family now indicating their intention to accept the revised offer, the bid should be turning unconditional as the Offeror surpasses the 50% shareholding threshold required for the offer to become unconditional. CosmoSteel CEO Ong Tong Hai owns a 18.15% stake in the company. He is the No.2 CosmoSteel shareholder after Hanwa Co which is a key member of the Offeror consortium. The Ong family's 27.96% stake (which had risen following the CEO's open market purchases after news of the initial offer) plus the Offeror's 32.47% stake add up to 60.43%.

CosmoSteel CEO Ong Tong Hai owns a 18.15% stake in the company. He is the No.2 CosmoSteel shareholder after Hanwa Co which is a key member of the Offeror consortium. The Ong family's 27.96% stake (which had risen following the CEO's open market purchases after news of the initial offer) plus the Offeror's 32.47% stake add up to 60.43%.

However, there is no indication the 90% acceptance target required for compulsory acquisition and delisting is in sight.

Shareholders who do not accept may face a scenario where the stock stays listed but its price potentially drifts back to historical levels ($0.13–$0.15).

Lim & Tan Securities has advised investors to accept the 25 cent final offer, noting that it sits within the IFA’s fair value range and only slightly below the company’s historical net asset value of 29 cents per share.

Come 14 July, if not earlier, we will know if this non-sexy business -- distributing piping system components to the energy, marine and other industries in the region -- will cease to trade on the public market.

CosmoSteel shareholders haven't had it easy in many recent years.

The company experienced a rough FY2024: revenue fell to S$69.6 million (-16.6% year-on-year) with a net loss of S$5.0 million (after a profitable FY2023).

Despite these losses, CosmoSteel’s balance sheet remained relatively robust, and posted a net profit of S$2.3 million for 1HFY2025, indicating a potential turnaround.

To begin with, the Offer is set to go unconditional as CEO Ong Tong Hai who now holds 18.15% and his family members said they intend to accept the 25-cent offer. |