|

Excerpts from CGS International's report

Analysts: William Tng, CFA & Tan Jie Hui

■ We expect ISDN to report its 1H25F results on 11 Aug as the company has announced that the board will meet on that date to approve the results.

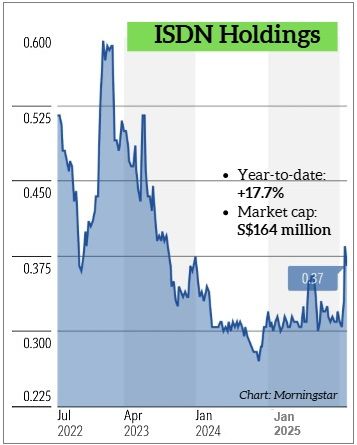

■ We think 1H25F revenue could have expanded at least c.10% yoy to S$192.1m while net profit could have grown 63% yoy to S$6.2m. ■ However, from 31 Dec 2024 to 30 Jun 2025, the US$ depreciated by 6.9% against the S$. This will lead to unrealised foreign exchange (fx) losses. ■ Given the valuation uplift from the MAS EMDP and the general improvement in business conditions, we upgrade our call on ISDN to Add with S$0.44 TP. |

|||||

Unrealised FX losses likely dragged down 1H25F headline net profit

We expect ISDN to report its 1H25F results on 11 Aug (ISDN does not provide quarterly business updates).

| Monetising water assets |

"As ISDN’s mini-hydropower operations build up in scale, the group should consider realising the value of this business either via a trade sale or a spin-off." -- CGS |

We believe ISDN’s 1H25F revenue could have grown a minimum 10% yoy to S$192.1m as business conditions likely improved gradually after the initial tariff surprise.

1H25 net profit could have grown 63% yoy to S$6.2m.

However, given that ISDN’s min-hydro power business is recorded in US$ as service concession receivables on the balance sheet and translated into S$, we estimate that was a c.S$5m-6m unrealised FX translation loss in its 1H25F results (the US$ depreciated by 6.9% against the S$ over 31 Dec 2024 to 30 Jun 2025).

Value up catalyst – focus on its core business

As at end-Dec 24, ISDN’s mini-hydropower business recognised as service concession receivables totalled S$84.6m.

ISDN’s mini-hydropower business is held through its 67.1%- owned subsidiary, Aenergy (unlisted).

The group has started the construction of its 4th (Lau Biang 2) and 5th plant (Lau Biang 3) in Indonesia.

ISDN hopes to have Lau Biang 2 operational in FY26F.

In our view, as ISDN’s mini-hydropower operations build up in scale, the group should consider realising the value of this business either via a trade sale or a spin-off.

This should then make it easier for investors to better understand and better value the company for its core industrial automation business.

This should also widen the appeal of the company to investors who prefer companies to focus on their core business.

| Reiterate Add We now value ISDN at 13.5x FY26F P/E (10-year FY16-25F average) as

William Tng, CFA, analystOur TP is hence raised to S$0.44 and we upgrade from Reduce to Add as earnings growth is likely to resume over FY25-27F. William Tng, CFA, analystOur TP is hence raised to S$0.44 and we upgrade from Reduce to Add as earnings growth is likely to resume over FY25-27F.Previously, we valued ISDN at 8.8x FY26F P/E, the average P/E of its previous earnings upcycle (FY16-21), due to tariff impact concerns. Re-rating catalysts include higher-than-expected net profit contribution from its hydropower business segment, a faster pace of economic growth in China as it stimulates its economy and a stronger semicon recovery. Downside risks include weak customer demand if the global economy continues to slow, and the possibility of bad debts as economic conditions worsen. |

Full report here