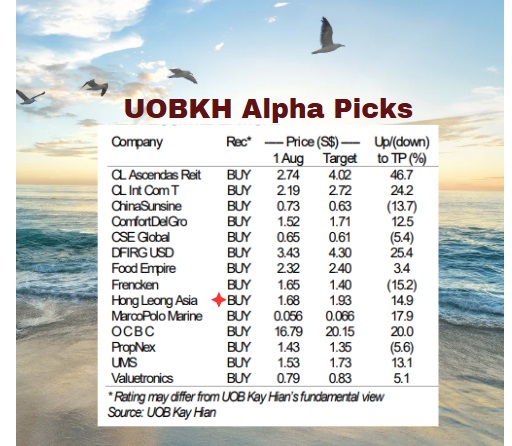

• One addition to UOB Kay Hian's latest alpha picks portfolio, Hong Leong Asia, looks like a latecomer, arriving after an impressive 82% year-to-date gain. • Hong Leong Asia, as a provider of ready-mix concrete, among other things, is a beneficiary early in a construction upcycle. • As for a later stage of the cycle? Well, the beneficiaries include Tai Sin Electric, which supplies electrical cables and has reported a 129% jump in 1HFY2025 (ended Dec 2024) profit to S$15.9 million (aided in part by a $2.2 million gain on disposal of a Cambodian subsidiary). Though not covered by analysts as yet, the stock has risen 41% year-to-date, most of it in July 2025. For more see: Construction & Data Centre Boom Boosts This Company's Cable Business But It Has to Navigate Copper Risks • Its market cap is S$255 million, with an annualised PE of 8. The company stands to benefit from continued cable demand from major infrastructure projects—including Changi Airport’s Terminal 5, Tuas Megaport, MRT expansions, as well as the ongoing data centre boom in Johor. However, copper price volatility remains a key risk to monitor. • Read on about UOB KH's alpha picks .... |

Excerpts from UOB KH report

| • Outperformance driven by small-mid caps. Backed by positive news flow about the S$5b EDQP fund, our Alpha Picks portfolio performance was yet again driven by our small-mid caps: iFAST (+37.3% mom), Frencken (+33.9% mom) and China Sunsine (+28.4% mom). iFAST rose from better-than-expected 2Q25 results while Frencken benefitted from positive sentiment towards semiconductor-related companies. China Sunsine increased on the back of better-than-expected ASPs and volume outlook for its upcoming 2Q25 results. There were no underperformers for Jul 25. |

ACTION

• Adjusting our portfolio. For Aug 25, in preparation for MAS’ S$5b capital injection, we add in three more small-mid cap picks to our Alpha Picks portfolio:

1) Hong Leong Asia on the back of favourable construction sector tailwinds;

2) Marco Polo Marine which is set to benefit from high charter rates and vessel utilisation in 2HFY25, and

3) CSE Global due to a robust and growing orderbook.

We take profit on both iFAST (+40.7%) and Sheng Siong Group, growing 40.7% and 19.3% since their additions to our portfolio.

| Hong Leong Asia- Buy |

Analyst: Llelleythan Tan

• Robust domestic construction demand.

|

HONG LEONG ASIA |

|

|

Share price: |

Target: |

We continue to see Hong Leong Asia (HLA) as a key beneficiary of increased construction demand across its key markets in both Singapore and Malaysia over the next 12-24 months.

With an around 20% Ready-Mix Concrete (RMC) market share in Singapore, increased multi-year public and private infrastructure projects are expected to boost demand in the near-to-medium term.

• Strong growth up north. In Malaysia, the quarterly value of construction works completed remains on an uptrend.

According to the Department of Statistics Malaysia, the quarterly value of construction work completed in 1Q25 reached RM42.9b (+2.1% qoq, +16.6% yoy).

This marks the 13th consecutive qoq improvement since construction activities resumed in 3Q21 with the next data release for 2Q25 statistics on 11 Aug 25. Llelleythan Tan, analystMoving forward, mega infrastructure projects such as the Mass Rapid Transit Phase 3, Pan Borneo Sabah Phase 1, High Speed Rail and Sabah-Sarawak Link Road are expected to help drive market sentiment as well.

Llelleythan Tan, analystMoving forward, mega infrastructure projects such as the Mass Rapid Transit Phase 3, Pan Borneo Sabah Phase 1, High Speed Rail and Sabah-Sarawak Link Road are expected to help drive market sentiment as well.

With significant market share in Malaysia and a strong pipeline of both public and private sector projects in the country, HLA’s building materials unit (BMU) serves as a strong proxy for the strong tailwinds seen in the construction sector, in our view.

| • Maintain BUY with a SOTP based target price of S$1.93. We value the BMU and diesel engine segments at S$949m (7x 2025F EV/EBITDA multiple) and S$1025m (8.0x 2025F EV/EBITDA multiple) respectively. SHARE PRICE CATALYSTS • Events: a) Better-than-expected dividends in 1H25 (1H24: S$0.01/share), and b) earnings surprise from stronger-than-expected engine and building materials sales. • Timeline: 6-12 months. |

Full report here.