|

Singapore-headquartered Winking Studios (AIM/SGX: WKS) is a leading AAA game art outsourcing and development firm. A one-of-a-kind company on the SGX which listed in 2023, Winking provides high-quality art outsourcing and game development services. |

Winking Studios -- rare Singapore play on global scale

As a rare SGX-listed company capturing business across the world, Winking works with an impressive 22 of the world's top game developers like EA, Ubisoft, and Sony.

Zeus notes Winking is a "global top four game art outsourcing company" in a US$10.9 billion market.

Its edge? Low costs from staff mostly in China and Taiwan—average employee cost is US$30.5k a year, half of US rates.

Winking recently added a London listing (LSE: WKS) to attract more investors and grow outside Asia.

Winking is 64.2% owned by Acer Group, a stake achieved through a combination of its pre-IPO stake, an investment during the 2023 IPO in Singapore, and share acquisitions in 2024 and during the 2024 AIM listing.

A S$3.7 billion market cap provider of IT products and services, Acer views Winking as integral to its strategy of expanding into higher-margin services and content provision, having invested a total of S$63.4 million.

Financial Highlights: Growth from Buys, Solid Cash

Below are key 1HFY2025 financial metrics of Winking:

|

US$’m, unless stated |

1H2025 |

1H2024 |

Change (%) |

|

Revenue |

19.4 |

15.2 |

+27.3 |

|

Gross Profit |

5.9 |

4.2 |

+38.2 |

|

Gross Margin (%) |

30.2 |

27.9 |

+2.3 pp |

|

Adjusted EBITDA |

2.4 |

2.1 |

+17.9 |

|

Adjusted EBITDA Margin (%) |

12.6 |

13.6 |

-1.0 pp |

|

EBITDA |

2.2 |

1.8 |

+18.3 |

|

Adjusted Net Profit |

1.4 |

1.1 |

+21.1 |

|

Net Profit |

0.9 |

0.9 |

+2.0 |

|

Cash & Equivalents + Bonds |

27.1 |

41.3 |

-34.4 |

|

Debt |

0 |

0 |

- |

Adjusted net profit grew 21.1% to US$1.4 million, highlighting underlying strength after one-off expenses like share-based compensation and fees related to its Nov 2024 listing on AIM.

Segment-wise,

| • Art outsourcing—82.1% of revenue. This segment grew 25.9% to US$15.9 million on orders from China, the US, and Malaysia. • Game development jumped 36.8% to US$3.4 million, driven by demand in China and Australia. • Global publishing and other services dipped 33.3% to US$0.07 million, a minor segment. |

Winking benefits from over 100 titles in "follow-up" status, where ongoing work like updating characters and props for existing games provides recurring revenue.

These repeat revenues have accounted for around 40% of Group revenue in recent years.

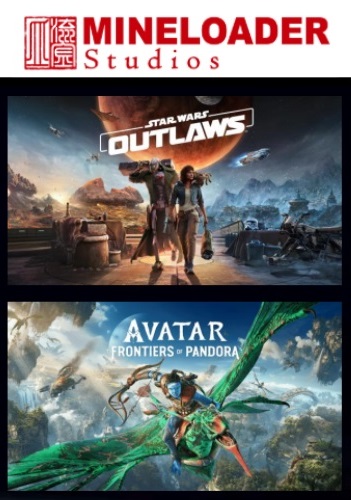

Cash is strong at US$27 million with no debt, and Winking is poised for more acquisitions.  Mineloader is Winking's largest acquisition to date at US$19.8 million.Winking CEO Johnny Jan emphasized M&A as a growth engine, noting ongoing talks in the UK and Europe.

Mineloader is Winking's largest acquisition to date at US$19.8 million.Winking CEO Johnny Jan emphasized M&A as a growth engine, noting ongoing talks in the UK and Europe.

Of this amount, 90% was paid immediately upon closing the deal, with the remaining 10% due in five years.

Zeus predicts 2025 sales at US$43.5 million (+36%) and EBITDA at US$5.1 million (+7%), with better growth in 2026.

What’s Driving Growth: Mobile and New Markets

Demand for mobile game art is hot, with 42% of Winking's work there.

Asia's gaming scene is growing fast—Zeus says Asia Pacific will hit 52% of global gaming sales by 2028, mobile at 67%.

New consoles like Nintendo Switch 2 (launched in June 2025) marks the beginning on an upcycle in the console market.

This will drive a material increase in demand for high-performance content, a segment where Winking, especially post-Mineloader acquisition, has a strong console-focused skillset.

Over 50% of Group activities are expected to be console-related post-integration.

Risks: Margins, Competition, Customer Reliance

| • Watch margins— Zeus noted adjusted EBITDA margin has risen steadily from 10.3% in 2022 to 17.8% in 2023 to 18.8% in 2024. Zeus forecasted margins, including ongoing listing and marketing expenses, of 11.8% in FY25 but assume margins resume their upward trend to 13.3% FY26 as Winking gains scale organically. • Market is competitive (Winking's 1H25 profit was still modest) and fragmented, withthe top ten players accounting for only 7.1% of market revenue in 2023. • AI might automate simple art, though Winking focuses on complex stuff. More importantly, its clients prohibit AI-generated work owing to potential copyright and lack of originality issues. In addition, there is potential backlash from the gaming community against AI generated content. • Winking's top five customers collectively accounted for 52% of total revenue in FY24, meaning the loss of a major client could significantly impact financial performance. |

Management sees good times ahead, planning capacity from customer newsflow.

Overall, Winking Studios presents an interesting growth story with its strategic acquisitions, increasing focus on higher-margin Western clients, and robust pipeline of work. |

||||||||||||||||||||||||||||||||||

See Winking Studios' PowerPoint deck here.