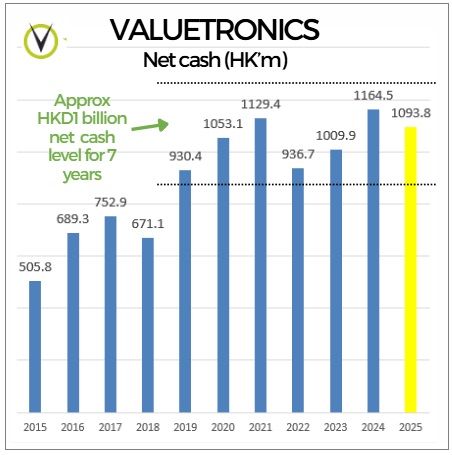

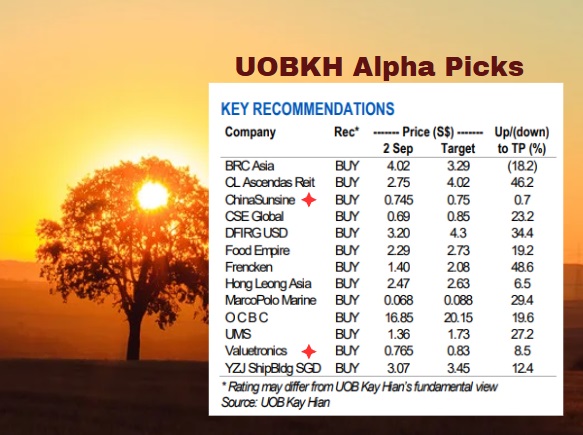

• Two stocks in UOB Kay Hian's alpha picks portfolio are cash-rich and trades at an attractive 3X ex-cash PE -- China Sunsine and Valuetronics. • Their stocks have gained 71% and 29%, respectively, year-to-date. This chart shows Valuetronics' large and steady cashpile in the past 7 years:  • Valuetronics benefits from its diversified electronic manufacturing bases in Vietnam and China, handling global trade uncertainties and maintaining healthy margins. Sunsine, meanwhile,is the world’s largest rubber accelerator producer, commanding a 35% market share in China, 23% globally, enabling it to leverage scale for cost efficiency and pricing flexibility. • The robust financials of these companies have enabled them to provide reliable streams of dividends over the years.

Even after its stock price gain, China Sunsine has a trailing dividend yield of 4.7% (final FY24 dividend of 3 cents and 1HFY25 interim dividend of 0.5 cents). • Meanwhile, Valuetronics has a yield of 5.9% based on its 27 HK cent dividend for FY25 ended March 2025. • Read more about UOB KH's alpha picks .... |

Excerpts from UOB KH report

| Trying to capture more upside. For Feb 26, we add in our recent initiations China Aviation Oil and Reclaims Global, as well as Hong Leong Asia and PropNex on inexpensive valuations given strong upcoming catalysts. We take profit on CL Ascendas REIT, Keppel, Marco Polo Marine and Riverstone.  |

| China Sunsine- Buy |

Analysts: Heidi Mo & John Cheong

• New dividend policy reinforces earnings confidence. Management introduced a formal dividend policy of at least a 40% payout for 2025-26, paid semi-annually, higher than the historical high of 36% payout in 2024.

This signals improved visibility and is backed by a strong net cash position of Rmb2,234m (S$0.43/share) as of 30 Jun 25.

• Supportive demand backdrop from auto and tyre sales. China’s auto sales grew 13% yoy in 9M25, with new energy vehicle sales up 35% yoy, while tyre production rose 2% yoy.

As Sunsine supplies over 75% of the world’s top 75 tyre makers, this provides a robust demand foundation across accelerators, insoluble sulphur and anti-oxidants.

This chart shows China Sunsine's large and growing cashpile in the past 10 years:

• Capacity expansion on track. Sunsine’s expansion projects remain on schedule, with trial runs expected between end-25 and early-26.

Upon completion, annual capacity will reach 272,000 tonnes in 2026, supporting volume growth and improving production efficiency.

• Maintain BUY with a target price of S$0.95, pegged to a PE of 11x 2026F earnings, or 2SD above the mean PE.

At current levels, Sunsine trades at an attractive 5x 2026F ex-cash PE and offers a 4% yield.  Heidi Mo, analystSHARE PRICE CATALYSTS

Heidi Mo, analystSHARE PRICE CATALYSTS

• Events:

a) Production commencement for new capacities,

b) higher ASPs for rubber chemicals, and

c) higher-than-expected utilisation rates.

• Timeline: 6-12 months.

Analysts: John Cheong & Heidi Mo • Key player in China civil aviation market. China Aviation Oil (CAO) is a key player in China’s civil aviation market as the country’s largest importer of jet fuel and a core supplier to its fast-growing aviation sector.  John Cheong, analyst • Strategic foothold at Shanghai Pudong International Airport. CAO owns a 33% stake in Shanghai Pudong International Airport Aviation Fuel Supply Company (SPIA), the sole jet-fuel supplier at one of Asia’s busiest hubs. The airport remains a key contributor to CAO’s associate earnings, and with the ongoing recovery in international air travel, SPIA’s fuel volumes and profitability are expected to improve. John Cheong, analyst • Strategic foothold at Shanghai Pudong International Airport. CAO owns a 33% stake in Shanghai Pudong International Airport Aviation Fuel Supply Company (SPIA), the sole jet-fuel supplier at one of Asia’s busiest hubs. The airport remains a key contributor to CAO’s associate earnings, and with the ongoing recovery in international air travel, SPIA’s fuel volumes and profitability are expected to improve. • Air traffic recovery supports jet fuel demand. CAO continues to benefit from the rebound in air travel, with China’s international outbound flights recovering to around 90% of 2019 levels as of 1H25, up from about 72% in 2024. Higher passenger and cargo traffic has driven stronger jet fuel demand and sustained volume growth at major airports including Shanghai Pudong, Guangzhou Baiyun and Beijing Capital, which together accounted for around 15% of China’s total passenger traffic in 2024. • Maintain BUY. Our target price of S$2.09 is pegged to 14.5x 2026F PE, +1.0SD above its 10-year historical PE, which we view as conservative, as it remains significantly below peers’ average of 24.7x 2026F PE. SHARE PRICE CATALYSTS • Events: a) Continued growth of travel activities at Shanghai Pudong International Airport, b) positive restructuring outcome at the parent level, and c) special dividend in 2025. • Timeline: 6-12 months. |

• Full UOB KH report here. • Full UOB KH report here.• See also DBS Research's take: VALUETRONICS: Classic Value Play? It Offers Consistent Dividends, Robust Balance Sheet, Margin Upside |