A reader contributed this article

| The stock price of Mandarin Oriental International, usually illiquid, has been inching upward in the past 2 weeks (last closing: US$2.28) on decent volume. That led up to the headline-making news of Alibaba’s potential acquisition of part of Mandarin's new office-cum-retail asset -- One Causeway Bay in Hong Kong. Mandarin Oriental issued a brief note confirming talks with an unnamed party. |

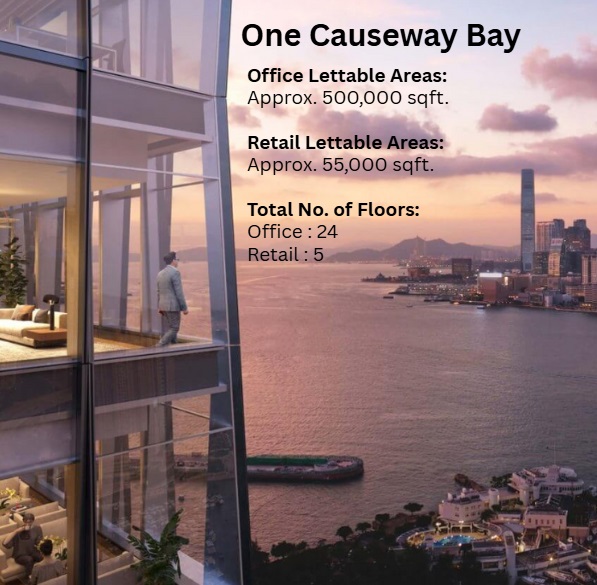

| Alibaba’s Play and One Causeway Bay |

Various media reported that Alibaba is in talks to buy 13 floors spanning 270,000 square feet, marking one of Hong Kong’s most significant corporate property transactions this year.

One Causeway Bay, redeveloped from the former Excelsior Hotel belonging to Mandarin Oriental, was always deemed a non-core asset in Mandarin Oriental’s primarily asset-light portfolio.

It sits on Mandarin Oriental's books at US$1,921m after taking several years of impairment losses given the over-supplied Hong Kong office market.

If completed, this divestment which news media pegged at potentially US$900 million, would allow Mandarin Oriental to recycle capital and continue its strategy of favoring management contracts over direct property ownership.

As of end 2024, Mandarin Oriental operated 41 managed hotels, of which 12 are owned or partially owned.

It is in the midst of closing the sale of its Munich hotel for 150m Euro. The partial sale of office space at One Causeway Bay will further advance its asset-light strategy.

Mandarin Oriental has a light debt load of US$152m as of Jun 2025. Assuming the closure of the Munich hotel and the Alibaba deals, it will turn net cash to the tune of cUS$900m.

What next?

Look at the playbooks at sister companies Dairy Farm (DFIRG), which divested non-core assets and returned US$650m to shareholders in the form of a special dividend, or Hongkong Land which divested its Singapore development arm MCL and 9 floors of One Exchange Square to HKEX -- and bought back shares.

We would not be surprised to see Mandarin Oriental channeling the proceeds to debt reduction and share buybacks to reduce the discount gap to its US$3.42 NAV.

Of course, it could also and return surplus cash to shareholders.

Based on the projected net cash, it could pay out as much as US$0.70/share.

| Investment Thesis: Value and Privatization |

Mandarin Oriental’s parent, Jardine Matheson, now owns 88% of the company—just shy of the 90% compulsory takeover threshold. Its progressive increase in its holding over recent years is shown in the table:

|

Year of Jardine Matheson Annual Report |

Stake in Mandarin Oriental |

|

2024 |

88.0% |

|

2023 |

80.2% |

|

2022 |

79.5% |

|

2021 |

79% |

|

2020 |

79% |

Coupled with typically thin trading, the dual London-Singapore-Bermuda listed Mandarin Oriental is a privatization candidate.

Jardine’s track record (e.g., privatising Jardine Strategic at a premium, albeit below NAV) signals that Mandarin Oriental’s public holders could see an exit offer.

Financially, Mandarin Oriental posted underlying profits of US$75 million for FY2024 on revenues up 13% to US$2.1 billion, driven by higher RevPARs and a growing fee base.

| Asset-Light Valuation: What’s the Right PE? |

Owning less brick and mortar frees up capital and focuses effort on building a brand and customer loyalty while earning higher returns on capital and scalable fee income.

Asset-light global operators often trade at 20–35x earnings (see table below):

|

Company |

Asset-Light |

P/E |

Key Notes |

|

Marriott International |

98% |

28-30x |

30,000+ hotels; pioneered asset-light model; strong loyalty program. |

|

Hilton Worldwide Holdings |

98% |

35–40x |

7,600+ hotels; high franchise penetration; strong loyalty program. |

|

InterContinental Hotels Group |

99% |

25–26x |

6,000+ hotels; high-margin IHG One Rewards; US$2.5B in asset sales since 2003. |

|

Hyatt Hotels Corporation |

~80% |

25–30x |

1,200+ hotels; US$5.6B in asset sales; strong in luxury/lifestyle segments. |

|

Wyndham Hotels & Resorts |

~95% |

18–20x |

9,000+ hotels; value-oriented brands; lower exposure to luxury segments. |

Mandarin Oriental currently trades at an implied 10X PE based on US$76 million profit (excluding non-cash revaluation losses on One Causeway Bay) and including the value of its investment properties.

|

Investment Takeaways |

→ For more, see MANDARIN ORIENTAL: Parent Company's Grip Tightens on Undervalued SGX Gem. Is Privatisation On The Cards? → For more, see MANDARIN ORIENTAL: Parent Company's Grip Tightens on Undervalued SGX Gem. Is Privatisation On The Cards? |