|

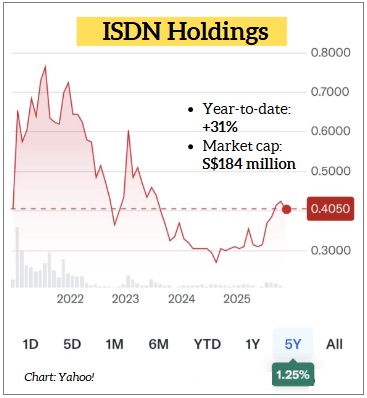

Glance at the latest numbers for ISDN Holdings, and you might scratch your head—revenue is soaring, but reported net profit is barely moving.

Then you will get it: ISDN’s real business is doing great, thank you; the fundamentals of its core segments are robust. |

The Real Scorecard: Core Profit

First, the good news: ISDN delivered strong top-line results for 9M2025 despite operating in what MD Teo Cher Koon described as "a chaotic environment" due chiefly to volatile tariffs.

Revenue grew by 21.9% year-on-year to S$319.8 million, thanks partly to construction revenue recognized from the fourth and fifth mini-hydropower plants.

Gross profit followed suit, increasing 13.6% to S$77.6 million.

|

$ millions |

9M2024 |

9M2025 |

YoY change |

|

Revenue |

262.5 |

319.8 |

+21.9% |

|

Gross Profit |

68.3 |

77.6 |

+13.6% |

|

Gross margin (%) |

26.0% |

24.3% |

–1.7 ppts |

|

Profit after tax |

7.6 |

8.5 |

+11.6% |

|

Profit attributable to shareholders |

3.7 |

3.6 |

–2.0% |

|

Adjustments for unrealised and non-recurring items: |

|||

|

Core Profit attributable to shareholders |

4.2 |

6.6 |

+57.5% |

Now, here is the confusing part: profit attributable to shareholders was almost flat, at S$3.6 million, down 2%.

Mr Teo explained that if you strip out "the non-cash, non-recurring, and long-term forex revaluation losses, we are about S$6.6 million, up by 57.5%".

Mr Teo explained that if you strip out "the non-cash, non-recurring, and long-term forex revaluation losses, we are about S$6.6 million, up by 57.5%".

That 57.5% surge in core profit tells the true story of operational efficiency and growth.

In short, the actual business engine is accelerating rapidly.

The Powerhouse Segments: Industrial Automation & Renewables

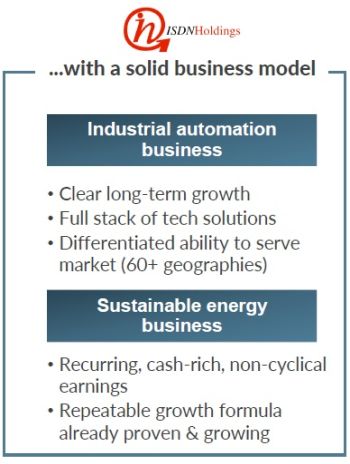

In Mr Teo's words, ISDN's mission is “powering smart operations for sustainable growth,” a succint description of its two main segments: Industrial Automation and Renewable Energy.

| 1. Industrial Automation (IA) |

This segment is the backbone, focusing on technology for automated factories.  This isn't just about moving boxes; it's about providing a full stack of solutions.

This isn't just about moving boxes; it's about providing a full stack of solutions.

ISDN offers everything from components (partnering with global leaders like Yaskawa and Renishaw) and local manufacturing, all the way up through control systems (PLC/PC control) and supervisory software (WMS, MES, Industrial 4.0).

The strategy? Focus on the high-end, niche market.

This focus helps ISDN "outperform" competitors addressing the lower end or mass market.

Contributing 86.5% of the 9M25 Group revenue, IA revenue grew 8.6%, with Southeast Asia expanding by 14.7%. China was +6.3%.

Keith Toh, a non-executive director at ISDN, noted that for 30 years, ISDN has chosen to constantly reinvest to "grow the scope of its technological relevance" by evolving from a simple distributor into a specialist offering "full systems, hardware, Cloud, IoT, and now AI".

ISDN is now moving into advanced integrated systems like smart warehouses.

| 2. Renewable Energy |

This segment focuses on mini hydropower plants in North Sumatra, generating extremely stable, long-term cash flows.

Revenue surged from S$7.7 million to S$43.1 million.

Currently, ISDN has 24.6 MW in operation, generating an estimated US$8–9 million in EBITDA annually. ISDN's 3 operational power plants. Two more (Lau Biang 2 and Lau Biang 3) are being constructed in North Sumatra.

ISDN's 3 operational power plants. Two more (Lau Biang 2 and Lau Biang 3) are being constructed in North Sumatra.

The future growth is huge: two more hydro plants (20 MW) are under construction and expected to come online next year.

With 44.6 MW capacity, the segment’s EBITDA will roughly double to around S$18-19 million.

This growth is secured by long-term Power Purchase Agreements (PPAs).

The Valuation Dilemma: Why Investors Misread the Picture

If the core profit is growing 57.3% and the stable energy business is set to double its profitability, why is the market failing to reflect this value?

The problem is complicated accounting, specifically the way the long-term energy contracts are mandated to be valued.

Because the PPAs are 25-year Build, Operate, and Transfer (BOT) agreements, accounting rules (IFRS) require ISDN to recognize these future revenues and receivables on the balance sheet.

These long-term receivables, denominated partly in USD, IDR, and SGD, must be revalued based on current exchange rates.

As Mr Toh put it, while the "enormously long revenue visibility, like 20 years or more... would be a very good thing for investors", the required accounting means that "even if currency moves a little bit, years of earnings get revalued, even though they're in the future".

|

→ The CGS report is here.

→ The CGS report is here.

→ See also: ISDN's 1H25 Core Profit Jumps 35%, Powering Ahead with Automation and Hydropower